Capital One 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One Annual Report 2000

00

SOARING

Table of contents

-

Page 1

SOARING Capital One Annual Report 2000 -

Page 2

The sky is not the limit. -

Page 3

... each account to each customer's needs and preferences. With IBS, the Company has created innovative products and services that have reduced its financial risk while delivering superior value to consumers. A holding company based in Falls Church, Virginia, Capital One Financial Corporation operates... -

Page 4

A dozen years ago we had an idea and wondered: -

Page 5

would it fly ? -

Page 6

It soared . Richard D. Fairbank Chairman and Chief Executive Officer -

Page 7

And gave wings to a dream that changed the credit card business forever. Nigel W. Morris President and Chief Operating Officer -

Page 8

-

Page 9

... IN NEW LINES OF BUSINESS. STRATEGIC ALLIANCES WITH MARKET LEADERS IN OTHER INDUSTRIES. RANKED AMONG THE BEST IN CREDIT QUALITY. FIRST MAJOR TELEVISION ADVERTISING CAMPAIGN. Our achievements last year began over a decade ago with a dream of using technology to transform the way financial services... -

Page 10

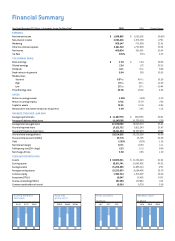

... loans Year-end off-balance sheet loans Year-end total managed loans Year-end total accounts (000s) Yield Net interest margin Delinquency rate (30+ days) Net charge-off rate YEAR-END REPORTED DATA: Assets Earning assets Average assets Average earning assets Common equity Associates (FTEs) Shares... -

Page 11

....® The Kmart alliance, launched in September, brought Capital One more than one million new customers during the last quarter of the year. The co-branded Visa® card and rewards program for BMG Entertainment offer numerous benefits to music fans. In South Africa, we are marketing credit cards and... -

Page 12

Where careers take flight . -

Page 13

... stock purchase or stock option programs. Between our initial public offering in 1994 and year-end 2000, Capital One's stock price appreciated at a compound annual rate of 52%, reflecting a financial track record that is one of the best in corporate America. 94% of our associates are proud to work... -

Page 14

...Canada and South Africa, and we're exploring elsewhere. Capital One's international loan portfolio now stands at $3 billion, and the world's rising demand for affordable, flexible and convenient credit presents a huge opportunity for further growth. In the U.K., where we began marketing our products... -

Page 15

-

Page 16

... service, giving our customers more control over their finances and leaving them with more money and more time to enjoy it. A strong brand will differentiate Capital One from the host of other MasterCard® and Visa® issuers. Our brand-building efforts have already increased customer response rates... -

Page 17

Spreading our wings . -

Page 18

... testing, customization and direct marketing. In 1998 we acquired Summit Acceptance Corporation, a small, well-run auto finance company that offered us an opportunity to put our information-based strategy to work in an industry still run on traditional lines. We renamed the business Capital One Auto... -

Page 19

-

Page 20

A rocket in cyberspace. -

Page 21

... marketing, innovation and risk management. Online service gives Capital One customers the power to track their spending, pay- accounts online, we can offer them other products and services. e stayed in test-pilot mode on the Internet for 18 months. A year after our takeoff, we're Number One. one... -

Page 22

... One Forbes® Platinum 400, Best Big Companies in America FORTUNE® America's Most Admired Companies The Sunday Times®, 50 Best Companies to work for Points of Light Foundation® Award for Excellence in Corporate Community Service Community Trustee award, Business Leadership Fairfax (Virginia... -

Page 23

2000 financial presentation -

Page 24

...'s Discussion and Analysis of Financial Condition and Results of Operations Selected Quarterly Financial Data Management's Report on Consolidated Financial Statements and Internal Controls Over Financial Reporting Report of Independent Auditors Consolidated Financial Statements Notes to Consolidated... -

Page 25

...-bearing deposits Borrowings Stockholders' equity $ $ $ $ $ MANAGED CONSUMER LOAN DATA: Average reported loans Average off-balance sheet loans Average total managed loans Interest income Year-end total managed loans Year-end total accounts (000s) Yield Net interest margin Delinquency rate Net... -

Page 26

... million, or 31%, reflect the increase in marketing investment in existing and new product opportunities and the cost of operations to manage the growth in the Company's accounts and products offered. Average managed consumer loans grew 25% for the year ended December 31, 2000, to $22.6 billion from... -

Page 27

... salaries and benefits expense of $303.8 million, or 64%, reflect the increase in marketing investment in existing and new product opportunities and the cost of operations to manage the growth in the Company's accounts and products offered. Average managed consumer loans grew 19% for the year ended... -

Page 28

...may begin sooner in certain circumstances, including if the annualized portfolio yield (consisting, generally, of interest and fees) for a three-month pe- riod drops below the sum of the certificate rate payable to investors, loan servicing fees and net credit losses during the period. Prior to the... -

Page 29

...have a significant, immediate impact on managed loan balances; rather they typically consist of lower credit limit accounts and balances that build over time. The terms of these customized card products tend to include annual membership fees and higher annual finance charge rates. The profile of the... -

Page 30

... the prior year, continued growth in the Company's portfolio of higher yielding products and repricings of low introductory rate loans during late 1998 and early 1999. The managed net interest margin for the year ended December 31, 1999, increased to 10.83% from 9.91% for the year ended December 31... -

Page 31

... Year Ended December 31 (Dollars in Thousands) Average Balance 2000 Income/ Expense Yield/ Rate Average Balance 1999 Income/ Expense Yield/ Rate Average Balance 1998 Income/ Expense Yield/ Rate ASSETS: Earning assets Consumer loans (1) Securities available for sale Other Total earning assets Cash... -

Page 32

... transactions. Servicing and securitizations income decreased $34.7 million, or 3%, for the year ended December 31, 2000, compared to 1999. This decrease was primarily due to an increase in net charge-offs on such loans as a result of the seasoning of accounts combined with a change in customer... -

Page 33

... the increase in salaries and associate benefits, was primarily a result of a 42% increase in the average number of accounts for the year ended December 31, 1999 and the Company's continued exploration and testing of new products and markets. INCOME TAXES The Company's effective income tax rate was... -

Page 34

... the reported portfolio combined with the seasoning of accounts. The 30-plus day delinquency rate for the managed consumer loan portfolio remained consistent at 5.23% as of December 31, 2000 and 1999. DELINQUENCIES Table 6 shows the Company's consumer loan delinquency trends for the years presented... -

Page 35

..., 2000, the managed net charge-off rate increased 5 basis points to 3.90%. For the year ended December 31, 2000, the reported net charge-off rate increased 105 basis points to 4.64%. The increases in managed and reported net charge-off rates were the result of a shift in the portfolio mix combined... -

Page 36

... fixed rate senior global bank note with a term of five years. The Company has historically issued senior unsecured debt of the Bank through its $8.0 billion domestic bank note program, of which $2.5 billion was outstanding as of December 31, 2000, with original terms of one to ten years. 34 md&a -

Page 37

... to test and market a variety of retail deposit origination strategies, including via the Internet, as well as to develop customized account management programs. As of December 31, 2000, the Company had $8.4 billion in interest-bearing deposits, with original maturities up to ten years. Table... -

Page 38

...or the Savings Bank's capital category. In August 2000, the Bank received regulatory approval and established a subsidiary bank in the United Kingdom. In connection with the approval of its former branch office in the United Kingdom, the Company committed to the Federal Reserve that, for so long as... -

Page 39

... economic activity associated with various interest rate scenarios. Further, in the event of a rate change of large magnitude, management would likely take actions to further mitigate its exposure to any adverse impact. For example, management may reprice interest rates on outstanding credit card... -

Page 40

... growth across a broad spectrum of new and existing customized products, which are distinguished by a range of credit lines, pricing structures and other characteristics. For example, our low introductory and non-introductory rate products, which are marketed to consumers with the best 38 md... -

Page 41

... one million accounts and servicing two million accounts online by the end of 2000. We expect continued growth in the internet services portion of our business in 2001, provided that we can continue to limit fraud and safeguard our customers' privacy. We have expanded our existing operations... -

Page 42

...experienced personnel to assist in the management and operations of new products and services; and other factors listed from time to time in the our SEC reports, including, but not limited to, the Annual Report on Form 10-K for the year ended December 31, 2000 (Part I, Item 1, Risk Factors). 40 md... -

Page 43

... is a tabulation of the Company's unaudited quarterly results for the years ended December 31, 2000 and 1999. The Company's common shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares may be traded in the over-the-counter stock market. There were 10,019 and... -

Page 44

... respects, the Company maintained effective internal controls over financial reporting. Richard D. Fairbank Chairman and Chief Executive Officer Nigel W. Morris President and Chief Operating Officer David M. Willey Executive Vice President and Chief Financial Officer 42 management's report -

Page 45

...of Capital One Financial Corporation at December 31, 2000 and 1999, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2000, in conformity with accounting principles generally accepted in the United States. McLean, Virginia... -

Page 46

Consolidated Balance Sheets December 31 (Dollars in Thousands, Except Per Share Data) 2000 1999 ASSETS: Cash and due from banks Federal funds sold and resale agreements Interest-bearing deposits at other banks Cash and cash equivalents Securities available for sale Consumer loans Less: Allowance... -

Page 47

... and securitizations Service charges and other customer-related fees Interchange Total non-interest income 1,152,375 1,644,264 237,777 3,034,416 1,187,098 1,040,944 144,317 2,372,359 789,844 611,958 86,481 1,488,283 Non-Interest Expense: Salaries and associate benefits Marketing Communications and... -

Page 48

...on securities, net of income tax benefits of $58,759 Foreign currency translation adjustments Other comprehensive loss Comprehensive income Cash dividends - $.11 per share Purchases of treasury stock Issuances of common stock Exercise of stock options Common stock issuable under incentive plan Other... -

Page 49

...deposits Net increase in other borrowings Issuances of senior notes Maturities of senior notes Dividends paid Purchases of treasury stock Net proceeds from issuances of common stock Proceeds from exercise of stock options Net cash provided by financing activities (Decrease) increase in cash and cash... -

Page 50

...the accounts of Capital One Financial Corporation (the "Corporation") and its subsidiaries. The Corporation is a holding company whose subsidiaries provide a variety of products and services to consumers. The principal subsidiaries are Capital One Bank (the "Bank"), which offers credit card products... -

Page 51

...swaps to reduce its sensitivity to changing foreign currency exchange rates. All of the Company's f/x contracts and currency swaps are designated and effective as hedges of specific assets or liabilities. The Company does not hold or issue derivative financial instruments for trading purposes. Swap... -

Page 52

... follows: buildings and improvements - 5-39 years; furniture and equipment - 3-10 years; computers and software - 3 years. Marketing The Company expenses marketing costs as incurred. Credit Card Fraud Losses The Company experiences fraud losses from the unauthorized use of credit cards. Transactions... -

Page 53

Note B SECURITIES AVAILABLE FOR SALE Securities available for sale as of December 31, 2000, 1999 and 1998 were as follows: Maturity Schedule 1 Year or Less 1-5 Years 5-10 Years Over 10 Years Market Value Totals Amortized Cost Totals DECEMBER 31, 2000 U.S. Treasury and other U.S. government agency ... -

Page 54

... 31, 2000, the aggregate amount of interest-bearing deposits with accounts equal to or exceeding $100 was $3,697,888. Secured Borrowings Capital One Auto Finance Corporation (formerly Summit Acceptance Corporation), a subsidiary of the Company, currently maintains three agreements to transfer pools... -

Page 55

... a multicurrency revolving credit facility (the "Multicurrency Facility"). The Multicurrency Facility is intended to finance the Company's business in the United Kingdom and is comprised of two Tranches, each in the amount of Euro 300,000 ($270,800 equivalent based on the exchange rate at closing... -

Page 56

... aggregate public offering price or its equivalent (based on the applicable exchange rate at the time of sale) in one or more foreign currencies, currency units or composite currencies as shall be designated by the Corporation. At December 31, 2000, the Corporation had existing unsecured senior debt... -

Page 57

... managers (including 1,884,435 options to the Company's Chief Executive Officer ["CEO"] and Chief Operating Officer ["COO"]) with an exercise price equal to the fair market value on the date of grant. The CEO and COO gave up their salaries for the year 2001 and their annual cash incentives, annual... -

Page 58

... immediately upon a change of control of the Company. As of December 31, 2000, 27,510 shares were available for grant under this plan. All options under this plan have a maximum term of ten years. The exercise price of each option equals or exceeds the market price of the Company's stock on the date... -

Page 59

... its benefit plans, including its Purchase Plan, dividend reinvestment plan and stock incentive plans. In July 1998 and February 2000, the Company's Board of Directors voted to increase this amount by 4.5 million and 10 million shares, respectively, of the Company's common stock. For the years ended... -

Page 60

... rate Other Income taxes Options to purchase approximately 5,496,000, 5,200,000 and 6,436,000 shares of common stock during 2000, 1999 and 1998, respectively, were not included in the computation of diluted earnings per share because the options' exercise prices were greater than the average market... -

Page 61

...approval of its former branch office in the United Kingdom, the Company committed to the Federal Reserve that, for so long as the Bank maintains a branch or subsidiary bank in the United Kingdom, the Company will maintain a minimum Tier 1 Leverage ratio of 3.0%. As of December 31, 2000 and 1999, the... -

Page 62

...four facilities located in Tampa, Florida and Federal Way, Washington. Monthly rent commences upon completion of each of the buildings. At December 31, 2000, the construction of two of the facilities has been completed and rent payments have commenced. The Company has a one year renewal option under... -

Page 63

... average life for receivables ranging from 7 to 8 months and weighted average discount rates ranging from 11% to 13%. Static pool credit losses are calculated by summing the actual and projected future credit losses and dividing them by the original balance of each pool of asset. Due to the short... -

Page 64

... 31, 2000 and 1999: Cash and Cash Equivalents The carrying amounts of cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at other banks approximated fair value. Securities Available for Sale The fair value of securities available for sale was determined... -

Page 65

...dates, taking into account the forward yield curve on the swaps and the forward rates on the currency swaps and f/x contracts. As of December 31, 2000 and 1999, the estimated fair value was $(39,121) and $80,566, respectively. Note Q CAPITAL ONE FINANCIAL CORPORATION (PARENT COMPANY ONLY) CONDENSED... -

Page 66

... paid Purchases of treasury stock Net proceeds from issuances of common stock Proceeds from exercise of stock options Net cash provided by financing activities Increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 157... -

Page 67

... and Chief Executive Officer Nigel W. Morris Nigel W. Morris President and Chief Operating Officer Capital One Financial Corporation President and Chief Operating Officer Marjorie M. Connelly Executive Vice President, Credit Card Operations W. Ronald Dietz* Managing Partner Customer Contact... -

Page 68

... Falls Church, VA 22042 Principal Financial Contact Paul Paquin Vice President, Investor Relations Capital One Financial Corporation 2980 Fairview Park Drive, Suite 1300 Falls Church, VA 22042-4525 (703) 205-1039 Copies of Form 10-K filed with the Securities and Exchange Commission are available... -

Page 69

Designed and produced by The Agency at Capital One Torrell Armstrong Kevin Carpenter Clint Delapaz Rita Hudgins Sonia Myrick Patty O'Toole Sarah Sherman Financials Creative and Art Director Designer Production Manager Editor Writer Project Manager -

Page 70

2980 Fairview Park Drive Suite 1300 Falls Church, VA 22042-4525 703/205.1000 www.capitalone.com