Avon 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

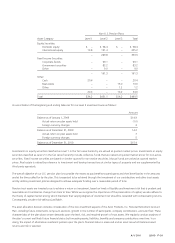

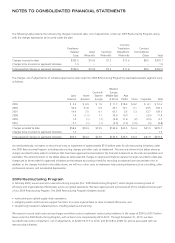

The U.S. pension plans include funded qualified plans and unfunded non-qualified plans. As of December 31, 2010, the U.S. qualified

pension plans had benefit obligations of $630.2 and plan assets of $451.7. As of December 31, 2009, the U.S. qualified pension plans had

benefit obligations of $615.5 and plan assets of $470.6. We believe we have adequate investments and cash flows to fund the liabilities

associated with the unfunded non-qualified plans.

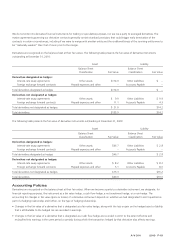

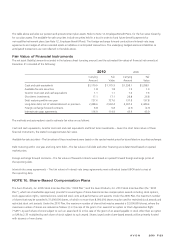

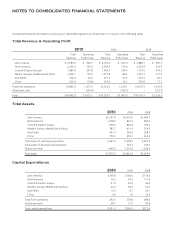

Components of Net Periodic Benefit Cost and Other Amounts Recognized in Other

Comprehensive Income

Pension Benefits

U.S. Plans Non-U.S. Plans Postretirement Benefits

2010 2009 2008 2010 2009 2008 2010 2009 2008

Net Periodic Benefit Cost:

Service cost $ 11.9 $ 11.7 $ 17.4 $ 14.6 $ 12.2 $ 14.8 $ 2.0 $ 3.2 $ 3.3

Interest cost 35.6 40.4 45.4 39.3 38.6 41.2 7.1 9.9 10.5

Expected return on plan assets (36.9) (43.0) (51.7) (37.7) (35.6) (43.1) (2.4) (2.5) (3.3)

Amortization of prior service credit (.3) (.3) (1.0) (1.3) (1.3) (1.7) (17.0) (9.7) (6.0)

Amortization of actuarial losses 38.5 29.5 28.4 13.0 10.8 10.3 3.5 3.2 .9

Amortization of transition obligation – – – .1 .1 .1 – – –

Settlements/curtailments 1.2 6.0 – 1.6 12.2 .3 – (.4) –

Special termination benefits – – – – – – – – –

Other – – – .6 .6 .6 – – –

Net periodic benefit cost $ 50.0 $ 44.3 $ 38.5 $ 30.2 $ 37.6 $ 22.5 $ (6.8) $ 3.7 $ 5.4

Other Changes in Plan Assets and

Benefit Obligations Recognized in

Other Comprehensive Income:

Actuarial (gains) losses $ 20.9 $(38.5) $217.4 $ (3.0) $ 17.1 $118.7 $ (3.8) $ 18.3 $16.2

Prior service cost (credit) (.2) (1.3) – – 1.6 – 17.0 (64.0) –

Amortization of prior service credit .3 .3 1.0 1.3 1.3 1.7 (3.6) 9.7 6.0

Amortization of actuarial losses (38.4) (29.5) (28.4) (14.5) (18.3) (10.3) – (3.2) (.9)

Amortization of transition obligation – – – (.1) (.1) (.1) – – –

Settlements/curtailments .2 .2 – (1.0) – 1.0 –

Foreign currency changes – – – (9.5) 18.9 (33.3) .1 1.0 (.8)

Total recognized in other comprehensive income* (17.4) (68.8) 190.0 (25.8) 20.5 75.7 9.7 (37.2) 20.5

Total recognized in net periodic benefit cost and

other comprehensive (income) loss $ 32.6 $(24.5) $228.5 $ 4.4 $ 58.1 $ 98.2 $ 2.9 $(33.5) $25.9

* Amounts represent the pre-tax effect included within other comprehensive income. The net of tax amounts are included within the Consolidated Statements

of Changes in Shareholders’ Equity.

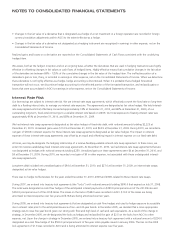

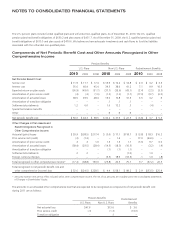

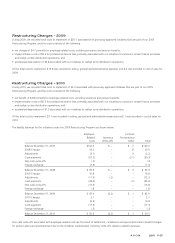

The amounts in accumulated other comprehensive loss that are expected to be recognized as components of net periodic benefit cost

during 2011 are as follows:

Pension Benefits Postretirement

BenefitsU.S. Plans Non-U.S. Plans

Net actuarial loss $47.6 $13.6 $ 3.6

Prior service credit (.3) (1.3) (16.0)

Transition obligation – .1 –