Avon 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

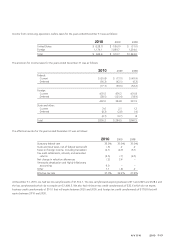

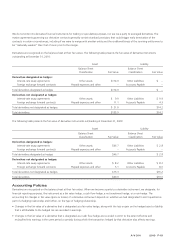

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In June 2009, the Financial Accounting Standards Board (“FASB”) amended its accounting guidance on the consolidation of variable interest

entities (“VIE”). Among other things, the new guidance requires a qualitative rather than a quantitative assessment to determine the primary

beneficiary of a VIE based on whether the entity (1) has the power to direct matters that most significantly impact the activities of the VIE

and 2) has the obligation to absorb losses or the right to receive benefits of the VIE that could potentially be significant to the VIE. In

addition, the amended guidance requires an ongoing reconsideration of the primary beneficiary. The provisions of this new guidance were

effective January 1, 2010 for Avon and did not have any impact on our financial statements.

In December 2010, the FASB issued Accounting Standards Update (“ASU”) 2010-29, Business Combinations (Topic 805): Disclosures of

Supplementary Pro Forma Information for Business Combinations (a consensus of the FASB Emerging Issues Task Force). The ASU specifies

that if a public entity presents comparative financial statements, the entity should disclose revenue and earnings of the combined entity as

though the business combination that occurred during the current year had occurred as of the beginning of the comparable prior annual

reporting period only. The amendments in this Update also expand the supplemental pro forma disclosures under Topic 805 to include a

description of the nature and amount of material, nonrecurring pro forma adjustments directly attributable to the business combination

included in the reported pro forma revenue and earnings. ASU 2010-29 is effective prospectively for business combinations for which the

acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2010. We have

implemented the provisions of this new guidance. Refer to Note 17, Goodwill and Intangible Assets.

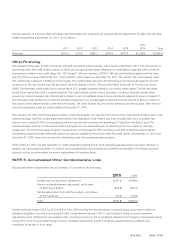

NOTE 3. Discontinued Operations

On November 8, 2010, the Company announced that Avon International Operations, Inc. (“AIO”), a wholly-owned subsidiary of the

Company, had agreed to sell the ownership interest in Avon Products Company Limited (“Avon Japan”) held by AIO pursuant to a tender

offer bid agreement between AIO and Devon Holdings K.K., an affiliate of TPG Capital (“Buyer”). The transaction included both the sale of

the Company’s stake in Avon Japan as well as certain pre-paid royalties in connection with intellectual property licenses for an aggregate

cash consideration of approximately $90. Avon Japan was previously reported within our Asia Pacific segment.

The transaction closed on December 29, 2010. Of the total cash consideration received, $81 was recognized in December 2010, resulting in

a net after tax gain of $10. The remaining $9 of the consideration received related to the use of Avon’s global brands, formulas and

products, and the use of the Avon name in Japan for a five year period. This portion of the royalty will be recognized on a straight line basis

over five years within continuing operations.

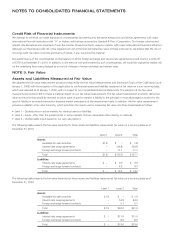

NOTE 4. Inventories

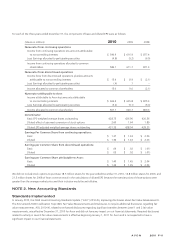

Inventories at December 31 consisted of the following:

2010 2009

Raw materials $ 371.6 $ 326.6

Finished goods 781.3 723.2

Total $1,152.9 $1,049.8