Avon 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

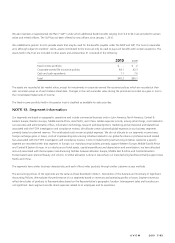

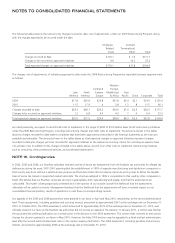

Intangible Assets

2010 2009

Gross

Amount

Accumulated

Amortization

Gross

Amount

Accumulated

Amortization

Amortized Intangible Assets

Customer relationships $221.9 $ (45.6) $38.5 $(31.0)

Licensing agreements 58.5 (46.1) 42.3 (37.5)

Noncompete agreements 8.2 (6.8) 7.4 (5.9)

Trademarks 6.6 (1.8) – –

Indefinite Lived Trademarks 173.4 – – –

Total $468.6 $(100.3) $88.2 $(74.4)

Aggregate Amortization Expense:

2010 $ 13.1

2009 $ 14.8

2008 $ 16.4

Estimated Amortization Expense:

2011 $ 23.6

2012 23.6

2013 21.4

2014 20.6

2015 20.0

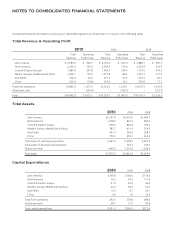

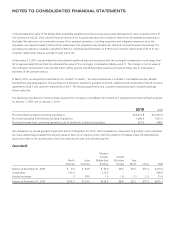

NOTE 18. Supplemental Balance Sheet Information

At December 31, 2010 and 2009, prepaid expenses and other included the following

Prepaid expenses and other 2010 2009

Deferred tax assets (Note 7) $ 347.4 $ 303.2

Receivables other than trade 145.9 142.3

Prepaid taxes and tax refunds receivable 247.1 296.9

Prepaid brochure costs, paper and other literature 121.4 120.7

Short-term investments 17.1 26.8

Property, plant and equipment held for sale 12.8 12.8

Deferred charge – 36.9

Other 133.5 102.7

Prepaid expenses and other $1,025.2 $1,042.3

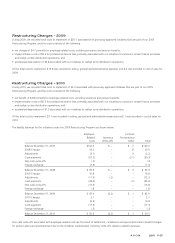

In accordance with guidance published by the International Practices Task Force, when a subsidiary in Venezuela purchases U.S. dollar

denominated cash at the parallel market exchange rate, the Venezuelan subsidiary should remeasure the cash at the parallel market

exchange rate. The subsidiary should translate the cash, as well as the remainder of its net assets, at the official rate, because this is expected

to be the rate that is available for dividend remittances. Since the remeasurement and translation occur at different exchange rates, a

difference arises between the actual U.S. dollar denominated cash balance and the “as translated” balance. The deferred charge in the table

above represents this difference for the U.S. Dollar denominated cash held by our Venezuelan subsidiary.

A V O N 2010 F-43