Avon 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 7. Income Taxes

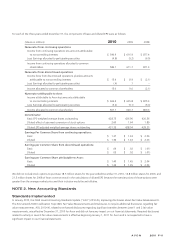

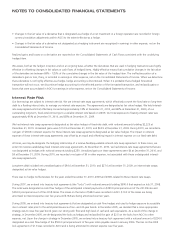

Deferred tax assets (liabilities) resulting from temporary differences in the recognition of income and expense for tax and financial reporting

purposes at December 31 consisted of the following:

2010 2009

Deferred tax assets:

Accrued expenses and reserves $ 279.7 $ 252.8

Pension and postretirement benefits 155.4 160.1

Asset revaluations 51.6 82.7

Capitalized expenses 76.1 65.1

Share-based compensation 55.3 60.0

Restructuring initiatives 39.7 25.2

Postemployment benefits 22.9 23.6

Tax loss carryforwards 465.4 362.8

Foreign tax credit carryforwards 178.8 144.2

Minimum tax and business credit carryforwards 42.6 38.6

All other 89.8 48.7

Valuation allowance (462.7) (370.2)

Total deferred tax assets 994.6 893.6

Deferred tax liabilities:

Depreciation and amortization (51.7) (40.9)

Unremitted foreign earnings (35.2) (26.2)

Prepaid expenses (7.8) (13.6)

Capitalized interest (10.4) (7.7)

All other (31.2) (21.0)

Total deferred tax liabilities (136.3) (109.4)

Net deferred tax assets $ 858.3 $ 784.2

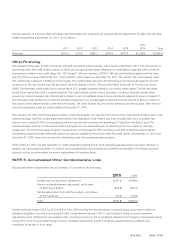

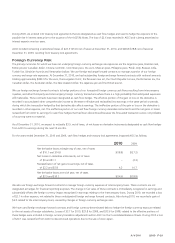

Deferred tax assets (liabilities) at December 31 were classified as follows:

2010 2009

Deferred tax assets:

Prepaid expenses and other $347.4 $303.2

Other assets 544.3 501.1

Total deferred tax assets 891.7 804.3

Deferred tax liabilities:

Income taxes (3.4) (.2)

Long-term income taxes (30.0) (19.9)

Total deferred tax liabilities (33.4) (20.1)

Net deferred tax assets $858.3 $784.2

The valuation allowance primarily represents amounts for foreign tax loss carryforwards. The basis used for recognition of deferred tax assets

included the profitability of the operations, related deferred tax liabilities and the likelihood of utilizing tax credit carryforwards during the

carryover periods. The net increase in the valuation allowance of $92.5 during 2010 was mainly due to several of our foreign entities

continuing to incur losses during 2010, thereby increasing the tax loss carryforwards for which a valuation allowance was provided.