Avon 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

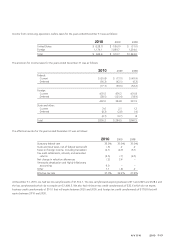

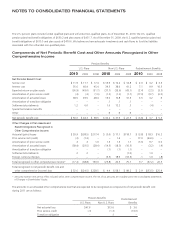

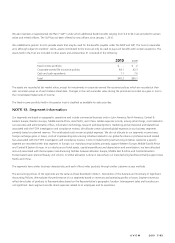

Reconciliation of Benefit Obligations, Plan Assets and Funded Status

The following table summarizes changes in the benefit obligation, plan assets and the funded status of our significant pension and

postretirement plans. We use a December 31 measurement date for all of our employee benefit plans.

Pension Plans Postretirement

BenefitsU.S. Plans Non-U.S. Plans

2010 2009 2010 2009 2010 2009

Change in Benefit Obligation:

Beginning balance $(702.2) $(726.2) $(711.3) $(606.0) $(134.6) $(178.3)

Service cost (11.9) (11.7) (14.6) (12.2) (2.0) (3.2)

Interest cost (35.6) (40.4) (39.3) (38.6) (7.1) (9.9)

Actuarial (loss) gain (44.4) (29.1) (16.2) (55.5) 2.1 (12.0)

Plan participant contributions – – (2.5) (2.8) (4.3) (8.7)

Benefits paid 92.6 110.1 40.1 38.6 13.5 18.8

Federal subsidy – – – – – (1.5)

Plan amendments .2 1.3 – (1.6) – 64.0

Settlements/ curtailments (1.3) (1.4) – 24.3 – (.6)

Special termination benefits – (4.8) (.1) (9.0) – –

Foreign currency changes and other – – 23.6 (48.5) (.6) (3.2)

Ending balance $(702.6) $(702.2) $(720.3) $(711.3) $(133.0) $(134.6)

Change in Plan Assets:

Beginning balance $ 470.6 $ 449.1 $ 499.5 $ 400.5 $ 39.6 $ 43.7

Actual return on plan assets 60.3 110.7 56.9 74.0 4.1 (4.1)

Company contributions 13.4 20.9 32.9 31.9 9.2 8.6

Special company contribution to fund

termination benefits – – – 9.0 – –

Federal subsidy – – – – – 1.5

Plan participant contributions – – 2.5 2.8 4.3 8.7

Benefits paid (92.6) (110.1) (40.1) (38.6) (13.5) (18.8)

Settlements – – – (19.9) – –

Foreign currency changes and other – – (11.1) 39.8 – –

Ending balance $ 451.7 $ 470.6 $ 540.6 $ 499.5 $ 43.7 $ 39.6

Funded Status:

Funded status at end of year $(250.9) $(231.6) $(179.7) $(211.8) $ (89.3) $ (95.0)

Amount Recognized in Balance Sheet:

Other assets $ – $ – $ 3.0 $ 2.6 $ – $ –

Accrued compensation (9.8) (17.0) (2.7) (1.7) (4.3) (3.9)

Employee benefit plans liability (241.1) (214.6) (180.0) (212.7) (85.0) (91.1)

Net amount recognized $(250.9) $(231.6) $(179.7) $(211.8) $ (89.3) $ (95.0)

Pretax Amounts Recognized in Accumulated

Other Comprehensive Loss:

Net actuarial loss $ 445.8 $ 463.4 $ 250.0 $ 277.7 $ 50.8 $ 58.0

Prior service credit (1.3) (1.4) (12.3) (14.3) (70.2) (87.1)

Transition obligation – – .3 .4 – –

Total pretax amount recognized $ 444.5 $ 462.0 $ 238.0 $ 263.8 $ (19.4) $ (29.1)

Supplemental Information:

Accumulated benefit obligation $ 685.2 $ 684.0 $ 653.4 $ 652.5 N/A N/A

Plans with Projected Benefit Obligation in Excess

of Plan Assets:

Projected benefit obligation $ 702.6 $ 702.2 $ 702.8 $ 708.1 N/A N/A

Fair value plan assets 451.7 470.6 520.2 493.7 N/A N/A

Plans with Accumulated Benefit Obligation

in Excess of Plan Assets:

Projected benefit obligation $ 702.6 $ 702.2 $ 693.3 $ 684.8 N/A N/A

Accumulated benefit obligation 685.2 684.0 653.4 652.5 N/A N/A

Fair value plan assets 451.7 470.6 511.6 470.9 N/A N/A

A V O N 2010 F-27