Avon 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

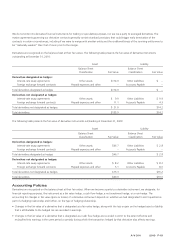

• Changes in the fair value of a derivative that is designated as a hedge of a net investment in a foreign operation are recorded in foreign

currency translation adjustments within AOCI to the extent effective as a hedge.

• Changes in the fair value of a derivative not designated as a hedging instrument are recognized in earnings in other expense, net on the

Consolidated Statements of Income.

Realized gains and losses on a derivative are reported on the Consolidated Statements of Cash Flows consistent with the underlying

hedged item.

We assess, both at the hedge’s inception and on an ongoing basis, whether the derivatives that are used in hedging transactions are highly

effective in offsetting changes in fair values or cash flows of hedged items. Highly effective means that cumulative changes in the fair value

of the derivative are between 80% - 125% of the cumulative changes in the fair value of the hedged item. The ineffective portion of a

derivative’s gain or loss, if any, is recorded in earnings in other expense, net on the Consolidated Statements of Income. When we determine

that a derivative is not highly effective as a hedge, hedge accounting is discontinued. When it is probable that a hedged forecasted

transaction will not occur, we discontinue hedge accounting for the affected portion of the forecasted transaction, and reclassify gains or

losses that were accumulated in AOCI to earnings in other expense, net on the Consolidated Statements of Income.

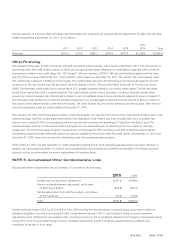

Interest Rate Risk

Our borrowings are subject to interest rate risk. We use interest-rate swap agreements, which effectively convert the fixed rate on long-term

debt to a floating interest rate, to manage our interest rate exposure. The agreements are designated as fair value hedges. We held interest-

rate swap agreements that effectively converted approximately 74% at December 31, 2010, and 82% at December 31, 2009, of our

outstanding long-term, fixed-rate borrowings to a variable interest rate based on LIBOR. Our total exposure to floating interest rates was

approximately 81% at December 31, 2010, and 83% at December 31, 2009.

We had interest-rate swap agreements designated as fair value hedges of fixed-rate debt, with notional amounts totaling $2,225 at

December 31, 2010. Unrealized gains were $114.9 at December 31, 2010, and $43.9 at December 31, 2009. During 2010, we recorded a

net gain of $66.8 in interest expense for these interest-rate swap agreements designated as fair value hedges. The impact on interest

expense of these interest-rate swap agreements was offset by an equal and offsetting impact in interest expense on our fixed-rate debt.

At times, we may de-designate the hedging relationship of a receive-fixed/pay-variable interest-rate swap agreement. In these cases, we

enter into receive-variable/pay-fixed interest-rate swap agreements. At December 31, 2010, we had interest-rate swap agreements that are

not designated as hedges with notional amounts totaling $250. Unrealized gains on these agreements were $0 at December 31, 2010, and

$0 at December 31, 2009. During 2010, we recorded a net gain of $0 in other expense, net associated with these undesignated interest-

rate swap agreements.

Long-term debt included net unrealized gains of $94.4 at December 31, 2010, and $27.6 at December 31, 2009, on interest rate swaps

designated as fair value hedges.

There was no hedge ineffectiveness for the years ended December 31, 2010, 2009 and 2008, related to these interest rate swaps.

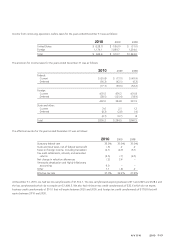

During 2007, we entered into treasury lock agreements (the “locks”) with notional amounts totaling $500.0 that expired on July 31, 2008.

The locks were designated as cash flow hedges of the anticipated interest payments on $250.0 principal amount of the 2013 Notes and

$250.0 principal amount of the 2018 Notes. The losses on the locks of $38.0 were recorded in AOCI. $19.2 of the losses are being

amortized to interest expense over five years and $18.8 are being amortized over ten years.

During 2005, we entered into treasury lock agreements that we designated as cash flow hedges and used to hedge exposure to a possible

rise in interest rates prior to the anticipated issuance of ten- and 30-year bonds. In December 2005, we decided that a more appropriate

strategy was to issue five-year bonds given our strong cash flow and high level of cash and cash equivalents. As a result of the change in

strategy, in December 2005, we de-designated the locks as hedges and reclassified the gain of $2.5 on the locks from AOCI to other

expense, net. Upon the change in strategy in December 2005, we entered into a treasury lock agreement with a notional amount of $250.0

designated as a cash flow hedge of the $500.0 principal amount of five-year notes payable issued in January 2006. The loss on the 2005

lock agreement of $1.9 was recorded in AOCI and is being amortized to interest expense over five years.