Avon 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

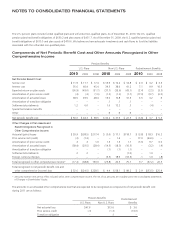

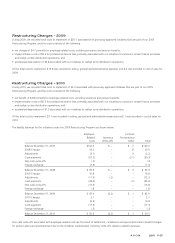

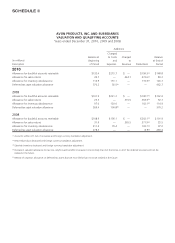

The following table presents the restructuring charges incurred to date, net of adjustments, under our 2005 Restructuring Program, along

with the charges expected to be incurred under the plan:

Employee-

Related

Costs

Asset

Write-offs

Inventory

Write-offs

Currency

Translation

Adjustment

Write-offs

Contract

Terminations/

Other Total

Charges incurred to date $332.6 $10.8 $7.2 $11.6 $8.5 $370.7

Charges to be incurred on approved initiatives 1.9 – – – – 1.9

Total expected charges on approved initiatives $334.5 $10.8 $7.2 $11.6 $8.5 $372.6

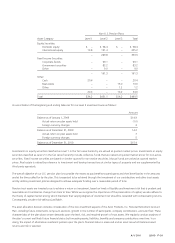

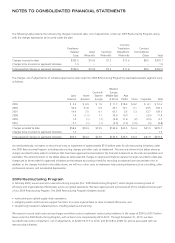

The charges, net of adjustments, of initiatives approved to date under the 2005 Restructuring Program by reportable business segment were

as follows:

Latin

America

North

America

Central &

Eastern

Europe

Western

Europe,

Middle East

& Africa

Asia

Pacific China Corporate Total

2005 $ 3.5 $ 6.9 $ 1.0 $ 11.7 $18.2 $ 4.2 $ 6.1 $ 51.6

2006 34.6 61.8 6.9 45.1 12.1 2.1 29.5 192.1

2007 14.9 7.0 4.7 65.1 3.6 1.3 12.7 109.3

2008 1.9 (1.1) 1.7 19.0 (0.7) – (3.0) 17.8

2009 1.4 (.1) (.7) (4.4) 11.6 (.2) (2.9) 4.7

2010 2.1 (.1) (.1) (3.9) (1.3) (1.0) (.5) (4.8)

Charges recorded to date $58.4 $74.4 $13.5 $132.6 $43.5 $ 6.4 $41.9 $370.7

Charges to be incurred on approved initiatives 1.9 – – – – – – 1.9

Total expected charges on approved initiatives $60.3 $74.4 $13.5 $132.6 $43.5 $ 6.4 $41.9 $372.6

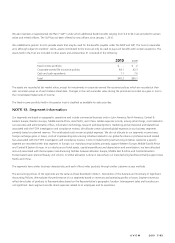

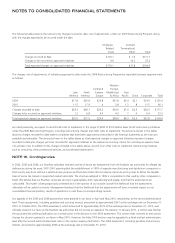

As noted previously, we expect to record total costs to implement of approximately $519 before taxes for all restructuring initiatives under

the 2005 Restructuring Program, including restructuring charges and other costs to implement. The amounts shown in the tables above as

charges recorded to date relate to initiatives that have been approved and recorded in the financial statements as the costs are probable and

estimable. The amounts shown in the tables above as total expected charges on approved initiatives represent charges recorded to date plus

charges yet to be recorded for approved initiatives as the relevant accounting criteria for recording an expense have not yet been met. In

addition to the charges included in the tables above, we will incur other costs to implement restructuring initiatives such as consulting, other

professional services, and accelerated depreciation.

2009 Restructuring Program

In February 2009, we announced a new restructuring program (the “2009 Restructuring Program”) which targets increasing levels of

efficiency and organizational effectiveness across our global operations. We have approved and announced all of the initiatives that are part

of our 2009 Restructuring Program. The 2009 Restructuring Program initiatives include:

• restructuring our global supply chain operations;

• realigning certain local business support functions to a more regional basis to drive increased efficiencies; and

• streamlining transaction-related services, including selective outsourcing.

We expect to record total restructuring charges and other costs to implement restructuring initiatives in the range of $300 to $310 before

taxes under the 2009 Restructuring Program, with actions to be completed by 2012-2013. Through December 31, 2010, we have

recorded total costs to implement, net of adjustments, of $228.3 ($77.5 in 2010, and $150.8 in 2009) for actions associated with our

restructuring initiatives.