Avon 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 14. Leases and Commitments

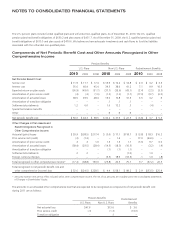

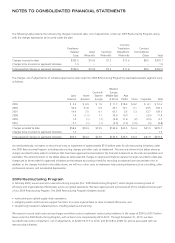

Minimum rental commitments under noncancellable operating leases, primarily for equipment and office facilities at December 31, 2010,

are included in the following table under leases. Purchase obligations include commitments to purchase paper, inventory and other services.

Year Leases

Purchase

Obligations

2011 $108.1 $223.4

2012 88.1 88.4

2013 77.3 62.9

2014 64.9 51.0

2015 59.8 50.3

Later years 167.2 14.6

Sublease rental income (24.5) –

Total $540.9 $490.6

Rent expense was $113.7 in 2010, $113.5 in 2009, and $117.8 in 2008. Plant construction, expansion and modernization projects with an

estimated cost to complete of approximately $500.1 were in progress at December 31, 2010.

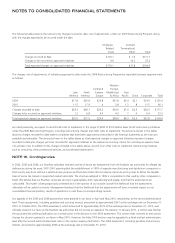

NOTE 15. Restructuring Initiatives

2005 Restructuring Program

In November 2005, we announced a multi-year turnaround plan to restore sustainable growth. As part of our turnaround plan, we launched

a restructuring program in late 2005 (the “2005 Restructuring Program”). Restructuring initiatives under this program include:

• enhancement of organizational effectiveness, including efforts to flatten the organization and bring senior management closer to

consumers through a substantial organization downsizing;

• implementation of a global manufacturing strategy through facilities realignment;

• implementation of additional supply chain efficiencies in distribution; and

• streamlining of transactional and other services through outsourcing and moves to low-cost countries.

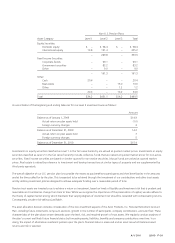

We have approved and announced all of the initiatives that are part of our 2005 Restructuring Program. We expect to record total

restructuring charges and other costs to implement restructuring initiatives of approximately $519 before taxes. Through December 31,

2010, we have recorded total costs to implement, net of adjustments, of $513.7 ($3.2 in 2010, $20.1 in 2009, $59.3 in 2008, $157.5 in

2007, $217.1 in 2006 and $56.5 in 2005) for actions associated with our restructuring initiatives.

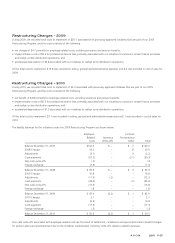

Restructuring Charges – 2008

During 2008, we recorded total costs to implement $59.3 associated with previously approved initiatives that are part of our 2005

Restructuring Program, and the costs consisted of the following:

• net charges of $17.8 primarily for employee-related costs, including severance and pension benefits;

• implementation costs of $30.5 for professional service fees, primarily associated with our initiatives to outsource certain finance and

human resource processes; and

• accelerated depreciation of $11.0 associated with our initiatives to realign some distribution operations and close some

manufacturing operations.

Of the total costs to implement, $56.2 was recorded in selling, general and administrative expenses and $3.1 was recorded in cost of

sales for 2008.