Avon 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

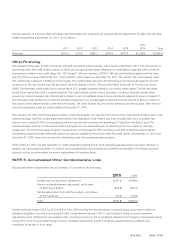

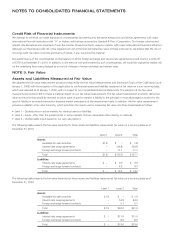

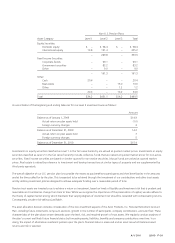

The table above excludes our pension and postretirement plan assets. Refer to Note 12, Employee Benefit Plans, for the fair value hierarchy

for our plan assets. The available-for-sale securities include securities held in a trust in order to fund future benefit payments for

non-qualified retirement plans (see Note 12, Employee Benefit Plans). The foreign exchange forward contracts and interest-rate swap

agreements are hedges of either recorded assets or liabilities or anticipated transactions. The underlying hedged assets and liabilities or

anticipated transactions are not reflected in the table above.

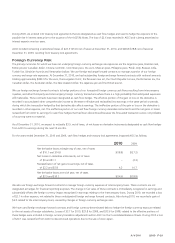

Fair Value of Financial Instruments

The net asset (liability) amounts recorded in the balance sheet (carrying amount) and the estimated fair values of financial instruments at

December 31 consisted of the following:

2010 2009

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Cash and cash equivalents $1,179.9 $1,179.9 $1,298.1 $1,298.1

Available-for-sale securities 1.8 1.8 1.9 1.9

Grantor trust cash and cash equivalents 1.1 1.1 7.6 7.6

Short term investments 17.1 17.1 26.8 26.8

Debt maturing within one year 727.6 727.6 137.8 137.8

Long-term debt, net of related discount or premium 2,408.6 2,502.4 2,307.2 2,440.4

Foreign exchange forward contracts 6.8 6.8 (2.9) (2.9)

Interest-rate swap agreements 114.9 114.9 43.9 43.9

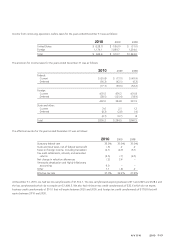

The methods and assumptions used to estimate fair value are as follows:

Cash and cash equivalents, Grantor trust cash and cash equivalents and Short term investments – Given the short term nature of these

financial instruments, the stated cost approximates fair value.

Available-for-sale securities – The fair values of these investments were based on the quoted market prices for issues listed on securities exchanges.

Debt maturing within one year and long-term debt – The fair values of all debt and other financing were determined based on quoted

market prices.

Foreign exchange forward contracts – The fair values of forward contracts were based on quoted forward foreign exchange prices at

the reporting date.

Interest-rate swap agreements – The fair values of interest-rate swap agreements were estimated based LIBOR yield curves at

the reporting date.

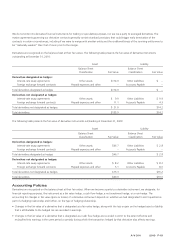

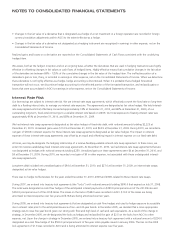

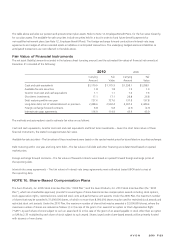

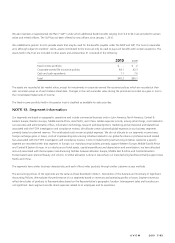

NOTE 10. Share-Based Compensation Plans

The Avon Products, Inc. 2005 Stock Incentive Plan (the “2005 Plan”) and the Avon Products, Inc. 2010 Stock Incentive Plan (the “2010

Plan”), which are shareholder approved, provide for several types of share-based incentive compensation awards including stock options,

stock appreciation rights, restricted stock, restricted stock units and performance unit awards. Under the 2005 Plan, the maximum number

of shares that may be awarded is 31,000,000 shares, of which no more than 8,000,000 shares may be used for restricted stock awards and

restricted stock unit awards. Under the 2010 Plan, the maximum number of shares that may be awarded is 32,000,000 shares, where the

maximum number of shares are reduced as follows: (i) in the case of the grant of an award of an option or Stock Appreciation Right

(“SAR”), by each share of stock subject to such an award and (ii) in the case of the grant of an award payable in stock other than an option

or SAR by 2.33 multiplied by each share of stock subject to such award. Shares issued under share-based awards will be primarily funded

with issuance of new shares.

A V O N 2010 F-23