Avon 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In millions, except per share and share data)

NOTE 1. Description of the Business and Summary of Significant Accounting Policies

Business

When used in these notes, the terms “Avon,” “Company,” “we,” “our” or “us” mean Avon Products, Inc.

We are a global manufacturer and marketer of beauty and related products. Our business is conducted worldwide, primarily in one channel,

direct-selling. Our reportable segments are based on geographic operations in six regions: Latin America; North America; Central & Eastern

Europe; Western Europe, Middle East & Africa; Asia Pacific; and China. We have centralized operations for Global Brand Marketing, Global

Sales and Supply Chain. Our product categories are Beauty, Fashion and Home. Beauty consists of color cosmetics, fragrances, skincare and

personal care. Fashion consists of fashion jewelry, watches, apparel, footwear, accessories and children’s products. Home consists of gift and

decorative products, housewares, entertainment and leisure products and nutritional products. Sales are made to the ultimate consumer

principally by independent Representatives.

Principles of Consolidation

The consolidated financial statements include the accounts of Avon and our majority and wholly-owned subsidiaries. Intercompany balances

and transactions are eliminated.

Use of Estimates

We prepare our consolidated financial statements and related disclosures in conformity with accounting principles generally accepted in the

United States of America, or GAAP. In preparing these statements, we are required to use estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ materially from those estimates and

assumptions. On an ongoing basis, we review our estimates, including those related to restructuring reserves, allowances for doubtful

accounts receivable, allowances for sales returns, provisions for inventory obsolescence, income taxes and tax valuation reserves, share-based

compensation, loss contingencies, the determination of discount rate and other actuarial assumptions for pension, postretirement and

postemployment benefit expenses and the valuation of intangible assets and contingent consideration.

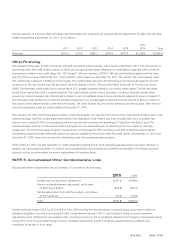

Foreign Currency

Financial statements of foreign subsidiaries operating in other than highly inflationary economies are translated at year-end exchange rates

for assets and liabilities and average exchange rates during the year for income and expense accounts. The resulting translation adjustments

are recorded within accumulated other comprehensive loss (“AOCI”). Gains or losses resulting from the impact of changes in foreign

currency rates on assets and liabilities denominated in a currency other than the functional currency are recorded in “Other expense, net”.

For financial statements of Avon subsidiaries operating in highly inflationary economies, the U.S. dollar is required to be used as the

functional currency. Highly inflationary accounting requires monetary assets and liabilities, such as cash, receivables and payables, to be

remeasured into U.S. dollars at the current exchange rate at the end of each period with the impact of any changes in exchange rates being

recorded in income. We record the impact of changes in exchange rates on monetary assets and liabilities in “Other expense, net”. Similarly,

deferred tax assets and liabilities are remeasured into U.S. dollars at the current exchange rates; however, the impact of changes in exchange

rates is recorded in “Income taxes” in the Consolidated Statement of Income. Nonmonetary assets and liabilities, such as inventory,

property, plant and equipment and prepaid expenses are recorded in U.S. dollars at the historical rates at the time of acquisition of such

assets or liabilities.

Venezuela Currency

Effective January 1, 2010, we began to account for Venezuela as a highly inflationary economy. Effective January 11, 2010, the Venezuelan

government devalued its currency and moved to a two-tier exchange structure. The official exchange rate moved from 2.15 to 2.60 for

essential goods and to 4.30 for nonessential goods and services. Effective December 30, 2010, the Venezuelan government eliminated the

2.60 rate which had been available for the import of essential goods. Substantially all of the imports of our subsidiary in Venezuela (“Avon

Venezuela”) falls into the nonessential classification.

A V O N 2010 F-7