Avon 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

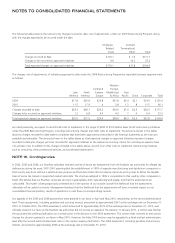

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

of the estimated fair value of the liability after probability-weighting and discounting various potential payments. Avon acquired control of

this business on July 28, 2010, and the financial results of the acquired operations are included in these financial statements beginning on

that date. Net sales and net income before taxes of the acquired operations, including acquisition and integration expenses, since the

acquisition were approximately $109 and $26, respectively. The acquisition was funded with cash and commercial paper borrowings. The

purchase price allocation resulted in goodwill of $314.4, indefinite lived trademarks of $150.0 and customer relationships of $172.8. The

customer relationships have an average 10-year useful life.

At December 31, 2010, we estimated that the potential additional payment associated with the contingent consideration could range from

$0 to approximately $35 and that the estimated fair value of the contingent consideration liability was $11. The change in the fair value of

the contingent consideration was recorded within selling, general and administrative expenses and was primarily due to a decrease in

estimates of the ultimate earnout.

In March 2010, we acquired Liz Earle Beauty Co. Limited (“Liz Earle”). The acquired business is included in our Western Europe, Middle

East & Africa operating segment. The purchase price allocation resulted in goodwill of $123.6, indefinite lived trademarks of $22.8, licensing

agreements of $8.7 and customer relationships of $4.7. The licensing agreements and customer relationships have a weighted average

8-year useful life.

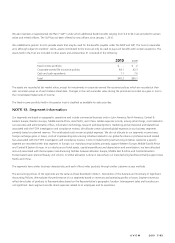

The following unaudited pro forma summary presents the Company’s consolidated information as if Silpada and Liz Earle had been acquired

on January 1, 2009, and on January 1, 2010.

2010 2009

Pro forma Revenue Results including Acquisitions $10,975.8 $10,473.3

Pro forma Operating Profit Results including Acquisitions 1,084.9 1,051.6

Pro forma Income from continuing operations, net of tax Results including Acquisitions 601.9 648.2

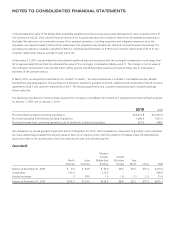

We completed our annual goodwill impairment test as of November 30, 2010, which indicated no impairment of goodwill, as the estimated

fair value substantially exceeded the carrying values of each of our reporting units, with the exception of Silpada where the estimated fair

value was similar to the carrying value, since this reporting unit was only recently acquired.

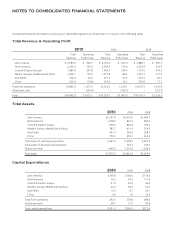

Goodwill

North

America

Latin

America

Western

Europe,

Middle East

& Africa

Central

& Eastern

Europe

Asia

Pacific China Total

Balance at December 31, 2009 $ 0.0 $ 94.9 $ 33.9 $8.9 $2.6 $75.2 $215.5

Acquisitions 314.4 – 123.6 – – – 438.0

Foreign exchange .3 18.6 1.0 (.5) (.1) 2.3 21.6

Balance at December 31, 2010 $314.7 $113.5 $158.5 $8.4 $2.5 $77.5 $675.1