Avon 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

indefinite-lived intangibles impairment assessments and no adjustments were necessary for the years ended December 31, 2010, 2009 or

2008. Additionally, no events or changes in circumstances occurred that indicated that our intangible assets with defined useful lives may

not be recoverable during the years ended December 31, 2010, 2009 or 2008. The asset impairment analyses performed for goodwill and

indefinite-lived intangibles require several estimates including future cash flows, growth rates and the selection of discount rates. For our

annual goodwill impairment test, the estimated fair value substantially exceeded the carrying values of each of our reporting units, with

the exception of Silpada where the estimated fair value was similar to the carrying value, since this reporting unit was only recently

acquired. See Note 17, Goodwill and Intangible Assets, to our 2010 Annual Report for further information. A significant decline in

expected future cash flows and growth rates or a change in the discount rate used to fair value expected future cash flows may result in a

goodwill impairment charge.

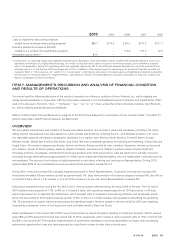

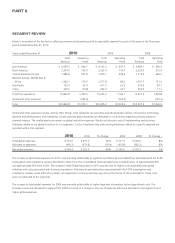

RESULTS OF CONTINUING OPERATIONS - CONSOLIDATED

%/Point Change

2010 2009 2008

2010 vs.

2009

2009 vs.

2008

Total revenue $10,862.8 $10,205.2 $10,507.5 6% (3)%

Cost of sales 4,041.3 3,825.5 3,883.9 6% (2)%

Selling, general and administrative expenses 5,748.4 5,374.1 5,299.1 7% 1%

Operating profit 1,073.1 1,005.6 1,324.5 7% (24)%

Interest expense 87.1 104.8 100.4 (17)% 4%

Interest income (14.0) (20.2) (37.1) (31)% (45)%

Other expense, net 54.7 7.3 38.2 * *

Net income attributable to Avon $ 606.3 $ 625.8 $ 875.3 (3)% (46)%

Diluted earnings per share attributable to Avon $ 1.39 $ 1.45 $ 2.03 (4)% (29)%

Advertising expenses(1) $ 400.4 $ 352.7 $ 390.5 14% (10)%

Gross margin 62.8% 62.5% 63.0% .3 .5

CTI restructuring .1 .1 – – .1

Venezuelan special items .6 – – .6

Adjusted Non-GAAP gross margin 63.5% 62.6% 63.1% .9 .5

Selling, general and administrative expenses as a

% of total revenue 52.9% 52.7% 50.4% .2 2.3

CTI restructuring (.7) (1.6) (.5) .9 (1.1)

Venezuelan special items (.1) – – (.1) –

Adjusted Non-GAAP selling, general and

administrative expenses as a % of total revenue 52.2% 51.0% 49.9% 1.2 1.1

Operating profit 1,073.1 1,005.6 1,324.5 7% (24)%

CTI restructuring 80.7 171.0 59.3

Venezuelan special items 81.0 – –

Adjusted Non-GAAP operating profit 1,234.8 1,176.6 1,383.8 5% (15)%

Operating margin 9.9% 9.9% 12.6% – (2.7)

CTI restructuring .7 1.7 .6 (1.0) 1.1

Venezuelan special items .7 – – .7 –

Adjusted Non-GAAP operating margin 11.4% 11.5% 13.2% (.1) (1.7)

Effective tax rate 37.0% 32.2% 27.8% 4.8 4.4

CTI restructuring .3 (2.2) .3 2.5 (2.5)

Venezuelan special items (5.6) – – (5.6) –

Adjusted Non-GAAP effective tax rate 31.7% 30.0% 28.1% 1.7 1.9

Units sold 1% 3%

Active Representatives 4% 10%

Amounts in the table above may not necessarily sum because the computations are made independently.

* Calculation not meaningful

(1) Advertising expenses are included within selling, general and administrative expenses.

A V O N 2010 27