Avon 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

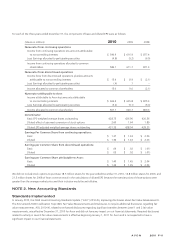

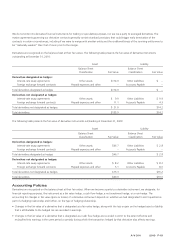

Annual maturities of long-term debt (including unamortized discounts and premiums and excluding the adjustments for debt with fair value

hedges) outstanding at December 31, 2010, are as follows:

2011 2012 2013 2014 2015

After

2016 Total

Maturities $513.5 $15.9 $381.7 $504.3 $147.3 $1,278.2 $2,840.9

Other Financing

We maintain a three-year, $1,000.0 revolving credit and competitive advance facility, which expires in November 2013. The interest rate on

borrowings under this credit facility is based on LIBOR plus the appropriate margin reflecting our credit default swap rate with a minimum

and maximum based on our credit rating (the “CDS Spread”). We also maintain a $300.0, 364 day credit facility (together with the three-

year, $1,000.0 revolving credit facility, the “credit facilities”) which expires on December 13, 2011. The interest rate on borrowings under

this credit facility is based on LIBOR plus a fixed margin. The credit facilities also allow for borrowing at an interest rate based on the CDS

Spread minus 1%, but not less than 0% per annum, plus the highest of prime, .5% plus the federal funds rate, or 1% plus one month

LIBOR. The three-year credit facility has an annual fee of $1.5, payable quarterly, based on our current credit ratings. The 364 day credit

facility has an annual fee of $0.2, payable quarterly. The credit facilities contain various covenants, including a financial covenant that

requires our interest coverage ratio (determined in relation to our consolidated pretax income and interest expense) to equal or exceed 4:1.

The three-year credit facility also provides for possible increases by up to an aggregate incremental principal amount of $250.0, subject to

the consent of the affected lenders under the credit facility. The credit facilities may be used for general corporate purposes. There were no

amounts outstanding under the credit facilities at December 31, 2010.

We maintain a $1,000.0 commercial paper program. Under the program, we may issue from time to time unsecured promissory notes in the

commercial paper market in private placements exempt from registration under federal and state securities laws, for a cumulative face

amount not to exceed $1,000.0 outstanding at any one time and with maturities not exceeding 270 days from the date of issue. The

commercial paper short-term notes issued under the program are not redeemable prior to maturity and are not subject to voluntary

prepayment. The commercial paper program is supported by our three-year $1,000.0 revolving credit and competitive advance facility.

Outstanding commercial paper effectively reduces the amount available for borrowing under this credit facility. At December 31, 2010 and

December 31, 2009, there were no amounts outstanding under the commercial paper program.

At December 31, 2010, we also had letters of credit outstanding totaling $16.4, which primarily guarantee various insurance activities. In

addition, we had outstanding letters of credit for various trade activities and commercial commitments executed in the ordinary course of

business, such as purchase orders for normal replenishment of inventory levels.

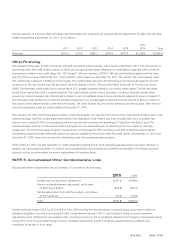

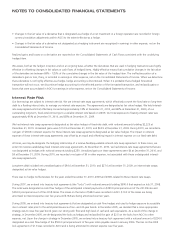

NOTE 6. Accumulated Other Comprehensive Loss

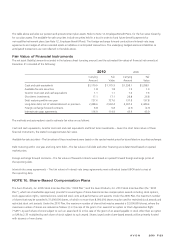

Accumulated other comprehensive loss at December 31 consisted of the following:

2010 2009

Foreign currency translation adjustments $(147.4) $(198.6)

Pension and postretirement adjustment, net of taxes

of $220.9 and $233.6 (443.8) (475.2)

Net derivative losses from cash flow hedges, net of taxes

of $7.9 and $10.1 (14.6) (18.8)

Total $(605.8) $(692.6)

Foreign exchange losses of $5.6 for 2010 and $14.5 for 2009 resulting from the translation of actuarial losses, prior service credit and

translation obligation recorded in Accumulated Other Comprehensive Income (“AOCI”) are included in foreign currency translation

adjustments in the rollforward of accumulated other comprehensive loss on the Consolidated Statements of Changes in Shareholders Equity.

During 2010, $1.6 of accumulated foreign currency translation adjustments and $9.0 of pension adjustments were realized upon

completion of the sale of Avon Japan.

A V O N 2010 F-15