Avon 2010 Annual Report Download - page 32

Download and view the complete annual report

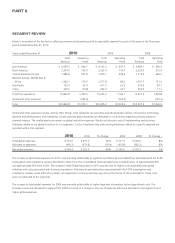

Please find page 32 of the 2010 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART II

Russia’s revenue grew 26% in the first half of 2010, but was flat during the second half, with Constant $ growth rates of 14% in the first

half and 2% in the second half. Russia’s performance in the second half of 2010 was primarily a result of slowing field growth due to weak

incentives. Increases in social benefit taxes levied against certain Representatives exacerbated the slowdown in field growth. In Russia,

weaker color and skincare performance negatively impacted revenue growth in the second half of 2010.

See the “Segment Review” section of this Management’s Discussion and Analysis of Financial Condition and Results of Operations for

additional information related to changes in revenue by segment.

During 2010, our operating margin was negatively impacted by the devaluation of the Venezuelan currency coupled with a required change

to account for operations in Venezuela on a highly inflationary basis. As a result of using the historic dollar cost basis of nonmonetary assets,

such as inventory, acquired prior to the devaluation, during 2010 operating profit was negatively impacted by $81 for the difference

between the historical cost at the previous official exchange rate of 2.15 and the new official exchange rate of 4.30.

In addition to the negative impact to operating margin discussed above, as a result of the devaluation of the Venezuelan currency coupled

with a required change to account for operations in Venezuela on a highly inflationary basis, during the first quarter of 2010 we also

recorded net charges of $46.1 in “Other expense, net” and $12.7 in “income taxes”, reflecting the write-down of monetary assets and

liabilities and deferred tax benefits. See discussion of Venezuela within the “Segment Review - Latin America” section of this Management’s

Discussion and Analysis of Financial Condition and Results of Operations for more information.

We believe that our operating cash flow and global cash and cash equivalent balances of approximately $1.2 billion, coupled with the

continuing execution of our turnaround strategies and the competitive advantages of our direct-selling business model, will allow us to

continue our focus on long-term sustainable, profitable growth. We are also focused on innovating our direct-selling channel through

technological and service model enhancements for our Representatives and assessing new product category opportunities.

In July 2010, we purchased substantially all the assets and liabilities of Silpada, a direct seller of jewelry products, primarily in North America,

for aggregate cash consideration of approximately $650. Pursuant to the terms of the agreement, we may be required to pay additional

consideration in 2015 if Silpada’s North America business achieves specific earnings targets. In March 2010, we acquired Liz Earle Beauty

Co. Limited (“Liz Earle”). The acquired business is included in our Western Europe, Middle East & Africa operating segment.

In December 2010, we completed the sale of our subsidiary in Japan, which has been reflected as discontinued operations for all periods.

Strategic Initiatives

At the end of 2005, we launched a comprehensive, multi-year turnaround plan to restore sustainable growth. As part of the turnaround

plan, we launched our PLS and SSI Programs. Since 2005, we have identified, and in many cases implemented, restructuring initiatives under

our 2005 and 2009 Restructuring Programs. We continue to implement certain initiatives under these restructuring programs. The

anticipated savings or benefits realized from these initiatives has funded and will continue to fund our investment in, amongst other things,

advertising, market intelligence, consumer research and product innovation. Whenever we refer to annualized savings or annualized

benefits, we mean the additional operating profit we expect to realize on a full-year basis every year following implementation of the

respective initiative as compared with the operating profit we would have expected to achieve without having implemented the initiative.

Advertising and Representative Value Proposition (“RVP”)

Investing in advertising is a key strategy. We significantly increased spending on advertising over the past four years. During 2010, our

investment in advertising increased by $48 or 14% and as a percentage of Beauty sales, our investment in advertising increased by 5%

compared to 2009. The advertising investments supported new product launches, such as UCR Mega Impact Lipstick, Super Extend Mascara,

Eternal Magic Fragrance, Outspoken by Fergie Fragrance, Anew Platinum Night Cream and Serum, Anew Luminosity-Pro Serum, and

Advance Technique Lotus Shield. Advertising investments also included advertising to recruit Representatives. We have also continued to

forge alliances with celebrities, including an alliance with Fergie for her Outspoken fragrance.

We continued to invest in our direct-selling channel to improve the reward and effort equation for our Representatives. We have committed

significant investments for extensive research to determine the payback on advertising and field tools and actions, and the optimal balance

of these tools and actions in our markets. We have allocated these significant investments in proprietary direct-selling analytics to better