Audi 2008 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

219

Consolidated Financial

Statements

170 Income Statement

171 Balance Sheet

172 Cash Flow Statement

173 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

174 Development of

fixed assets 2008

176 Development of

fixed assets 2007

178 General information

183 Recognition and

measurement principles

189 Notes to the Income

Statement

196 Notes to the Balance Sheet

209 Additional disclosures

227 Events occurring subsequent

to the balance sheet date

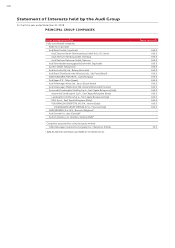

228 Statement of Interests

held by the Audi Group

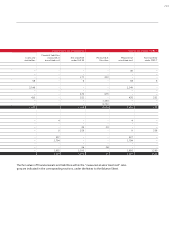

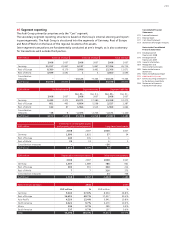

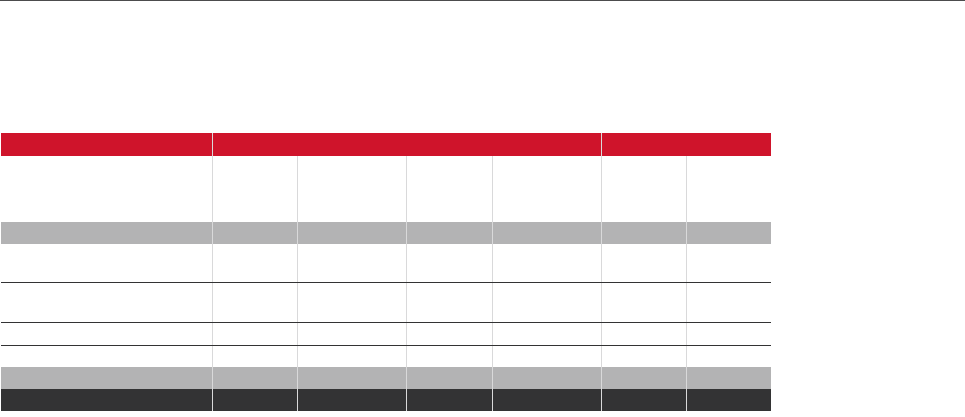

Nominal volume of derivative financial instruments

The nominal volumes of the hedges presented represent the total of all buying and selling

prices on which the transactions are based.

EUR million Nominal volumes Fair values

Dec. 31,

2008

Residual time

to maturity

up to 1 year

Dec. 31,

2007

Residual time

to maturity

up to 1 year

Dec. 31,

2008

Dec. 31,

2007

Cash flow hedges 12,805 5,266 9,222 4,464 810 800

Foreign exchange

contracts 7,588 5,185 6,807 4,463 570 625

Currency option

transactions 4,980 –2,414 –309 175

Currency swaps – – 1 1 ––

Commodity futures 237 81 – – – 69 –

Non-hedge derivatives 147 88 451 177 82 50

Total portfolio 12,952 5,354 9,673 4,641 892 850

The derivative financial instruments used exhibit a maximum hedging term of five years.

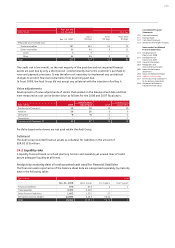

35 Cash Flow Statement

The Cash Flow Statement details the payment streams for both the 2008 fiscal year and the

previous year, categorized according to cash used and received for operating, investing and

financing activities. The effects of changes in the group of consolidated companies and to

foreign exchange rates on cash flows are presented separately.

Cash flow from operating activities includes all payment streams in connection with ordinary

activities and is presented using the indirect calculation method. Starting from the profit before

profit transfer and tax, all income and expenses with no impact on cash flow (mainly write-

downs) are excluded.

In 2008, cash flow from operating activities included payments for interest received amounting

to EUR 400 (278) million and for interest paid amounting to EUR 95 (91) million. The Audi

Group received dividends and profit transfers totaling EUR 71 (84) million in 2008. The income

tax payments item substantially comprises payments made to Volkswagen AG (Wolfsburg) on

the basis of the single-entity relationship for tax purposes in Germany, as well as payments to

foreign tax authorities.

Cash flow from investing activities includes capitalized development costs as well as additions

to other intangible assets, property, plant and equipment, long-term investments and non-

current loans advanced. The change in investment property, the proceeds from the disposal

of assets, the proceeds from the sale of investments and the change in securities effective as

payment are similarly reported in cash flow from investing activities. The sale of

AUDI DO BRASIL E CIA. (Curitiba, Brazil) produced an inflow of EUR 101 million. Furthermore,

changes from fixed deposits with a residual maturity of more than three months and credit

extended were transferred to cash flow from investing activities. The comparative figures for the

previous year have been adjusted accordingly, resulting in a reduction of EUR 75 million in cash

flow from investing activities, whilst cash flow from financing activities rose by EUR 75 million.

Cash flow from financing activities includes cash used for the transfer of profit, as well as

changes in financial liabilities.

The changes in the Balance Sheet items that are presented in the Cash Flow Statement cannot

be derived directly from the Balance Sheet because the effects of currency translation and of

changes in the group of consolidated companies do not affect cash and are segregated.

The change in cash and cash equivalents due to changes in the group of consolidated companies

relates to companies that have been consolidated for the first time.