Audi 2008 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

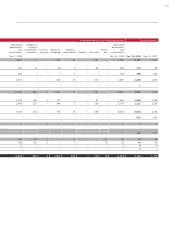

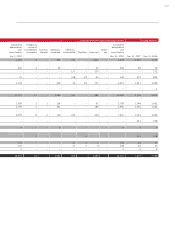

185

Consolidated Financial

Statements

170 Income Statement

171 Balance Sheet

172 Cash Flow Statement

173 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

174 Development of

fixed assets 2008

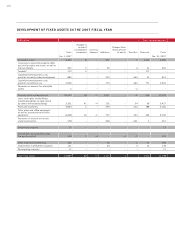

176 Development of

fixed assets 2007

178 General information

183 Recognition and

measurement principles

183 Recognition of income

and expenses

183 Intangible assets

184 Property, plant

and equipment

184 Investment property

184 Investments accounted for

using the equity method

185 Impairment tests

185 Financial instruments

187 Other receivables and

financial assets

187 Deferred tax

187 Inventories

188 Securities, cash and

cash equivalents

188 Provisions for pensions

188 Other provisions

188 Management’s estimates

and assessments

189 Notes to the Income

Statement

196 Notes to the Balance Sheet

209 Additional disclosures

227 Events occurring subsequent

to the balance sheet date

228 Statement of Interests

held by the Audi Group

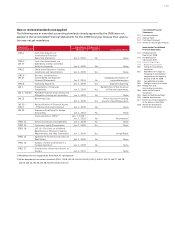

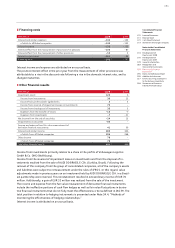

IMPAIRMENT TESTS

Fixed assets are tested regularly for impairment as of the balance sheet date. Impairment tests

are carried out for development activities and property, plant and equipment on the basis of

expected product life cycles, the respective revenue and cost situation, current market expecta-

tions and currency-specific factors.

Expected future cash flows to fixed assets are discounted with country-specific discount rates

that adequately reflect the risk and amount to at least 9 percent before tax.

Impairment loss pursuant to IAS 36 is recognized where the recoverable amount, i.e. the higher

amount from either the use or disposal of the asset in question, has declined below its carrying

amount.

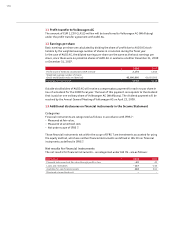

FINANCIAL INSTRUMENTS

Financial assets and liabilities (financial instruments) are recognized and measured in accor-

dance with IAS 39.

On this basis, financial assets are divided into the following categories according to the purpose

of their acquisition:

– financial assets measured at fair value through profit or loss,

– loans and receivables,

– held-to-maturity investments,

– available-for-sale financial assets.

No financial assets in the category of “held-to-maturity investments” are in use within the Audi

Group.

Financial liabilities are allocated to the following categories depending on the reason for their

acquisition:

– financial liabilities measured at fair value through profit or loss,

– financial liabilities measured at amortized cost.

Where financial instruments are purchased or sold in the customary manner, they are recog-

nized using settlement date accounting, in other words at the value on the day on which the

asset is delivered.

Initial measurement of financial assets and liabilities is carried out at fair value.

Subsequent measurement of financial instruments is dependent on the category assigned to

the instrument in accordance with IAS 39 and is carried out either at amortized cost (using the

effective interest method) or at fair value.

Financial instruments are abandoned if the rights to payments from the investment have ex-

pired or been transferred and the Audi Group has substantially transferred all risks and oppor-

tunities associated with their title.

Evidence of the need for reclassification, and objective indicators for the impairment of a finan-

cial asset or group of financial assets, are reviewed on each balance sheet date.

Financial assets include both originated and derivative claims or commitments, as detailed

below.

Originated financial instruments

The “Loans and receivables” and “Financial liabilities measured at amortized cost” categories

include originated financial instruments measured at amortized cost. These include, in particu-

lar:

– loans advanced,

– trade receivables and payables,

– other current assets and liabilities,

– financial liabilities.