Audi 2008 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

182

CONSOLIDATION PRINCIPLES

The assets and liabilities of the domestic and foreign companies included in the Consolidated

Financial Statements are recognized in accordance with the standard accounting and measure-

ment policies of the Audi Group.

In the case of subsidiaries that are being consolidated for the first time, the assets and

liabilities are to be measured at their fair value at the time of acquisition. Any realized hidden

reserves and expenses are amortized, depreciated or reversed in accordance with the develop-

ment of the corresponding assets and liabilities as part of the subsequent consolidation proc-

ess. Where the acquisition values of the investments exceed the Group share in the equity of the

relevant company as calculated in this manner, goodwill is created. Goodwill acquired in a busi-

ness combination is tested for impairment regularly, at the balance sheet date, and an impair-

ment loss is recognized if necessary.

Within the Audi Group, the predecessor method is applied in relation to common control trans-

actions. Under this method, the assets and liabilities of the acquiree are measured at the gross

carrying amounts of the previous parent company. The predecessor method thus means that no

adjustment to the fair value of the acquired assets and liabilities is performed at the time of

acquisition; any goodwill arising during initial consolidation is adjusted against equity, without

affecting income.

The Consolidated Financial Statements also include securities funds whose assets are attribut-

able in substance to the Group.

Receivables and liabilities between consolidated companies are netted, and expenses and in-

come eliminated. Interim profits and losses are eliminated from Group inventories and fixed

assets.

Consolidation processes affecting income are subject to deferrals of income taxes, with deferred

tax assets and liabilities being offset where the term and tax creditor are the same.

The same accounting policies for determining the pro rata equity are applied to Audi Group

companies accounted for using the equity method. The last set of audited financial statements

of the company in question serves as the basis for this purpose.

FOREIGN CURRENCY TRANSLATION

The currency of the Audi Group is the euro (EUR).

Foreign currency transactions in the individual financial statements of AUDI AG and the subsidi-

aries are translated on the basis of the exchange rates at the time of the transaction. Monetary

items in foreign currencies are translated at the exchange rate applicable on the balance sheet

date. Exchange differences are recognized in the current-period income statements of the re-

spective Group companies.

The foreign companies belonging to the Audi Group are foreign entities and prepare their finan-

cial statements in their local currency. The only exceptions are AUDI HUNGARIA MOTOR Kft.

(Győr, Hungary) and Audi Volkswagen Middle East FZE (Dubai, United Arab Emirates), which

prepare their annual financial statements in euros and U.S. dollars, respectively, rather than in

local currency. The concept of the “functional currency” is applied when translating financial

statements prepared in foreign currency. Assets and liabilities, with the exception of equity, are

translated at the year-end exchange rate. The effects of foreign currency translation on equity

are reported in the currency exchange reserve with no effect on income. The items in the Income

Statement are translated using weighted average monthly rates. Currency translation variances

arising from the differing exchange rates used in the Balance Sheet and Income Statement are

recognized in equity, without affecting income.

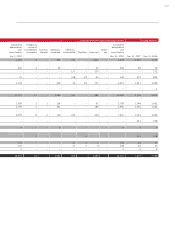

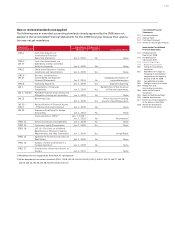

The development of the exchange rates serving as the basis for currency translation is shown

below: