Audi 2008 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261

|

|

209

Consolidated Financial

Statements

170 Income Statement

171 Balance Sheet

172 Cash Flow Statement

173 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

174 Development of

fixed assets 2008

176 Development of

fixed assets 2007

178 General information

183 Recognition and

measurement principles

189 Notes to the Income

Statement

196 Notes to the Balance Sheet

200 Equity

203 Liabilities

209 Additional disclosures

227 Events occurring subsequent

to the balance sheet date

228 Statement of Interests

held by the Audi Group

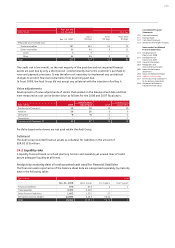

31 Trade payables

EUR million Dec. 31, 2008 Dec. 31, 2007

Trade payables to

third parties 2,820 2,236

affiliated companies 475 550

associated companies 78

Total 3,302 2,794

The fair values of the trade payables correspond to the carrying amounts due to their short-term

nature.

The customary retention of title applies to liabilities from deliveries of goods.

ADDITIONAL DISCLOSURES

32 Capital management

The primary goal of capital management within the Audi Group is to assure financial flexibility

in order to achieve business and growth targets, and to enable continuous, steady growth in the

value of the Company. The capital structure is steered specifically with this in mind, and the

economic environment is kept under constant observation. The objectives, methods and pro-

cedures for optimizing capital management remained unchanged on December 31, 2008.

The equity and financial liabilities from the transfer of profit are summarized in the following

table:

EUR million Dec. 31, 2008 Dec. 31, 2007

Equity 10,328 8,355

as % of total capital 84 81

Financial liabilities from the transfer of profit 1,906 1,943

Current financial liabilities 673 527

Non-current financial liabilities 3 4

Liabilities from the transfer of profit 1,230 1,412

as % of total capital 16 19

Total capital 12,234 10,298

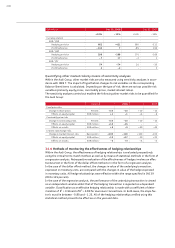

Around 99.55 percent of the issued capital is held by Volkswagen AG (Wolfsburg), with which a

control and profit transfer agreement exists.

In the 2008 fiscal year, equity rose by 23.6 percent as compared to the prior year. This was sub-

stantially attributable to a cash injection to the capital reserve by Volkswagen AG and to the

allocation to other retained earnings.