Audi 2008 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

186

The amortized cost of a financial asset or financial liability, using the effective interest method,

is the amount at which a financial instrument was measured at initial recognition minus any

principal repayments and any impairment losses. Receivables and liabilities denominated in

foreign currencies are measured at the mean of the buying and selling rate on the balance sheet

date. In the case of liabilities, amortized costs generally correspond to the nominal or settle-

ment value.

In the case of current items, the fair values to be additionally indicated in the Notes correspond

to the amortized cost. For non-current assets and liabilities with more than one year to matur-

ity, fair values are determined by discounting future cash flows at market rates.

Liabilities from financial lease agreements are carried at the present value of the leasing in-

stallments.

Available-for-sale financial assets include originated financial instruments that are designated

as such or that cannot be allocated to any other IAS 39 category, and are as a general rule car-

ried at fair value. In the case of listed financial instruments – exclusively securities in the case of

the Audi Group – this corresponds to the market value on the balance sheet date. If no active

market exists, fair value is determined using investment mathematics methods, for example by

discounting future cash flows at the market rate or applying established option pricing models.

The fluctuations in value of available-for-sale securities are initially accounted for within a sepa-

rate equity reserve with no effect on income, after taking deferred tax into account. Unless there

is evidence of lasting impairment, the financial result includes only capital gains or losses real-

ized through disposal. If there is evidence of a lasting decline in value, the cumulative loss is

removed from the equity reserve and recognized in the Income Statement. However, impair-

ments already recorded in the Income Statement – to the extent that the securities concerned

are equity instruments – are not reversed with an effect on income. If, on the other hand, the

securities concerned are debt instruments, impairment losses are reversed with an effect on

income if the increase in the fair value, when viewed objectively, is based on an event that oc-

curred after the impairment loss was recorded with an effect on income.

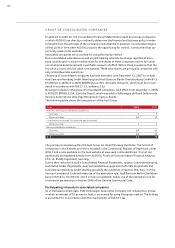

Derivative financial instruments and hedge accounting

Derivative financial instruments are used as a hedge against foreign exchange and commodity

price risks for items on the Balance Sheet and for future cash flows. Futures, as well as options

in the case of foreign exchange risks, are used for this purpose. A requirement of hedge account-

ing is that a clear hedging relationship between the underlying transaction and the hedge must

be documented, and its effectiveness must be demonstrated.

Recognition of the fair value changes in hedges depends on the nature of the hedging relation-

ship.

When hedging future cash flows, the fluctuations in the market value of the effective portion of

a derivative financial instrument are initially reported in a special reserve within equity, with no

effect on income, and are only recognized as income or expense once the hedged item is due.

The ineffective portion of a hedge is recognized immediately in income.

Derivative financial instruments that are used to hedge market risks according to commercial

criteria but that do not fully meet the requirements of IAS 39 with regard to effectiveness of

hedging relationships are classified as “financial instruments measured at fair value through

profit or loss.” Their fair values are calculated as already detailed under “Available-for-sale

financial assets.” Measurement takes place at market value.