Audi 2008 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

217

Consolidated Financial

Statements

170 Income Statement

171 Balance Sheet

172 Cash Flow Statement

173 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

174 Development of

fixed assets 2008

176 Development of

fixed assets 2007

178 General information

183 Recognition and

measurement principles

189 Notes to the Income

Statement

196 Notes to the Balance Sheet

209 Additional disclosures

227 Events occurring subsequent

to the balance sheet date

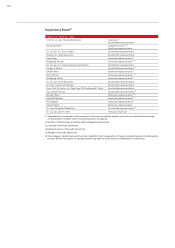

228 Statement of Interests

held by the Audi Group

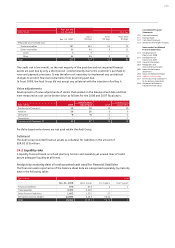

Fund price risks

The special mutual funds created using surplus liquidity are exposed, in particular, to an equity

and bond price risk that may arise from fluctuating stock market prices and indices, and market

interest rates. The changes in bond prices resulting from a variation in market interest rates are

quantified separately in the corresponding notes on “Currency risks” and on “Interest rate risks,”

reflecting the evaluation of foreign exchange and other interest rate risks from the special mu-

tual funds.

Risks from special mutual funds are generally countered by maintaining a broad mix of prod-

ucts, issuers and regional markets when investing funds, as stipulated in the investment guide-

lines. Where necessitated by the market situation, currency hedges in the form of futures con-

tracts are also used. Such measures are coordinated by AUDI AG in agreement with the Group

Treasury of Volkswagen AG (Wolfsburg) and implemented at operational level by the special

mutual funds’ risk management teams.

Fund price risks are measured within the Audi Group in accordance with IFRS 7 using sensitivity

analyses. The impact of hypothetical changes to risk variables on financial instrument prices is

calculated. Market prices and indices are particularly relevant risk variables in the case of fund

price risks.

Commodity price risks

Commodity price risks are avoided or limited by entering into commodity futures transactions.

The hedging measures are coordinated regularly between AUDI AG and Volkswagen AG

(Wolfsburg), in accordance with the existing Volkswagen organizational guideline. The hedging

transactions are performed centrally for AUDI AG by Volkswagen AG on the basis of an agency

agreement. The results from hedging contracts are credited or debited to the Audi Group on the

basis of the proportionate share of the Volkswagen Group’s overall hedging volume.

Hedging measures relate principally to the supply of the following raw materials: aluminum,

lead and copper. Contracts are concluded exclusively with first-rate national and international

banks whose creditworthiness is regularly examined by leading rating agencies.

Commodity price risks are also calculated using sensitivity analyses. Hypothetical changes to the

listed prices of the above commodities are studied to calculate their impact on the cost struc-

ture and thus on profit before tax.

Interest rate risks

Interest rate risks stem from changes in market rates, above all for medium- and long-term

variable-rate receivables and liabilities.

The Audi Group is exposed to interest rate risks primarily in the euro zone, Great Britain, the

United States and Asia. To minimize the impact of fluctuating rates in these regions, use is also

made of interest rate derivatives.

The risks associated with changing interest rates are presented in accordance with IFRS 7 using

sensitivity analyses. These involve presenting the effects of changes in market interest rates on

interest payments, interest income and expenses, other components of the result and, where

applicable, equity.

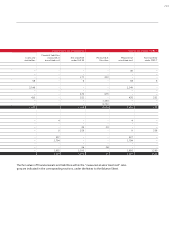

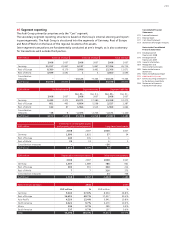

Quantifying currency risks by means of sensitivity analyses

If the functional currencies had in each case increased or decreased in value by 10 percent com-

pared with the other currencies, the following major effects on the hedging provision in equity

and on profit before tax would have resulted. There is no virtue in adding up the individual fig-

ures, as the results for each functional currency are based on differing scenarios. Owing to the

change to a more informative form of presentation, the figures for December 31, 2007 are not

comparable with the aggregated individual figures of the prior year. Nevertheless, the figures

for the prior year have also been determined in the new form of presentation and stated below

in order to make a comparison possible.