Audi 2008 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

162

The development of international raw materials markets presents a further risk. In addition to

securing adequate supplies of production materials, priority is given to minimizing cost risks.

The Audi Group implements comprehensive hedging strategies and permanently monitors rele-

vant raw materials markets.

Of particular importance here is the development of oil prices. A renewed, permanent increase

in the price of oil could lead not just to higher production and energy costs for the Company but

also to rising fuel costs, which could make customers more reluctant to buy cars. The Audi

Group has sought to pre-empt such problems by developing new, efficient drive concepts, alter-

native fuels and vehicle concepts that focus on changing customer requirements, such as the

Audi brand’s highly economical e models.

As a company with global operations, the Audi Group generates a significant portion of its reve-

nue in foreign currency. As a result, it is exposed to risk from exchange rate fluctuations that

cannot be anticipated, but which could adversely affect revenue and, therefore, consolidated net

profit. Of particular note are exchange rate fluctuations between the euro and the U.S. dollar,

the pound sterling and the Japanese yen. The Audi Group counters these risks by employing

appropriate hedging instruments to an economically reasonable extent and in close, continuous

consultation with the Volkswagen Group.

Other risk factors include unforeseeable political intervention in the economy, an escalation in

political tensions, terrorist attacks and possible pandemics, all of which could also have a detri-

mental effect on the Audi Group’s business performance by undermining economic activity or

international capital markets.

INDUSTRY RISKS

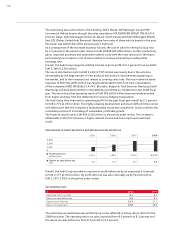

The financial crisis and the associated squeeze in the credit markets poses a major challenge to

the entire automotive industry. In addition to it being more difficult to access outside capital,

borrowing costs have also gone up. Thanks to the Audi Group’s successful business performance

in recent years, it enjoys high liquidity and therefore considers itself to be in a good position to

tackle future challenges.

One consequence of tighter lending practices is that a growing reluctance has been detected

among customers to make purchases. Moreover, bad debts and the remeasurement of residual

value risks are undermining the financial performance, net worth and financial position of many

enterprises. Thanks to the Audi Group’s cautious use of vehicle financing instruments within its

profit-oriented growth strategy, it is exposed to only modest economic risk here. Its long-

established conservative approach to the assessment of residual values when concluding vehicle

financing is particularly effective in mitigating risks.

The increasingly difficult conditions in the automotive industry have engendered more predatory

competition, characterized by the growing use of sales subsidies. This development may result

in price erosion and higher marketing costs particularly in the Audi Group’s key sales regions

of Western Europe, the United States and China, which in turn would adversely affect the Com-

pany’s revenue and earnings performance. Any trend among direct competitors towards reduc-

ing prices will likewise undermine revenue and earnings as the Company will be unable to en-

tirely ignore such practices in the long term. In addition, potential state subsidies for individual

manufacturers or vehicle categories could distort competition, thereby adversely affecting the

financial position of the Audi Group.

A further major challenge for the entire automotive industry stems from the growing pressure

to improve vehicles’ fuel efficiency and reduce their emissions. In addition to the various legal

requirements being discussed around the world, such as CO2 limits, a protracted public debate

could adversely affect the image of all manufacturers and so ultimately be to the detriment of