Audi 2008 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

183

Consolidated Financial

Statements

170 Income Statement

171 Balance Sheet

172 Cash Flow Statement

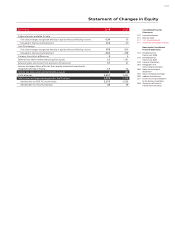

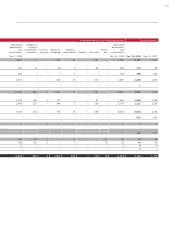

173 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

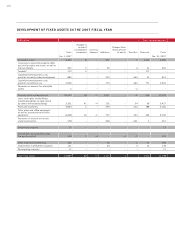

174 Development of

fixed assets 2008

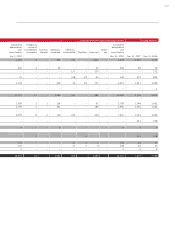

176 Development of

fixed assets 2007

178 General information

178 Accounting principles

180 Group of consolidated

companies

181 Key effects of changes to

the group of consolidated

companies on the opening

balance sheet for 2008

182 Consolidation principles

182 Foreign currency translation

183 Recognition and

measurement principles

183 Recognition of income

and expenses

183 Intangible assets

184 Property, plant

and equipment

184 Investment property

184 Investments accounted for

using the equity method

185 Impairment tests

185 Financial instruments

187 Other receivables and

financial assets

187 Deferred tax

187 Inventories

188 Securities, cash and

cash equivalents

188 Provisions for pensions

188 Other provisions

188 Management’s estimates

and assessments

189 Notes to the Income

Statement

196 Notes to the Balance Sheet

209 Additional disclosures

227 Events occurring subsequent

to the balance sheet date

228 Statement of Interests

held by the Audi Group

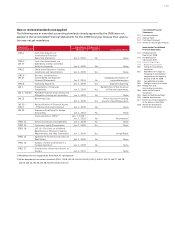

1 EUR in foreign currency Dec. 31, 2008 Dec. 31, 2007 2008 2007

Year-end exchange rate Average exchange rate

Australia AUD 2.0274 1.6757 1.7416 1.6356

Brazil BRL 3.2436 2.6145 2.6743 2.6632

Japan JPY 126.1400 164.9300 152.4541 161.2406

Canada CAD 1.6998 1.4449 1.5594 1.4690

South Korea KRW 1,839.1300 1,377.9600 1,606.0872 1,273.3329

USA USD 1.3917 1.4721 1.4710 1.3706

People’s Republic of China CNY 9.4956 10.7524 10.2236 10.4186

As all consolidated subsidiaries have their registered offices in countries in which there is

currently no hyperinflation, IAS 29 does not apply.

RECOGNITION AND MEASUREMENT PRINCIPLES

RECOGNITION OF INCOME AND EXPENSES

Revenue, interest income and other operating income are always recorded when the services are

rendered or the goods or products are delivered, in other words transfer of risk and reward to

the customer.

Proceeds from the sale of vehicles for which buy-back agreements exist are not realized imme-

diately, but on a straight-line basis over the period between sale and buy-back, on the basis of

the difference between the selling price and the anticipated buy-back price. These vehicles are

reported under inventories.

Operating expenses are recognized as income when the service is used or at the time they are

economically incurred.

INTANGIBLE ASSETS

Intangible assets acquired for consideration are recognized at cost of purchase, taking into

account ancillary costs and cost reductions, and are amortized on a scheduled straight-line basis

over their useful life.

Concessions, rights and licenses relate to purchased computer software and subsidies paid.

Research costs are treated as current expenses in accordance with IAS 38. The development

costs for products going into series production are capitalized, provided that production of

these products is likely to bring economic benefit to the Audi Group. If the conditions stated in

IAS 38 for capitalization are not met, the costs are expensed in the Income Statement in the

year in which they occur.

Capitalized development costs encompass all direct and indirect costs that can be directly allo-

cated to the development process. Financing costs are not capitalized. Amortization is per-

formed on a straight-line basis from the start of production, over the anticipated model life of

the developed products.

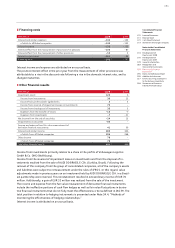

The amortization plan is based principally on the following useful lives:

Useful life

Concessions, industrial property rights and similar rights and assets 3–15 years

of which software 3–5 years

Capitalized development costs 5–9 years