Audi 2008 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148

Economic activity remained positive in most of the Central and Eastern European countries in

2008. However, economic development in Russia experienced an abrupt slowdown in the second

half of the year as a result of the financial crisis and falling oil prices.

Latin America continued its upward economic trend in 2008, though it lost most of its economic

momentum in the second half of the year.

Emerging markets in Asia helped to underpin global economic activity in 2008, though they

were unable to fully escape the impact of the global downturn. The growth rate in China fell

to 9.0 (13.0) percent. India continued to expand, albeit with rather less momentum, and saw

growth reach 7.0 (9.0) percent. Economic growth in Japan on the other hand hit -0.4 (2.4) per-

cent due to both a weakened export trade and low domestic demand.

International car market

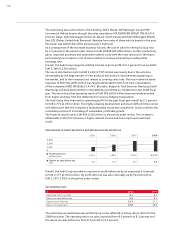

On the back of slower growth in the first half of the year, the global demand for cars slipped

considerably in the second half of 2008. The deteriorating underlying economic situation caused

auto markets in many major industrial nations to experience a sharp downturn in sales. The rate

of expansion in emerging markets also fell away noticeably during the course of the year and did

not suffice to compensate for lost sales in the United States, Japan and Western Europe. As a

result, vehicle sales fell worldwide by 5.8 percent to 55.7 million passenger cars.

In the United States, the development of the overall car market in 2008 was by and large domi-

nated by the adverse effects of the financial crisis. The erosion of consumer confidence coupled

with the squeeze on lending for vehicle financing prompted a sharp year-on-year downturn in

unit sales by 18.0 percent to 13.2 million units.

The overall market for passenger cars in Western Europe (excluding Germany) experienced a

substantial drop of 10.1 percent to 10.5 million vehicles. In particular, important high-volume

markets tumbled year-on-year by as much as 50 percent during the final months of the year.

Registrations of new cars were down in Great Britain by 11.3 percent in 2008 and by 13.4 per-

cent in Italy. The Spanish market contracted particularly dramatically, shrinking by 28.1 percent

by the end of the year. Only the French car market approached the prior-year level, falling by

just 0.7 percent.

By contrast, the car market in Central and Eastern European countries remained buoyant,

though there was a distinct loss of momentum towards the end of the year. Vehicle sales in

Russia, the region’s most significant car market, rose by 15.5 percent to 2.7 million units.

In South America, the upward trend in the Brazilian auto market continued and passenger car

sales exceeded the previous year’s record by 11.0 percent to reach 2.2 million vehicles. The

overall car market in Argentina grew by 6.6 percent to 428,000 units.

The rate of growth in the Asia-Pacific region dwindled during 2008. With sales totaling 14.7

million passenger cars, the overall volume was only 2.3 percent up on the prior-year figure.

The Chinese car market weakened, most particularly due to higher fuel prices, so that the high

growth rates experienced in previous years could not be repeated. With sales of passenger cars

reaching 5.5 million units, year-on-year market growth in China only reached 7.8 percent. The

slowdown in India was more pronounced, where the car market grew by just 2.1 percent to

around 1.2 million vehicles. In Japan, the car market remained as weak as it had been in the

previous year. The volume of new car registrations fell by 3.9 percent to 4.2 million vehicles.