Audi 2008 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261

|

|

218

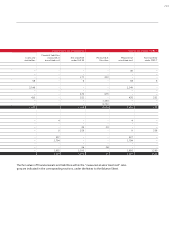

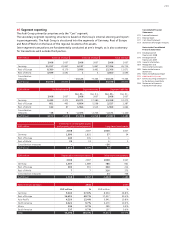

EUR million Dec. 31, 2008 Dec. 31, 2007

+ 10% – 10% + 10% – 10%

Currency relation

EUR / USD

Hedging provision 662 – 421 560 – 512

Profit before tax – 134 7 – 85 104

EUR / GBP

Hedging provision 288 – 288 170 – 166

Profit before tax – 7 17 – 2 1

EUR / JPY

Hedging provision 54 – 54 20 – 20

Profit before tax 2 – 2– 2

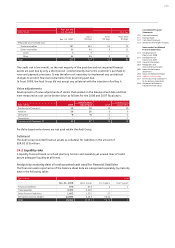

Quantifying other market risks by means of sensitivity analyses

Within the Audi Group, other market risks are also measured using sensitivity analyses in accor-

dance with IFRS 7. The impact of hypothetical changes to risk variables on the corresponding

Balance Sheet items is calculated. Depending on the type of risk, there are various possible risk

variables (primarily equity prices, commodity prices, market interest rates).

The sensitivity analyses carried out enabled the following other market risks to be quantified for

the Audi Group:

Data in 2008 2007

Fund price risks

Change in share prices Percent + 10 – 10 + 10 – 10

Effects on equity capital EUR million + 1 – 1 + 6 – 6

Commodity price risks

Change in commodity prices Percent + 10 – 10 + 10 – 10

Effects on equity capital EUR million + 15 – 15 – –

Effects on results EUR million + 9 – 9 + 40 – 40

Interest rate change risks

Change in market interest rate Basis points + 100 – 100 + 100 – 100

Effects on equity capital EUR million – 15 + 17 – 20 + 22

Effects on results EUR million – 3 + 3 + 4 – 4

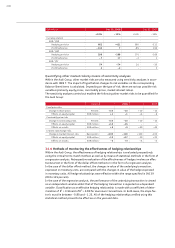

34.4 Methods of monitoring the effectiveness of hedging relationships

Within the Audi Group, the effectiveness of hedging relationships is evaluated prospectively

using the critical terms match method, as well as by means of statistical methods in the form of

a regression analysis. Retrospective evaluation of the effectiveness of hedges involves an effec-

tiveness test in the form of the dollar offset method or in the form of a regression analysis.

In the case of the dollar offset method, the changes in value of the underlying transaction,

expressed in monetary units, are compared with the changes in value of the hedge expressed

in monetary units. All hedge relationships were effective within the range specified in IAS 39

(80 to 125 percent).

In the case of the regression analysis, the performance of the underlying transaction is viewed

as an independent variable whilst that of the hedging transaction is regarded as a dependent

variable. Classification as an effective hedging relationship is made with a coefficient of deter-

mination of R2 > 0.96 and of R2 > 0.80 for aluminum transactions. In both cases, the slope fac-

tor b must lie between – 0.80 and – 1.25. All of the hedging relationships verified using this

statistical method proved to be effective on the year-end date.