Audi 2008 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2008 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261

|

|

184

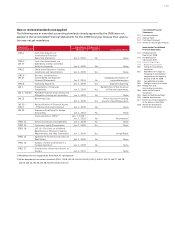

The amortization is allocated to the corresponding functional areas.

Goodwill created or acquired in a business combination is recognized and tested for impairment

regularly, as of the balance sheet date, pursuant to IAS 36. If necessary, an unscheduled im-

pairment loss resulting from this test is recognized.

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are measured at acquisition cost or cost of construction, with

scheduled straight-line depreciation applied according to the pro rata temporis method.

The costs of purchase include the purchase price, ancillary costs and cost reductions.

In the case of self-constructed fixed assets, the cost of construction includes both the directly

attributable cost of materials and cost of labor as well as indirect materials and indirect labor

costs, which must be capitalized, including pro rata depreciation. Interest on borrowings is not

included.

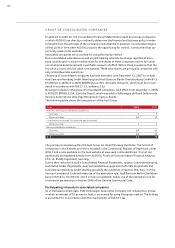

The depreciation plan is generally based on the following useful lives, which are reassessed

yearly:

Useful life

Buildings 14–50 years

Land improvements 10–33 years

Plant and machinery 6–12 years

Plant and office equipment including special tools 3–15 years

In accordance with IAS 17, property, plant and equipment used on the basis of lease agree-

ments is capitalized in the Balance Sheet if the conditions of a finance lease are met; in other

words if the significant risks and opportunities which result from its use have passed to the

lessee. Capitalization is performed at the time of the agreement, at the lower of fair value or

present value of the minimum lease payments. The straight-line depreciation method is based

on the shorter of economic life or term of lease contract. The payment obligations resulting

from the future lease installments are recognized as a liability at the present value of the leas-

ing installments.

Where Group companies have entered into operating leases as the lessee, in other words if not

all risks and opportunities associated with title have passed to them, leasing installments and

rents are expensed directly in the Income Statement.

INVESTMENT PROPERTY

Investment property is measured at amortized cost. Buildings are depreciated on a straight-line

basis over a useful life of 33 years.

INVESTMENTS ACCOUNTED FOR USING THE EQUITY METHOD

Companies in which AUDI AG is directly or indirectly able to exercise significant influence on

financial and operating policy decisions (associated companies) are accounted for using the

equity method. The pro rata equity of these companies is regularly recorded under long-term

investments and the share of earnings recorded as income under the financial result.