Advance Auto Parts 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-46

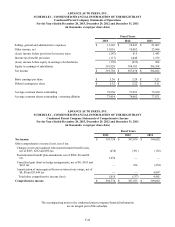

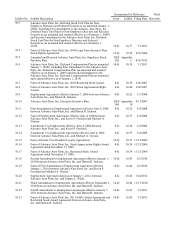

ADVANCE AUTO PARTS, INC.

SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT

Notes to the Condensed Parent Company Statements

December 28, 2013, December 29, 2012 and December 31, 2011

(in thousands, except per share data)

4. Long-Term Debt

Senior Unsecured Notes

The Company issued 4.50% senior unsecured notes on December 3, 2013 at 99.69% of the principal amount of $450,000

which are due December 1, 2023 (the “2023 Notes”). The 2023 Notes bear interest at a rate of 4.50% per year payable semi-

annually in arrears on June 1 and December 1 of each year, beginning June 1, 2014. The net proceeds from the offering of these

notes were approximately $445,200, after deducting underwriting discounts and commissions and estimated offering expenses

payable by the Company. The net proceeds from the 2023 Notes were used in aggregate with borrowings under the Company’s

revolver and term loan and cash on-hand to fund the Company’s acquisition of General Parts International, Inc. on January 2,

2014.

The Company previously issued 4.50% senior unsecured notes on January 2012 at 99.968% of the principal amount of

$300,000 which are due January 15, 2022 (the “2022 Notes”). The 2022 Notes bear interest at a rate of 4.50% per year payable

semi-annually in arrears on January 15 and July 15 of each year. The Company’s 5.75% senior unsecured notes were issued in

April 2010 at 99.587% of the principal amount of $300,000 and are due May 1, 2020 (the “2020 Notes” or collectively with the

2023 Notes and the 2022 Notes, “the Notes”). The 2020 Notes bear interest at a rate of 5.75% per year payable semi-annually

in arrears on May 1 and November 1 of each year. Advance served as the issuer of the Notes with certain of Advance’s

domestic subsidiaries currently serving as subsidiary guarantors. The terms of the Notes are governed by an indenture (as

amended, supplemented, waived, or otherwise modified, the “Indenture”) among the Company, the subsidiary guarantors from

time to time party thereto and Wells Fargo Bank, National Association, as Trustee.

The Company may redeem some or all of the Notes at any time or from time to time, at the redemption price described in

the Indenture. In addition, in the event of a Change of Control Triggering Event (as defined in each of the Indentures for the

Notes), the Company will be required to offer to repurchase the Notes at a price equal to 101% of the principal amount thereof,

plus accrued and unpaid interest to the repurchase date. The Notes are currently fully and unconditionally guaranteed, jointly

and severally, on an unsubordinated and unsecured basis by each of the subsidiary guarantors. The Company will be permitted

to release guarantees without the consent of holders of the Notes under the circumstances described in the Indenture: (i) upon

the release of the guarantee of the Company’s other debt that resulted in the affected subsidiary becoming a guarantor of this

debt; (ii) upon the sale or other disposition of all or substantially all of the stock or assets of the subsidiary guarantor; or (iii)

upon the Company’s exercise of its legal or covenant defeasance option.

The Indenture contains customary provisions for events of default including for: (i) failure to pay principal or interest when

due and payable; (ii) failure to comply with covenants or agreements in the Indenture or the Notes and failure to cure or obtain

a waiver of such default upon notice; (iii) a default under any debt for money borrowed by the Company or any of its

subsidiaries that results in acceleration of the maturity of such debt, or failure to pay any such debt within any applicable grace

period after final stated maturity, in an aggregate amount greater than $25,000 without such debt having been discharged or

acceleration having been rescinded or annulled within 10 days after receipt by the Company of notice of the default by the

Trustee or holders of not less than 25% in aggregate principal amount of the Notes then outstanding; and (iv) events of

bankruptcy, insolvency or reorganization affecting the Company and certain of its subsidiaries. In the case of an event of

default, the principal amount of the Notes plus accrued and unpaid interest may be accelerated. The Indenture also contains

covenants limiting the ability of the Company and its subsidiaries to incur debt secured by liens and to enter into sale and lease-

back transactions.

Bank Debt

The Company fully and unconditionally guarantees the revolving credit facility of Stores. The revolving credit agreement

does not contain restrictions on the payment of dividends, loans or advances between the Company and Stores and Stores’

subsidiaries. Therefore, there are no such restrictions as of December 28, 2013 and December 29, 2012.