Advance Auto Parts 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 28, 2013, December 29, 2012 and December 31, 2011

(in thousands, except per share data)

F-18

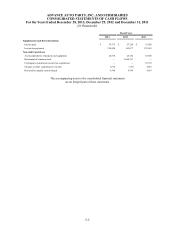

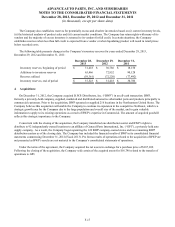

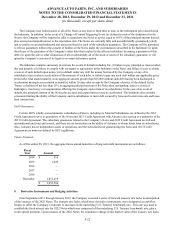

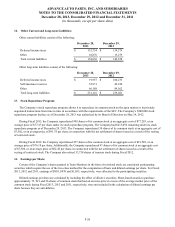

The following table summarizes the consideration paid for BWP and the amounts of the assets acquired and liabilities

assumed that were recognized at the acquisition date:

Total Consideration $ 187,109

Recognized amounts of identifiable assets

acquired and liabilities assumed

Cash and cash equivalents $ 972

Receivables 22,615

Inventory 52,229

Other current assets 9,741

Property, plant and equipment 5,329

Intangible assets 31,600

Other assets 2,253

Accounts payable (37,303)

Accrued and other current liabilities (11,843)

Long-term liabilities (11,930)

Total identifiable net assets 63,663

Goodwill 123,446

Total acquired net assets $ 187,109

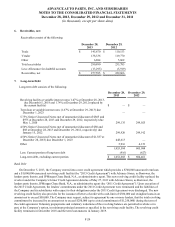

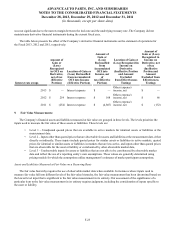

Due to the nature of BWP’s business, the assets acquired and liabilities assumed as part of this acquisition are similar in

nature to those of Advance. For additional information regarding intangible assets acquired, see Note 5, Goodwill and

Intangible Assets. All of the goodwill is expected to be deductible for income tax purposes. The Company completed its

purchase accounting related to the BWP acquisition in the third quarter of Fiscal 2013.

Subsequent to December 28, 2013, the Company acquired GPI. Refer to Note 23, Subsequent Event, for further details of

the GPI acquisition.

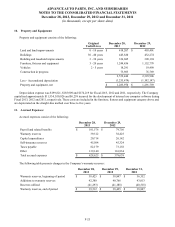

5. Goodwill and Intangible Assets:

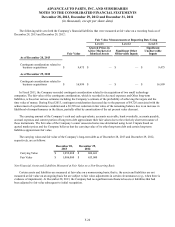

Goodwill

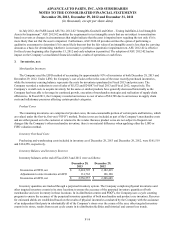

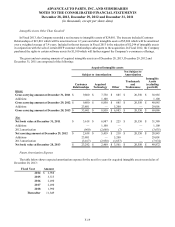

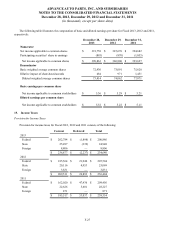

The Company has goodwill recorded in both the Advance Auto Parts (“AAP”) and Autopart International (“AI”) segments.

The following table reflects the carrying amount of goodwill pertaining to the Company’s two segments and the changes in

goodwill carrying amounts.

AAP Segment AI Segment Total

Balance at December 31, 2011 $ 58,095 $ 18,294 $ 76,389

Fiscal 2012 activity — — —

Balance at December 29, 2012 $ 58,095 $ 18,294 $ 76,389

Fiscal 2013 activity 123,446 — 123,446

Balance at December 28, 2013 $ 181,541 $ 18,294 $ 199,835

As discussed in Note 4, Acquisitions, on December 31, 2012, the Company acquired BWP in an all-cash transaction which

resulted in the addition of $123,446 of goodwill in the AAP Segment.