Advance Auto Parts 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11

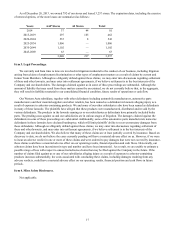

In addition, the indenture governing the notes related to the GPI acquisition and the credit agreement governing the new

credit facilities contain financial and other restrictive covenants that limit our ability to engage in activities that may be in our

long-term best interests. Our failure to comply with those covenants could result in an event of default which, if not cured or

waived, could result in the acceleration of all of our debt, including such notes.

Retention of Key GPI Personnel

The success of the integration with GPI will depend in part on the ability to retain key GPI employees who are expected to

continue employment with the combined company. If any of these employees decide not to remain with the combined

company, it is possible we may be unable to locate suitable replacements for such key employees or to secure employment of

suitable replacements on reasonable terms. In addition, if key employees terminate their employment, management’s attention

might be diverted from successfully integrating GPI’s operations to hiring suitable replacements and the combined company's

business might suffer.

We may not be able to successfully implement our business strategy, including increasing comparable store sales,

enhancing our margins and increasing our return on invested capital, which could adversely affect our business,

financial condition, results of operations, cash flows and liquidity.

We have implemented numerous initiatives as part of our business strategy to increase comparable store sales, enhance our

margins and increase our return on invested capital in order to increase our earnings and cash flow. If we are unable to

implement these initiatives efficiently and effectively, or if these initiatives are unsuccessful, our business, financial condition,

results of operations, cash flows and liquidity could be adversely affected.

Successful implementation of our business strategy also depends on factors specific to the automotive aftermarket industry

and numerous other factors that may be beyond our control. In addition to the aforementioned risk factors, adverse changes in

the following factors could undermine our business strategy and have a material adverse effect on our business, financial

condition, results of operations and cash flow:

• the competitive environment in the automotive aftermarket retail sector that may force us to reduce prices below our

desired pricing level or increase promotional spending;

• our ability to anticipate changes in consumer preferences and to meet customers’ needs for automotive products

(particularly parts availability) in a timely manner;

• our ability to maintain and eventually grow DIY market share; and

• our ability to continue our Commercial sales growth.

For that portion of our inventory manufactured and/or sourced outside the United States, geopolitical changes, changes in

trade regulations, currency fluctuations, shipping related issues, natural disasters, pandemics and other factors beyond our

control may increase the cost of items we purchase or create shortages which could have a material adverse effect on our sales

and profitability.

We will not be able to expand our business if our growth strategy is not successful, including the availability of suitable

locations for new store openings, or the continued increase in supply chain capacity and efficiency, which could

adversely affect our business, financial condition, results of operations and cash flows.

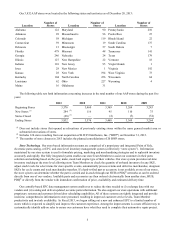

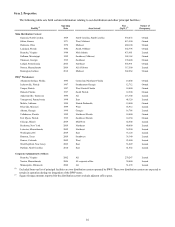

New Store Openings

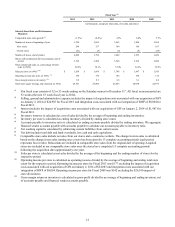

We have increased our store count significantly in the last ten years from 2,539 stores at the end of our 2003 fiscal year to

4,049 stores as of December 28, 2013. We intend to continue to increase the number of our stores and expand the markets we

serve as part of our growth strategy, primarily by opening new stores. We may also grow our business through strategic

acquisitions. We do not know whether the implementation of our growth strategy will be successful. As we open more stores it

becomes more critical that we have consistent execution across our entire store chain. The actual number of new stores to be

opened and their success will depend on a number of factors, including, among other things:

• the availability of desirable store locations;

• the negotiation of acceptable lease or purchase terms for new locations;

• the availability of financial resources, including access to capital at cost-effective interest rates; and

• our ability to manage the expansion and to hire, train and retain qualified sales associates.