Advance Auto Parts 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

and (ii) the positive impact from a higher mix of Commercial sales. AI segment sales were $306.1 million, an increase of $5.1

million, or 1.7%, over Fiscal 2011.

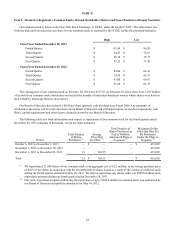

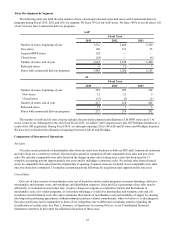

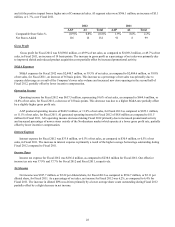

2012 2011

AAP AI Total AAP AI Total

Comparable Store Sales % (0.9)% 0.8% (0.8)% 1.9% 8.6% 2.2%

Net Stores Added 116 16 132 91 8 99

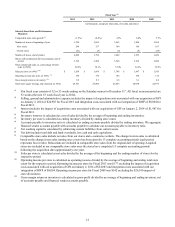

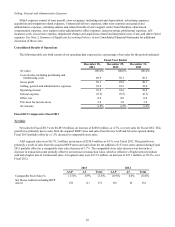

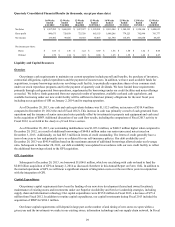

Gross Profit

Gross profit for Fiscal 2012 was $3,098.0 million, or 49.9% of net sales, as compared to $3,069.3 million, or 49.7% of net

sales, in Fiscal 2011, an increase of 19 basis points. The increase in gross profit as a percentage of net sales was primarily due

to improved shrink and reduced product acquisition costs partially offset by increased promotional activity.

SG&A Expenses

SG&A expenses for Fiscal 2012 were $2,440.7 million, or 39.3% of net sales, as compared to $2,404.6 million, or 39.0%

of net sales, for Fiscal 2011, an increase of 36 basis points. This increase as a percentage of net sales was primarily due to

expense deleverage as a result of the Company’s lower sales volume and increased new store openings in the second half of

Fiscal 2012, partially offset by lower incentive compensation.

Operating Income

Operating income for Fiscal 2012 was $657.3 million, representing 10.6% of net sales, as compared to $664.6 million, or

10.8% of net sales, for Fiscal 2011, a decrease of 18 basis points. This decrease was due to a higher SG&A rate partially offset

by a slightly higher gross profit rate.

AAP produced operating income of $648.5 million, or 11.0% of net sales, for Fiscal 2012 as compared to $653.1 million,

or 11.1% of net sales, for Fiscal 2011. AI generated operating income for Fiscal 2012 of $8.8 million as compared to $11.5

million for Fiscal 2011. AI’s operating income decreased during Fiscal 2012 primarily due to increased promotional activity

and increased percentage of newer stores outside of the Northeastern market which operate at a lower gross profit rate, partially

offset by lower incentive compensation.

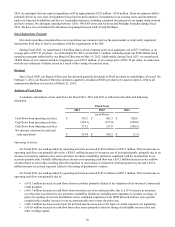

Interest Expense

Interest expense for Fiscal 2012 was $33.8 million, or 0.5% of net sales, as compared to $30.9 million, or 0.5% of net

sales, in Fiscal 2011. The increase in interest expense is primarily a result of the higher average borrowings outstanding during

Fiscal 2012 compared to Fiscal 2011.

Income Taxes

Income tax expense for Fiscal 2012 was $236.4 million, as compared to $238.6 million for Fiscal 2011. Our effective

income tax rate was 37.9% and 37.7% for Fiscal 2012 and Fiscal 2011, respectively.

Net Income

Net income was $387.7 million, or $5.22 per diluted share, for Fiscal 2012 as compared to $394.7 million, or $5.11 per

diluted share, for Fiscal 2011. As a percentage of net sales, net income for Fiscal 2012 was 6.2%, as compared to 6.4% for

Fiscal 2011. The increase in diluted EPS was driven primarily by a lower average share count outstanding during Fiscal 2012

partially offset by a slight decrease in net income.