Advance Auto Parts 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

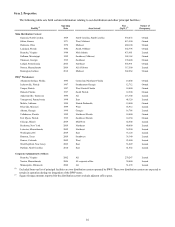

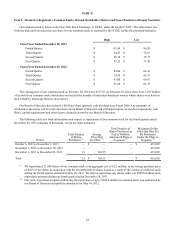

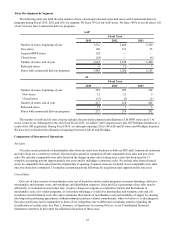

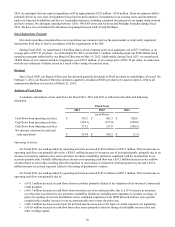

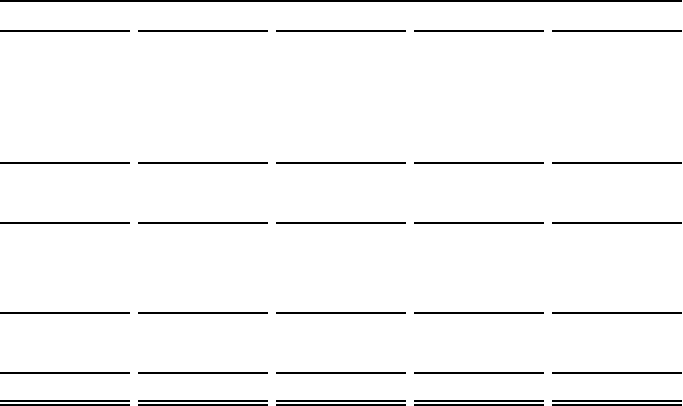

Item 6. Selected Consolidated Financial Data.

The following table sets forth our selected historical consolidated statement of operations, balance sheet, cash flows and

other operating data. Included in this table are key metrics and operating results used to measure our financial progress. The

selected historical consolidated financial and other data (excluding the Selected Store Data and Performance Measures) as of

December 28, 2013 and December 29, 2012 and for the three years ended December 28, 2013 have been derived from our

audited consolidated financial statements and the related notes included elsewhere in this report. The historical consolidated

financial and other data as of December 31, 2011, January 1, 2011 and January 2, 2010 and for the years ended January 1, 2011

and January 2, 2010 have been derived from our audited consolidated financial statements and the related notes that have not

been included in this report. You should read this data along with “Management’s Discussion and Analysis of Financial

Condition and Results of Operations”, and our consolidated financial statements and the related notes included elsewhere in

this report.

Fiscal Year (1)

2013 2012 2011 2010 2009

(in thousands, except per share data, store data and ratios)

Statement of Operations Data:

Net Sales $ 6,493,814 $ 6,205,003 $ 6,170,462 $ 5,925,203 $ 5,412,623

Cost of sales 3,241,668 3,106,967 3,101,172 2,963,888 2,768,397

Gross Profit 3,252,146 3,098,036 3,069,290 2,961,315 2,644,226

Selling, general and administrative expenses (2) 2,591,828 2,440,721 2,404,648 2,376,382 2,189,841

Operating income 660,318 657,315 664,642 584,933 454,385

Interest expense (3) (36,618) (33,841) (30,949) (26,861) (23,337)

Other income (expense), net 2,698 600 (457) (1,017) 607

Income before provision for income taxes 626,398 624,074 633,236 557,055 431,655

Income tax expense 234,640 236,404 238,554 211,002 161,282

Net income $ 391,758 $ 387,670 $ 394,682 $ 346,053 $ 270,373

Per Share Data:

Net income per basic share $ 5.36 $ 5.29 $ 5.21 $ 4.00 $ 2.85

Net income per diluted share 5.32 5.22 5.11 3.95 2.83

Cash dividends declared per basic share 0.24 0.24 0.24 0.24 0.24

Weighted average basic shares outstanding 72,930 73,091 75,620 86,082 94,459

Weighted average diluted shares outstanding 73,414 74,062 77,071 87,155 95,113

Cash flows provided by (used in):

Operating activities $ 545,250 $ 685,281 $ 828,849 $ 666,159 $ 699,690

Investing activities (362,107) (272,978) (289,974) (199,350) (185,539)

Financing activities 331,217 127,907 (540,183) (507,618) (451,491)

Balance Sheet and Other Financial Data:

Cash and cash equivalents $ 1,112,471 $ 598,111 $ 57,901 $ 59,209 $ 100,018

Inventory 2,556,557 2,308,609 2,043,158 1,863,870 1,631,867

Inventory turnover (4) 1.33 1.43 1.59 1.70 1.70

Inventory per store (5) 631 609 558 523 477

Accounts payable to Inventory ratio (6) 85.3% 87.9% 80.9% 71.0% 61.2%

Net working capital (7) $ 1,224,599 $ 624,562 $ 105,945 $ 276,222 $ 421,591

Capital expenditures 195,757 271,182 268,129 199,585 192,934

Total assets 5,564,774 4,613,814 3,655,754 3,354,217 3,072,963

Total debt 1,053,584 605,088 415,984 301,824 204,271

Total net debt (8) (58,887) 6,977 358,083 252,171 113,781

Total stockholders' equity 1,516,205 1,210,694 847,914 1,039,374 1,282,365