Advance Auto Parts 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

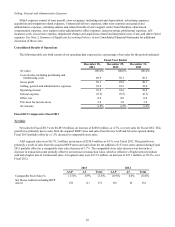

Gross Profit

Gross profit for Fiscal 2013 was $3,252.1 million, or 50.1% of net sales, as compared to $3,098.0 million, or 49.9% of net

sales, in Fiscal 2012, an increase of 15 basis points. The increase in gross profit as a percentage of net sales was driven by

increased merchandise margins, due to lower acquisition costs and a favorable product mix, and improvement in shrink

partially offset by planned inefficiencies in supply chain costs associated with the ramp-up in shipments of inventory from our

new distribution center and the impact from a higher mix of Commercial sales which have a lower gross profit rate. The

increase in our Commercial mix of sales was primarily due to the sales from the acquired BWP stores.

SG&A Expenses

SG&A expenses for Fiscal 2013 were $2,591.8 million, or 39.9% of net sales, as compared to $2,440.7 million, or 39.3%

of net sales, for Fiscal 2012, an increase of 58 basis points. Included in SG&A expenses in Fiscal 2013 were $25.0 million, or

38 basis points, of transaction expenses associated with our acquisition of GPI and $8.0 million, or 12 basis points, of expenses

associated with our integration of BWP. Other primary drivers of the net increase in SG&A expenses, as a percentage of net

sales, include costs associated with increased new store openings and higher incentive compensation, partially offset by lower

marketing expense and a decrease in overall administrative and support costs.

Operating Income

Operating income for Fiscal 2013 was $660.3 million, representing 10.2% of net sales, as compared to $657.3 million, or

10.6% of net sales, for Fiscal 2012, a decrease of 42 basis points. This decrease was due to a higher SG&A rate partially offset

by a higher gross profit rate.

AAP generated operating income of $647.8 million, or 10.5% of net sales, for Fiscal 2013 as compared to $648.5 million,

or 11.0% of net sales, for Fiscal 2012. This decrease on a rate basis was due to the gross profit and SG&A drivers previously

discussed. AI generated operating income for Fiscal 2013 of $12.5 million as compared to $8.8 million for Fiscal 2012. The

increase in AI’s operating income was primarily due to improvements in store labor productivity and SG&A leverage driven by

lower administrative and support costs.

Interest Expense

Interest expense for Fiscal 2013 was $36.6 million, or 0.6% of net sales, as compared to $33.8 million, or 0.5% of net

sales, in Fiscal 2012.

Income Taxes

Income tax expense for Fiscal 2013 was $234.6 million, as compared to $236.4 million for Fiscal 2012. Our effective

income tax rate was 37.5% and 37.9% for Fiscal 2013 and Fiscal 2012, respectively.

Net Income

Net income was $391.8 million, or $5.32 per diluted share, for Fiscal 2013 as compared to $387.7 million, or $5.22 per

diluted share, for Fiscal 2012. As a percentage of net sales, net income for Fiscal 2013 was 6.0%, as compared to 6.2% for

Fiscal 2012. The increase in diluted EPS was driven primarily by the increase in net income.

Fiscal 2012 Compared to Fiscal 2011

Net Sales

Net sales for Fiscal 2012 were $6,205.0 million, an increase of $34.5 million, or 0.6%, over net sales for Fiscal 2011. This

growth was primarily due to sales from AAP and AI stores added within Fiscal 2012 partially offset by a decrease in

comparable store sales.

AAP segment sales were $5,914.9 million, an increase of $30.0 million, or 0.5%, over Fiscal 2011. This growth was

primarily a result of sales from the net addition of 116 new stores over Fiscal 2012 partially offset by a comparable store sales

decrease of (0.9)%. The comparable store sales decrease was driven by a decrease in transaction count partially offset by an

increase in transaction value despite more promotional activity in response to lower customer demand. The increase in

transaction value is primarily due to (i) the gradual increase in cost and complexity of automotive parts and commodity prices