Advance Auto Parts 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

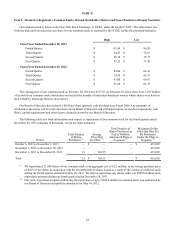

Fiscal 2013 Highlights

A high-level summary of our financial results and other highlights from our Fiscal 2013 include:

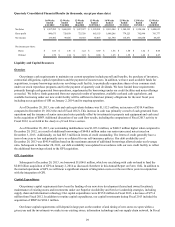

Financial

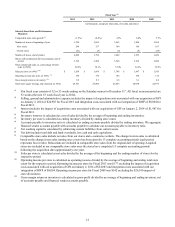

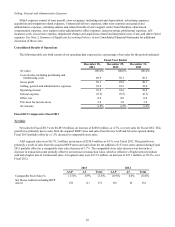

• Total sales during Fiscal 2013 increased 4.7% to $6,493.8 million as compared to Fiscal 2012, primarily driven by the

addition of the 124 acquired BWP stores and 151 other net new stores partially offset by a 1.5% decrease in

comparable store sales.

• Our operating income for Fiscal 2013 was $660.3 million, an increase of $3.0 million from the comparable period in

Fiscal 2012. As a percentage of total sales, operating income was 10.2%, a decrease of 42 basis points, due to higher

SG&A partially offset by a higher gross profit rate. Included in the higher SG&A was $25.0 million of expenses

associated with our acquisition of GPI on January 2, 2014 and $8.0 million of expenses associated with our integration

of BWP.

• Our inventory balance as of December 28, 2013 increased $247.9 million, or 10.7%, over the prior year driven

primarily by our new store growth, acquisition of BWP and support of inventory availability initiatives.

• We generated operating cash flow of $545.3 million during Fiscal 2013, a decrease of 20.4% compared to Fiscal 2012,

primarily due to an increase in inventory, net of accounts payable.

Other

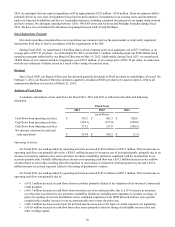

• On December 31, 2012, we completed the acquisition of BWP, a leading Commercial provider in the Northeast.

• In December 2013, we issued $450 million of principal amount of 4.50% senior unsecured notes, due in 2023, and

entered into a new credit agreement, in anticipation of our acquisition of GPI.

Subsequent to Fiscal 2013, we completed the acquisition of GPI, a leading privately-held distributor and supplier of

original equipment and aftermarket automotive replacement products for commercial markets operating under the Carquest and

Worldpac brands.

Refer to the “Results of Operations” and “Liquidity” sections for further details of our income statement and cash flow

results, respectively.

Business Update

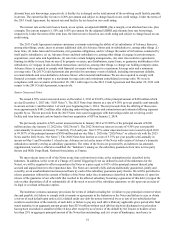

Our two key strategies are Superior Availability and Service Leadership. Superior Availability is aimed at product

availability and maximizing the speed, reliability and efficiency of our supply chain. Service Leadership leverages our product

availability in addition to more consistent execution of customer-facing initiatives to strengthen our integrated operating

approach of serving our DIY and Commercial customers in our stores and on-line. Through these two key strategies, we believe

we can continue to build on the initiatives discussed below and produce favorable financial results over the long term. Sales to

Commercial customers remain the biggest opportunity for us to increase our overall market share in the automotive aftermarket

industry. Our Commercial sales, as a percentage of total sales, increased to 40.4% in Fiscal 2013 compared to 38.1% in Fiscal

2012. This increase has been more pronounced in Fiscal 2013 due to the contribution of the acquired BWP stores which are

more weighted in Commercial sales than our Advance stores.

Our strategic priorities include:

• Growing our Commercial business through improved delivery speed and reliability, increased customer retention,

increased volume with national and regional accounts, and the integrations of BWP and GPI, respectively;

• Improving localized parts availability through the continued increase in the number of our larger HUB stores,

strengthened focus on in-store availability and leveraging the advancement of our supply chain infrastructure

beginning with our new Remington distribution center;

• Accelerating our new store growth rate; and

• Continuing our focus on store execution through more effective scheduling, increased productivity and simplification,

improved product on-hand accuracy, expanded sales training and continued measurement of customer engagement.

Acquisitions

On December 31, 2012, we acquired B.W.P. Distributors, Inc., a privately-held company that supplied, marketed and

distributed automotive aftermarket parts and products principally to Commercial customers. Prior to the acquisition, BWP