Advance Auto Parts 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

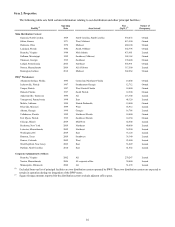

operated or supplied 216 locations in the Northeastern United States. Concurrent with the closing of the acquisition, we

transferred one distribution center and BWP’s rights to distribute to 92 independently owned locations to an affiliate of GPI.

We believe this acquisition will enable us to continue our expansion in the competitive Northeast, which is a strategic growth

area for us due to the large population and overall size of the market, and to gain valuable information to apply to our existing

operations as a result of BWP’s expertise in Commercial. During the second quarter of Fiscal 2013, we began integrating the

124 BWP company-owned stores and two distribution centers into our Advance Auto Parts operations and plan to finish the

integration by mid-2014. The integration of BWP stores consists of converting or consolidating those locations into Advance

Auto Parts locations.

After the 2013 fiscal year, we acquired General Parts International, Inc. on January 2, 2014 for a purchase price of $2.08

billion. GPI, formerly a privately held company, is a leading distributor and supplier of original equipment and automotive

aftermarket replacement products for commercial markets operating under the Carquest and Worldpac brands. As of the

acquisition date, GPI operated 1,248 Carquest stores and 105 Worldpac branches located in 45 states and Canada and serviced

approximately 1,400 independently-owned Carquest stores. We believe the acquisition of GPI will allow us to expand our

geographic presence, commercial capabilities and overall scale to better serve customers. For additional information on the GPI

acquisition, refer to Note 23, Subsequent Event, in the Notes to our Consolidated Financial Statements, included in Item 15.

Exhibits, Financial Statement Schedules, of this Annual Report on Form 10-K.

Automotive Aftermarket Industry

Operating within the automotive aftermarket industry, we are influenced by a number of general macroeconomic factors

similar to those affecting the overall retail industry. These factors include, but are not limited to, fuel costs, unemployment

rates, consumer confidence and competition. The ongoing uncertainty in the macroeconomic environment continues to impact

us and the retail industry in general. While we believe that the current macroeconomic environment continues to constrain

consumer spending, we remain confident that the long-term dynamics of the automotive aftermarket industry are positive.

Furthermore, we continue to believe we are well positioned to serve our customers by meeting their needs in a challenging

macroeconomic environment.

We believe that two key drivers of demand within the automotive aftermarket are (i) the number of miles driven in the U.S.

and (ii) the number and average age of vehicles on the road.

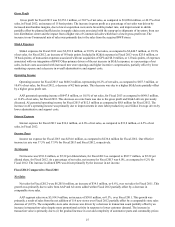

Miles Driven

We believe that the number of total miles driven in the U.S. influences the demand for the repair and maintenance of

vehicles. As the number of miles driven increases, consumers’ vehicles are more likely to need repair and maintenance,

resulting in an increase in the need for automotive parts and maintenance items. While miles driven in the U.S. remained

relatively flat during 2012, miles driven began to increase beginning in the second calendar quarter of 2013 and continuing

through the end of the year. Historically, rapid increases in fuel prices have negatively impacted total miles driven as consumers

react to the increased expense by reducing travel. In 2012 and 2013, gas prices were relatively flat and have become somewhat

less volatile when compared to prior years. Another factor impacting miles driven is the average daily commute, which

corresponds to the unemployment rate. As the unemployment rate improves as it has over the past two years, the number of

employees commuting increases and in turn the number of miles driven increases. While we believe there are ongoing

macroeconomic pressures on our consumers, the return of increases in miles driven and stabilization in gasoline prices and

improvements in the unemployment rate will continue to drive demand in the automotive aftermarket industry.

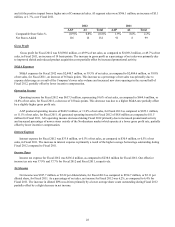

Number of Registered Vehicles and Increase in Average Vehicle Age

We believe that the total number of vehicles (excluding medium and heavy duty trucks) on the road and the average age of

vehicles on the road also heavily influence the demand for products sold within the automotive aftermarket industry. There

were 248 million vehicles on the road in 2013 which is 6% higher than in 2003. While recent industry data reported by the

Automotive Aftermarket Industry Association (“AAIA”) indicates that the growth in number of vehicles on the road has

decelerated and new vehicle registrations are increasing, the average age of vehicle continues to increase. The average age of

vehicles has gradually increased over the last five years from 10.3 years in 2009 to 11.3 years in 2013. We believe that the

average age of vehicles continues to increase due to relatively constant scrappage rates, a rate of new car sales well under the

10-year trend and an increase in overall quality of vehicles. As the average age of a vehicle increases, a larger percentage of the

miles driven are outside of the manufacturer warranty period. These out-of-warranty, older vehicles generate a stronger demand

for automotive aftermarket products due to routine maintenance cycles and more frequent mechanical failures. We believe that

despite an improving economy consumers will continue to keep their vehicles even longer contributing to the trend of an aging

vehicle population.