Advance Auto Parts 2013 Annual Report Download - page 97

Download and view the complete annual report

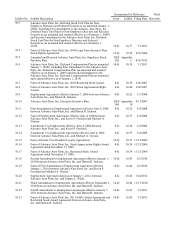

Please find page 97 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-45

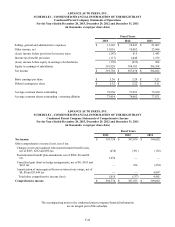

ADVANCE AUTO PARTS, INC.

SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT

Notes to the Condensed Parent Company Statements

December 28, 2013, December 29, 2012 and December 31, 2011

(in thousands, except per share data)

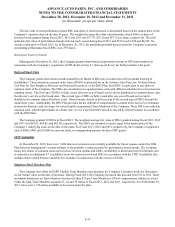

Accordingly, earnings per share is computed by dividing net income attributable to the Company’s common shareholders

by the weighted-average common shares outstanding during the period. The two-class method is an earnings allocation formula

that determines income per share for each class of common stock and participating security according to dividends declared

and participation rights in undistributed earnings. Diluted income per common share reflects the more dilutive earnings per

share amount calculated using the treasury stock method or the two-class method.

Basic earnings per share of common stock has been computed based on the weighted-average number of common shares

outstanding during the period, which is reduced by stock held in treasury and shares of nonvested restricted stock. Diluted

earnings per share of common stock reflects the weighted-average number of shares of common stock outstanding, outstanding

deferred stock units and the impact of outstanding stock options, and stock appreciation rights (collectively “share-based

awards”). Share-based awards containing performance conditions are included in the dilution impact as those conditions are

met. Diluted earnings per share are calculated by including the effect of dilutive securities.

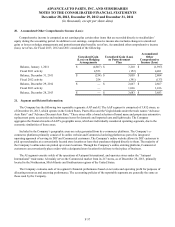

New Accounting Pronouncements

In July 2013, the Financial Accounting Standards Board, or FASB, issued ASU No. 2013-11 “Presentation of an

Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward

Exists.” Under ASU 2013-11 an entity is required to present an unrecognized tax benefit, or a portion of an

unrecognized tax benefit, in the financial statements as a reduction to a deferred tax asset for a net operating loss

carryforward, a similar tax loss, or a tax credit carryforward. If a net operating loss carryforward, a similar tax loss, or a

tax credit carryforward is not available at the reporting date, the unrecognized tax benefit should be presented in the

financial statements as a liability and should not be combined with deferred tax assets. ASU 2013-11 is effective for

fiscal years, and interim periods within those years, beginning after December 15, 2013. The adoption of this guidance

affects presentation only and, therefore, it is not expected to have a material impact on the Company’s consolidated

financial condition, results of operations or cash flows.

In February 2013, the FASB issued ASU No. 2013-02 “Comprehensive Income - Reporting of Amounts Reclassified Out

of Accumulated Other Comprehensive Income.” ASU 2013-02 is an amendment adding new disclosure requirements for items

reclassified out of accumulated other comprehensive income (“AOCI”). The amendment requires presentation of changes in

AOCI balances by component and significant items reclassified out of AOCI by component either (1) on the face of the

statement of operations or (2) as a separate disclosure in the notes to the financial statements. ASU 2013-02 is effective for

fiscal years beginning after December 15, 2012. The adoption of ASU 2013-02 had no impact on the Company’s consolidated

financial condition, results of operations or cash flows.

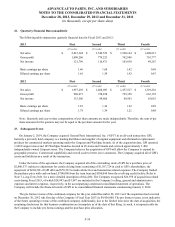

3. Intercompany Transactions

On December 29, 2012, Stores declared a non-cash dividend to the Company totaling $2,231,200. The dividend was

comprised of: (i) the forgiveness of the $1,632,300 intercompany receivable owed to Stores by the Company and (ii) the

issuance of a $598,900 intercompany note payable from Stores to the Company.

The intercompany note payable contains terms and conditions that are similar in all material respects to the Notes

discussed in footnote 4 below.