Advance Auto Parts 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

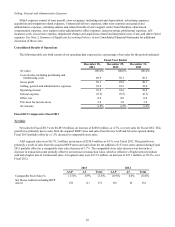

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of financial condition and results of operations should be read in conjunction with

“Selected Consolidated Financial Data,” our consolidated historical financial statements and the notes to those statements

that appear elsewhere in this report. Our discussion contains forward-looking statements based upon current expectations that

involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of

events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors,

including those set forth under the sections entitled “Forward-Looking Statements” and “Risk Factors” elsewhere in this

report.

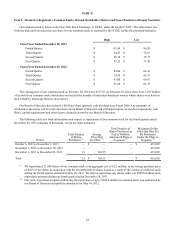

Our fiscal year ends on the Saturday nearest December 31st of each year, which results in an extra week every several

years (the next 53 week fiscal year is 2014). Our first quarter consists of 16 weeks, and the other three quarters consist of 12

weeks.

Introduction

We are a leading specialty retailer of automotive aftermarket parts, accessories, batteries and maintenance items primarily

operating within the United States. Our stores carry an extensive product line for cars, vans, sport utility vehicles and light

trucks. We serve both DIY and Commercial customers. Our Commercial customers consist primarily of delivery customers for

whom we deliver products from our store locations to our Commercial customers’ places of business, including independent

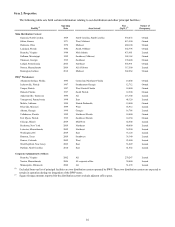

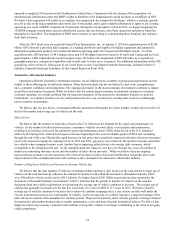

garages, service stations and auto dealers. As of December 28, 2013, we operated 4,049 stores throughout 39 states, Puerto

Rico and the Virgin Islands.

As of December 28, 2013, we operated in two reportable segments: Advance Auto Parts, or AAP, and Autopart

International, or AI. The AAP segment is comprised of our store operations within the Northeastern, Southeastern and

Midwestern (inclusive of South Central) regions of the United States, Puerto Rico and the Virgin Islands. These stores operate

under the trade name “Advance Auto Parts” except for certain stores in the state of Florida, which operate under the “Advance

Discount Auto Parts” trade name. As of December 28, 2013, we operated 3,832 stores in the AAP segment. Our AAP stores

offer a broad selection of brand name and proprietary automotive replacement parts, accessories and maintenance items for

domestic and imported cars and light trucks. Through our integrated operating approach, we serve our DIY and Commercial

customers from our store locations and online at www.AdvanceAutoParts.com. Our online website allows our DIY customers

to pick up merchandise at a conveniently located store or have their purchases shipped directly to their home or business. Our

Commercial customers can conveniently place their orders online.

As of December 28, 2013, we operated 217 stores in the AI segment under the “Autopart International” trade name. AI’s

business serves the Commercial market from its store locations primarily in the Northeastern, Mid-Atlantic and Southeastern

regions of the United States.

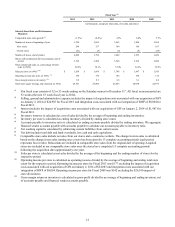

Management Overview

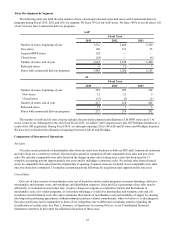

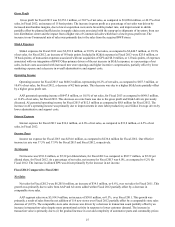

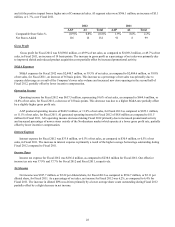

We generated earnings per diluted share, or diluted EPS, of $5.32 during Fiscal 2013 compared to $5.22 for Fiscal 2012.

Negatively impacting our diluted EPS in Fiscal 2013 were $27.0 million of transaction related expenses related to our

acquisition of GPI on January 2, 2014 and $8.0 million of expenses associated with our integration of BWP. Excluding these

impacts, our operating income accelerated in the second half of our fiscal year primarily due to improving sales and more

disciplined cost control. Throughout much of Fiscal 2013, our sales remained constrained in many of our markets in part due

to the ongoing uncertainty in the macroeconomic environment and increased competition in our operating area. We believe

consumer spending was suppressed as consumers faced higher payroll taxes, the uncertainty regarding the federal government

shutdown and the apprehension regarding the impact of health care reform. We believe that our core consumers are performing

only the repairs that are absolutely necessary to keep their vehicles on the road which has resulted in a significant level of

deferred maintenance. During the fourth quarter of Fiscal 2013, our sales accelerated particularly in some of our colder weather

markets, driven by the extraordinary cold weather which has increased the demand for failure and maintenance parts. We

continue to generate a significant amount of cash on-hand to invest in capital improvements and initiatives to support our key

strategies, Superior Availability and Service Leadership, which are discussed later in the “Business Update.”