Advance Auto Parts 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

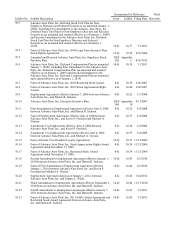

F-43

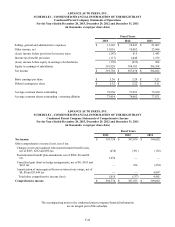

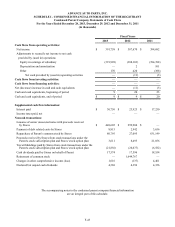

ADVANCE AUTO PARTS, INC.

SCHEDULE I - CONDENSED FINANCIAL INFORMATION OF THE REGISTRANT

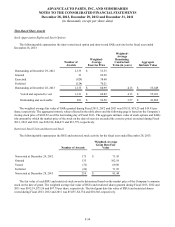

Condensed Parent Company Statements of Cash Flows

For the Years Ended December 28, 2013, December 29, 2012 and December 31, 2011

(in thousands)

Fiscal Years

2013 2012 2011

Cash flows from operating activities:

Net income $ 391,758 $ 387,670 $ 394,682

Adjustments to reconcile net income to net cash

provided by (used in) operations:

Equity in earnings of subsidiary (391,928)(388,103)(394,398)

Depreciation and amortization — 2 101

Other 170 420 (388)

Net cash provided by (used in) operating activities — (11)(3)

Cash flows from investing activities: ———

Cash flows from financing activities: ———

Net (decrease) increase in cash and cash equivalents — (11)(3)

Cash and cash equivalents, beginning of period 9 20 23

Cash and cash equivalents, end of period $ 9 $ 9 $ 20

Supplemental cash flow information:

Interest paid $ 30,750 $ 23,925 $ 17,250

Income taxes paid, net — — —

Noncash transactions:

Issuance of senior unsecured notes with proceeds received

by Stores $ 448,605 $ 299,904 $ —

Payment of debt related costs by Stores 8,815 2,942 3,656

Repurchase of Parent's common stock by Stores 80,795 27,095 631,149

Proceeds received by Stores from stock transactions under the

Parent's stock subscription plan and Stores' stock option plan 3,611 8,495 21,056

Tax withholdings paid by Stores from stock transactions under the

Parent's stock subscription plan and Stores' stock option plan (21,856)(26,677)(6,582)

Cash dividends paid by Stores on behalf of Parent 17,574 17,596 18,554

Retirement of common stock — 1,644,767 —

Changes in other comprehensive income (loss) 1,016 (137) 4,401

Declared but unpaid cash dividends 4,368 4,396 4,356

The accompanying notes to the condensed parent company financial information

are an integral part of this schedule.