Advance Auto Parts 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 28, 2013, December 29, 2012 and December 31, 2011

(in thousands, except per share data)

F-37

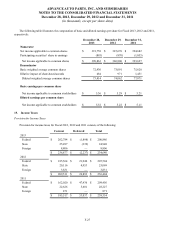

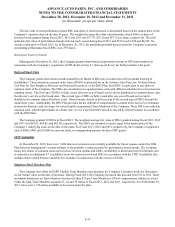

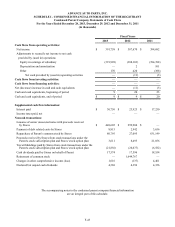

20. Accumulated Other Comprehensive Income (Loss):

Comprehensive income is computed as net earnings plus certain other items that are recorded directly to stockholders’

equity during the accounting period. In addition to net earnings, comprehensive income also includes changes in unrealized

gains or losses on hedge arrangements and postretirement plan benefits, net of tax. Accumulated other comprehensive income

(loss), net of tax, for Fiscal 2013, 2012 and 2011 consisted of the following:

Unrealized Gain

(Loss) on Hedging

Arrangements

Unrealized Gain (Loss)

on Postretirement

Plan

Accumulated

Other

Comprehensive

Income (Loss)

Balance, January 1, 2011 $ (4,807) $ 3,210 $ (1,597)

Fiscal 2011 activity 4,553 (152) 4,401

Balance, December 31, 2011 $ (254) $ 3,058 $ 2,804

Fiscal 2012 activity 254 (391)(137)

Balance, December 29, 2012 $ — $ 2,667 $ 2,667

Fiscal 2013 activity — 1,016 1,016

Balance, December 28, 2013 $ — $ 3,683 $ 3,683

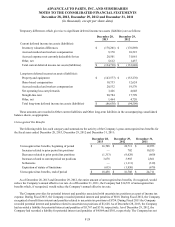

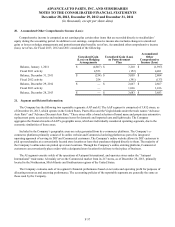

21. Segment and Related Information:

The Company has the following two reportable segments: AAP and AI. The AAP segment is comprised of 3,832 stores, as

of December 28, 2013, which operate in the United States, Puerto Rico and the Virgin Islands under the trade names “Advance

Auto Parts” and “Advance Discount Auto Parts.” These stores offer a broad selection of brand name and proprietary automotive

replacement parts, accessories and maintenance items for domestic and imported cars and light trucks. The Company

aggregates the financial results of AAP’s geographic areas, which are individually considered operating segments, due to the

economic similarities of those areas.

Included in the Company’s geographic areas are sales generated from its e-commerce platforms. The Company’s e-

commerce platforms primarily consist of its online website and Commercial ordering platform as part of its integrated

operating approach of serving its DIY and Commercial customers. The Company’s online website allows its DIY customers to

pick up merchandise at a conveniently located store location or have their purchases shipped directly to them. The majority of

the Company’s online sales are picked up at store locations. Through the Company’s online ordering platform, Commercial

customers can conveniently place orders with a designated store location for delivery to their place of business.

The AI segment consists solely of the operations of Autopart International, and operates stores under the “Autopart

International” trade name. AI mainly serves the Commercial market from its 217 stores, as of December 28, 2013, primarily

located in the Northeastern, Mid-Atlantic and Southeastern regions of the United States.

The Company evaluates each of its segment’s financial performance based on net sales and operating profit for purposes of

allocating resources and assessing performance. The accounting policies of the reportable segments are generally the same as

those used by the Company.