Advance Auto Parts 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

• a $13.4 million decrease in cash flow from the excess tax benefit from share-based compensation; and

• a $7.0 million decrease in net income.

Partially offsetting the decrease in operating cash flow was:

• a $56.8 million increase in cash flows provided by an increase in accrued expenses related to timing of the payment of

certain expenses.

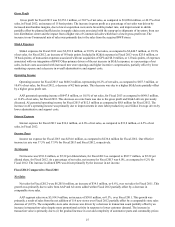

Investing Activities

For Fiscal 2013, net cash used in investing activities increased by $89.1 million to $362.1 million. The increase in cash

used in investing activities was primarily driven by cash used in the acquisition of BWP, partially offset by a reduction in

investments in property and equipment as a result of less spending on existing stores, new store development, information

technology, and investments in supply chain.

For Fiscal 2012, net cash used in investing activities decreased by $17.0 million to $273.0 million. The decrease in cash

used was primarily driven by the decrease in cash used for business acquisitions.

Financing Activities

For Fiscal 2013, net cash provided by financing activities increased by $203.3 million to $331.2 million. This increase was

primarily a result of a net change in borrowings under our senior unsecured notes and credit facilities, partially offset by a

$53.7 million increase in the repurchase of common stock under our stock repurchase program.

For Fiscal 2012, net cash used in financing activities increased by $668.1 million to $127.9 million. This increase was

primarily a result of:

• a $604.0 million decrease in cash used for the repurchase of common stock under our stock repurchase program; and

• $299.9 million provided by the issuance of senior unsecured notes.

Partially offsetting these increases was a $230.0 million decrease in net borrowings on credit facilities.

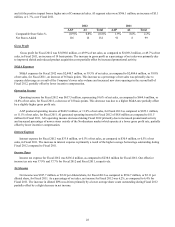

Long-Term Debt

Bank Debt

On December 5, 2013, we entered into a new credit agreement which provides a $700.0 million unsecured term loan and a

$1.0 billion unsecured revolving credit facility (the “2013 Credit Agreement”) with Advance Stores, as Borrower, the lenders

party thereto, and JPMorgan Chase Bank, N.A., as administrative agent. This new revolving credit facility replaced the revolver

under our former Credit Agreement dated as of May 27, 2011 with Advance Stores, as Borrower, the lenders party thereto,

JPMorgan Chase Bank, N.A., as administrative agent (the “2011 Credit Agreement”). Upon execution of the 2013 Credit

Agreement, the lenders’ commitments under the 2011 Credit Agreement were terminated and the liabilities of us and our

subsidiaries with respect to their obligations under the 2011 Credit Agreement were discharged. The new revolving credit

facility also provides for the issuance of letters of credit with a sub-limit of $300.0 million and swingline loans in an amount

not to exceed $50.0 million. We may request, subject to agreement by one or more lenders, that the total revolving

commitment be increased by an amount not to exceed $250.0 million (up to a total commitment of $1.25 billion) during the

term of the credit agreement. Voluntary prepayments and voluntary reductions of the revolving balance are permitted in whole

or in part, at our option, in minimum principal amounts as specified in the revolving credit facility. The revolving credit facility

terminates in December 2018 and the term loan matures in January 2019.

As of December 28, 2013, we had not borrowed any amounts under the 2013 Credit Agreement but subsequently borrowed

$700.0 million under the term loan and $306.0 million under the revolver in conjunction with our acquisition of GPI on January

2, 2014. As of December 28, 2013, we had letters of credit outstanding of $87.3 million. The letters of credit generally have a

term of one year or less and primarily serve as collateral for our self-insurance policies. Our debt availability as of

December 28, 2013 was $545.4 million based on the maximum amount of additional borrowings allowed under our leverage

ratio.

The interest rate on borrowings under the revolving credit facility is based, at our option, on adjusted LIBOR, plus a

margin, or an alternate base rate, plus a margin. The current margin is 1.30% and 0.30% per annum for the adjusted LIBOR and