Advance Auto Parts 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 28, 2013, December 29, 2012 and December 31, 2011

(in thousands, except per share data)

F-22

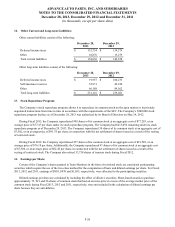

The Company may redeem some or all of the Notes at any time or from time to time, at the redemption price described in

the Indenture. In addition, in the event of a Change of Control Triggering Event (as defined in each of the Indentures for the

Notes), the Company will be required to offer to repurchase the Notes at a price equal to 101% of the principal amount thereof,

plus accrued and unpaid interest to the repurchase date. The Notes are currently fully and unconditionally guaranteed, jointly

and severally, on an unsubordinated and unsecured basis by each of the subsidiary guarantors. The Company will be permitted

to release guarantees without the consent of holders of the Notes under the circumstances described in the Indenture: (i) upon

the release of the guarantee of the Company’s other debt that resulted in the affected subsidiary becoming a guarantor of this

debt; (ii) upon the sale or other disposition of all or substantially all of the stock or assets of the subsidiary guarantor; or (iii)

upon the Company’s exercise of its legal or covenant defeasance option.

The Indenture contains customary provisions for events of default including for: (i) failure to pay principal or interest when

due and payable; (ii) failure to comply with covenants or agreements in the Indenture or the Notes and failure to cure or obtain

a waiver of such default upon notice; (iii) a default under any debt for money borrowed by the Company or any of its

subsidiaries that results in acceleration of the maturity of such debt, or failure to pay any such debt within any applicable grace

period after final stated maturity, in an aggregate amount greater than $25,000 without such debt having been discharged or

acceleration having been rescinded or annulled within 10 days after receipt by the Company of notice of the default by the

Trustee or holders of not less than 25% in aggregate principal amount of the Notes then outstanding; and (iv) events of

bankruptcy, insolvency or reorganization affecting the Company and certain of its subsidiaries. In the case of an event of

default, the principal amount of the Notes plus accrued and unpaid interest may be accelerated. The Indenture also contains

covenants limiting the ability of the Company and its subsidiaries to incur debt secured by liens and to enter into sale and lease-

back transactions.

Debt Guarantees

Certain 100% wholly-owned domestic subsidiaries of Stores, including its Material Subsidiaries (as defined in the 2013

Credit Agreement) serve as guarantors of the Notes and 2013 Credit Agreement with Advance also serving as a guarantor of the

2013 Credit Agreement. The subsidiary guarantees related to the Company’s Notes and 2013 Credit Agreement are full and

unconditional and joint and several, and there are no restrictions on the ability of Advance to obtain funds from its subsidiaries.

Also, Advance has no independent assets or operations, and the subsidiaries not guaranteeing the Notes and 2013 Credit

Agreement are minor as defined by SEC regulations.

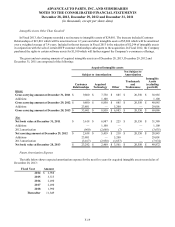

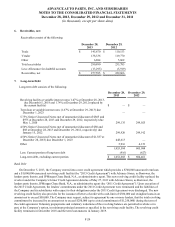

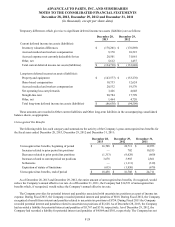

Future Payments

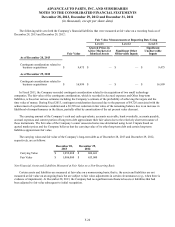

As of December 28, 2013, the aggregate future annual maturities of long-term debt instruments are as follows:

Fiscal

Year Amount

2014 $ 916

2015 1,049

2016 —

2017 —

2018 —

Thereafter 1,051,619

$ 1,053,584

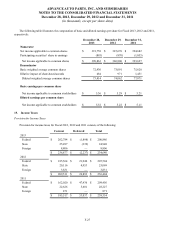

8. Derivative Instruments and Hedging Activities:

From September 2011 through January 2012, the Company executed a series of forward treasury rate locks in anticipation

of the issuance of the 2022 Notes. The treasury rate locks, which were derivative instruments, were designated as cash flow

hedges to offset the Company’s exposure to increases in the underlying U.S. Treasury benchmark rate. This rate was used to

establish the fixed interest rate for 2022 Notes which was comprised of the underlying U.S. Treasury benchmark rate, plus a

credit spread premium. Upon issuance of the 2022 Notes, the cumulative change in fair market value of the treasury rate locks