Advance Auto Parts 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 28, 2013, December 29, 2012 and December 31, 2011

(in thousands, except per share data)

F-20

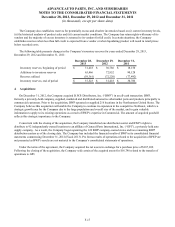

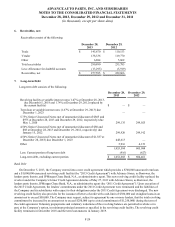

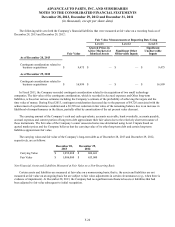

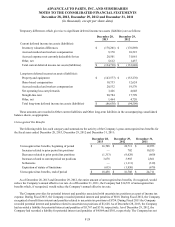

6. Receivables, net:

Receivables consist of the following:

December 28,

2013

December 29,

2012

Trade $ 145,670 $ 110,153

Vendor 138,336 119,770

Other 6,884 5,862

Total receivables 290,890 235,785

Less: Allowance for doubtful accounts (13,295)(5,919)

Receivables, net $ 277,595 $ 229,866

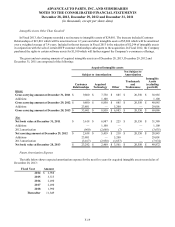

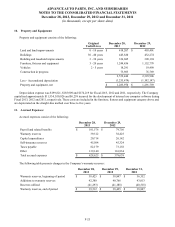

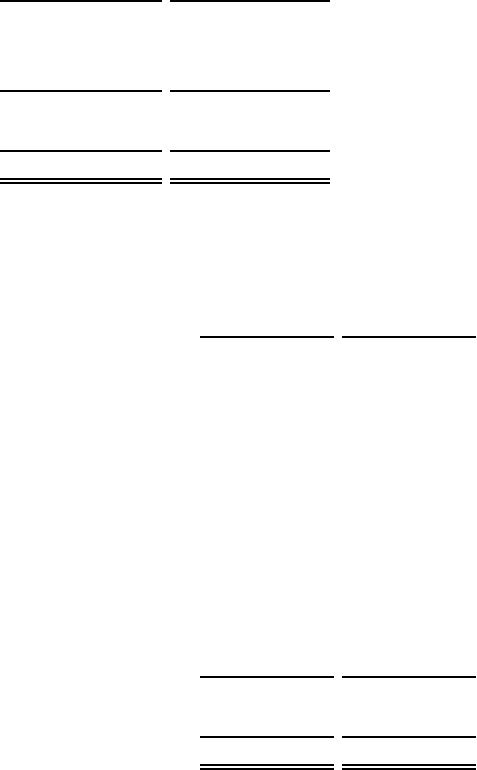

7. Long-term Debt:

Long-term debt consists of the following:

December 28,

2013

December 29,

2012

Revolving facility at variable interest rates (1.47% at December 28, 2013,

due December 5, 2018 and 1.74% at December 29, 2012 replaced by

the current facility) $ — $ —

Term loan at variable interest rates (1.67% at December 29, 2013) due

December 1, 2023 — —

5.75% Senior Unsecured Notes (net of unamortized discount of $865 and

$975 at December 28, 2013 and December 29, 2012, respectively) due

May 1, 2020 299,135 299,025

4.50% Senior Unsecured Notes (net of unamortized discount of $80 and

$88 at December 28, 2013 and December 29, 2012, respectively) due

January 15, 2022 299,920 299,912

4.50% Senior Unsecured Notes (net of unamortized discount of $1,387 at

December 28, 2013) due December 1, 2023 448,613 —

Other 5,916 6,151

1,053,584 605,088

Less: Current portion of long-term debt (916)(627)

Long-term debt, excluding current portion $ 1,052,668 $ 604,461

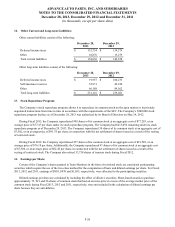

Bank Debt

On December 5, 2013, the Company entered into a new credit agreement which provides a $700,000 unsecured term loan

and a $1,000,000 unsecured revolving credit facility (the “2013 Credit Agreement”) with Advance Stores, as Borrower, the

lenders party thereto, and JPMorgan Chase Bank, N.A., as administrative agent. This new revolving credit facility replaced the

revolver under the Company’s former Credit Agreement dated as of May 27, 2011 with Advance Stores, as Borrower, the

lenders party thereto, JPMorgan Chase Bank, N.A., as administrative agent (the “2011 Credit Agreement”). Upon execution of

the 2013 Credit Agreement, the lenders’ commitments under the 2011 Credit Agreement were terminated and the liabilities of

the Company and its subsidiaries with respect to their obligations under the 2011 Credit Agreement were discharged. The new

revolving credit facility also provides for the issuance of letters of credit with a sub-limit of $300,000 and swingline loans in an

amount not to exceed $50,000. The Company may request, subject to agreement by one or more lenders, that the total revolving

commitment be increased by an amount not to exceed $250,000 (up to a total commitment of $1,250,000) during the term of

the credit agreement. Voluntary prepayments and voluntary reductions of the revolving balance are permitted in whole or in

part, at the Company’s option, in minimum principal amounts as specified in the revolving credit facility. The revolving credit

facility terminates in December 2018 and the term loan matures in January 2019.