Advance Auto Parts 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

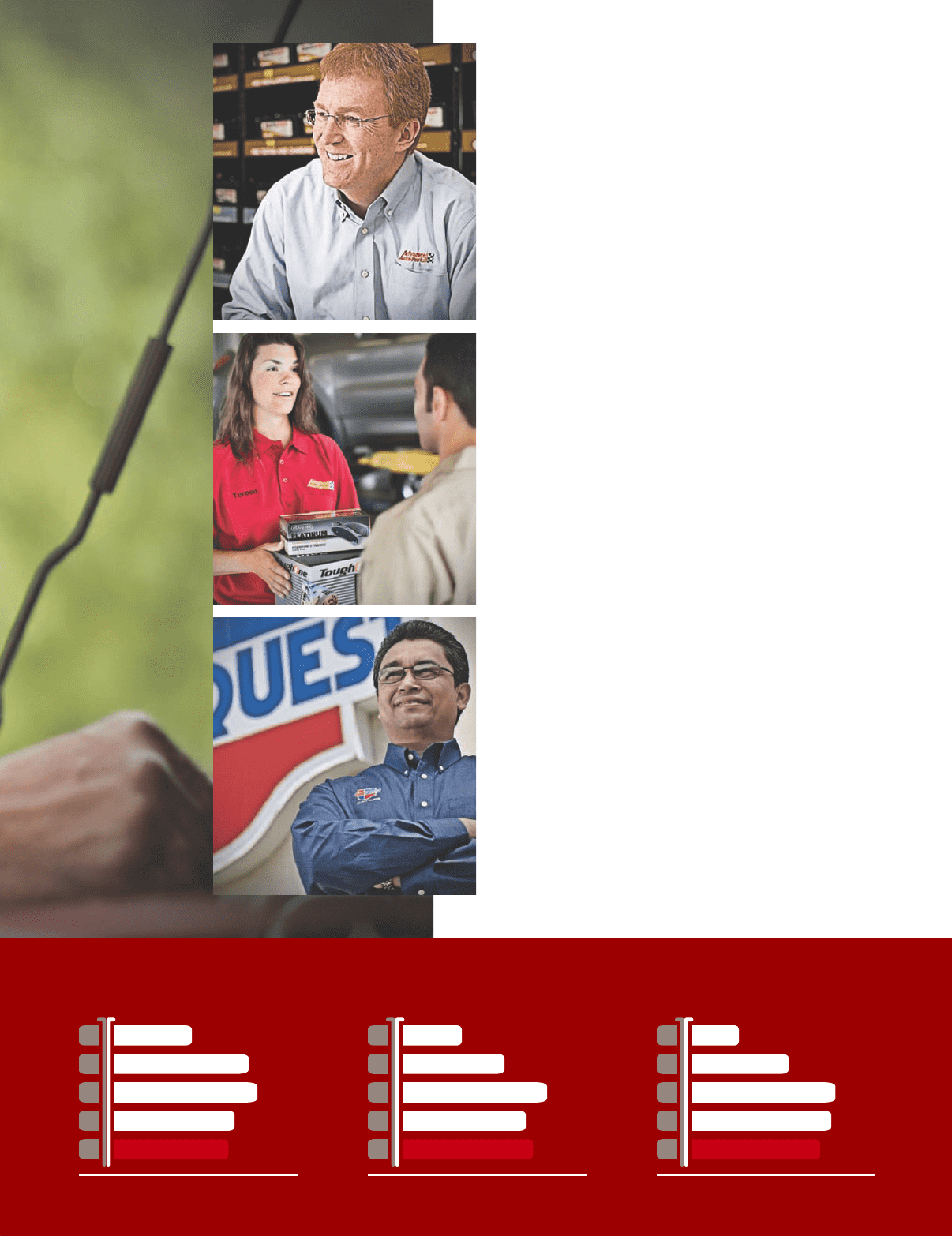

I am pleased to present to you our 2013

Annual Report. I would like to thank all our

Team Members for their hard work and

for their commitment to better serve our

customers and grow our business during

the past year.

In 2013, Advance achieved record sales

of $6.5 billion, strong operating income

and consistent free cash ow generation.

2013 was also a historic year as the

Company took a major strategic step

forward through the acquisition of General

Parts International, Inc. positioning us for

sustainable long-term growth and value

creation as the largest parts provider

in the automotive aftermarket industry.

We closed on the transaction just after

our 2013 scal year end. In addition to

the strategic and nancial merits of the

acquisition, our condence and conviction

was reinforced by our December 2012

continued

Letter to our STOCKHOLDERS

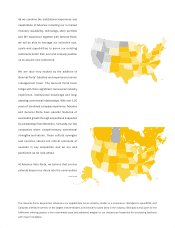

Performance Measures(2)

Sales per Store (in thousands) Operating Income per Store (in thousands) Return on Invested Capital %(3)

$1,595 $142 15.1%

$1,697 $168 17.5%

$1,708 $184 19.5%

$1,664 $176 19.4%

$1,656 $177 19.0%

09 09 09

10 10 10

11 11 11

12 12 12

13 13 13

*See next page for footnotes.