Advance Auto Parts 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

December 28, 2013, December 29, 2012 and December 31, 2011

(in thousands, except per share data)

F-30

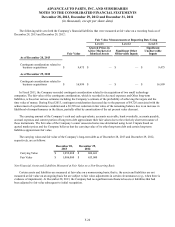

provided for any penalties associated with tax contingencies unless considered probable of assessment. The Company does not

expect its unrecognized tax benefits to change significantly over the next 12 months.

During the next 12 months, it is possible the Company could conclude on approximately $6,000 to $7,000 of the

contingencies associated with unrecognized tax uncertainties due mainly to the conclusion of audits and the expiration of

statutes of limitations. The majority of these resolutions would be achieved through the completion of current income tax

examinations.

The Company files U.S. and state income tax returns in jurisdictions with varying statutes of limitations. Fiscal 2010 and

subsequent years generally remain subject to examination by federal and state tax authorities.

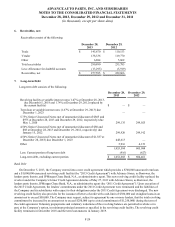

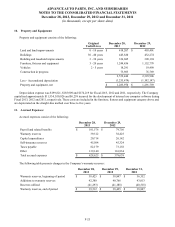

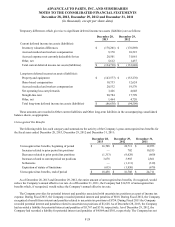

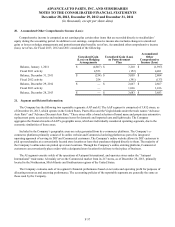

16. Lease Commitments:

As of December 28, 2013, future minimum lease payments due under non-cancelable operating leases with lease terms

ranging from 1 year to 30 years through the year 2043 for all open stores are as follows:

Fiscal Year Amount

2014 $ 353,508

2015 316,637

2016 299,810

2017 283,333

2018 263,162

Thereafter 925,475

$ 2,441,925

The Company anticipates its future minimum lease payments will be partially off-set by future minimum sub-lease income.

As of December 28, 2013 and December 29, 2012, future minimum sub-lease income to be received under non-cancelable

operating leases is $29,950 and $25,561, respectively.

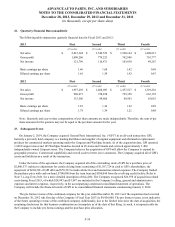

Net Rent Expense

Net rent expense for Fiscal 2013, 2012 and 2011 was as follows:

December 28,

2013

December 29,

2012

December 31,

2011

Minimum facility rentals $ 328,581 $ 300,552 $ 289,306

Contingency facility rentals 578 907 1,162

Equipment rentals 5,333 5,027 5,403

Vehicle rentals 29,100 18,401 20,565

363,592 324,887 316,436

Less: Sub-lease income (5,983)(4,600)(3,967)

$ 357,609 $ 320,287 $ 312,469

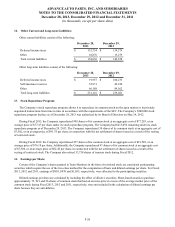

17. Contingencies:

In the case of all known contingencies, the Company accrues for an obligation, including estimated legal costs, when it is

probable and the amount is reasonably estimable. As facts concerning contingencies become known to the Company, the

Company reassesses its position with respect to accrued liabilities and other potential exposures. Estimates that are particularly

sensitive to future change include legal matters, which are subject to change as events evolve and as additional information

becomes available during the administrative and litigation process.