Advance Auto Parts 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

NotestoConsolidatedFinancialStatements(continued)

FortheYearsEndedJanuary1,2005,January3,2004,andDecember28,2002(inthousands,exceptpersharedata)

As permitted under SFAS No. 123, “Accounting for

Stock-BasedCompensation,”theCompanyaccountsforits

stockoptionsusingtheintrinsicvaluemethodprescribed

inAccountingPrinciplesBoardOpinionNo.25,“Account-

ingforStockIssuedtoEmployees,”orAPBNo.25.Under

APBNo.25,compensationcostforstockoptionsismea-

sured as the excess, if any, of the market price of the

Company’s common stock at the measurement date over

theexerciseprice.Accordingly,theCompanyhasnotrec-

ognizedcompensationexpenseontheissuanceofitsstock

optionsbecausetheexercisepriceequaledthefairmarket

valueofthe underlyingstockonthe grantdate.Nocom-

pensationexpensewasrequiredforthefiscalyearsended

January1,2005,January3,2004andDecember28,2002.

During fiscal 2002, the Company established an

employee stock purchase plan. The plan is intended to

qualifyasanemployeestockpurchaseplanunderSection

423 of the Internal Revenue Code of 1986, as amended.

In May 2002, the Company registered 700 shares with

the Securities and Exchange Commission to be issued

under the plan. All eligible team members may purchase

common stock at 85% of fair market value (determined

quarterly) through payroll deductions. There are annual

limitations on team member purchases of either $25,000

per team member or 10% of compensation, whichever

is less. Under the plan, team members purchased 118,

147 and 28 shares in fiscal years 2004, 2003 and 2002,

respectively.

20.FairValueofFinancialInstruments

The carrying amount of cash and cash equivalents,

receivables,bankoverdrafts,accountspayable,borrowings

securedbyreceivablesandcurrentportionoflong-termdebt

approximates fair value because of the short maturity of

those instruments. The carrying amount for variable rate

long-term debt approximates fair value for similar issues

availabletotheCompany.Therewasnofixedratelong-term

debtoutstandingatJanuary1,2005orJanuary3,2004.

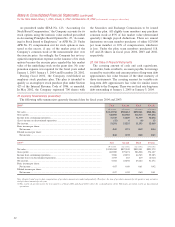

21.QuarterlyFinancialData(unaudited)

Thefollowingtablesummarizesquarterlyfinancialdataforfiscalyears2004and2003:

2004(1) First Second Third Fourth

(16weeks) (12weeks) (12weeks) (12weeks)

Netsales.................................................................................................................................... $1,122,918 $908,412 $890,161 $848,806

Grossprofit............................................................................................................................... 520,898 422,302 416,515 393,656

Incomefromcontinuingoperations......................................................................................... 51,343 53,229 51,399 32,056

(Loss)incomeondiscontinuedoperations.............................................................................. (52) 6 (6) 13

Netincome................................................................................................................................ 51,291 53,235 51,393 32,069

Basicincomepershare:

Netincome............................................................................................................................ 0.69 0.71 0.69 0.44

Dilutedincomepershare:

Netincome............................................................................................................................ 0.68 0.70 0.68 0.43

2003(1) First Second Third Fourth

(16weeks) (12weeks) (12weeks) (13weeks)

Netsales.................................................................................................................................... $1,005,968 $827,348 $839,101 $821,279

Grossprofit............................................................................................................................... 463,989 379,474 386,928 374,127

Incomefromcontinuingoperations......................................................................................... 3,968 43,291 44,745 33,283

Income(loss)ondiscontinuedoperations............................................................................... 1,073 167 419 (2,011)

Netincome................................................................................................................................ 5,041 43,458 45,164 31,272

Basicincomepershare:

Netincome............................................................................................................................ 0.07 0.60 0.61 0.42

Dilutedincomepershare:

Netincome............................................................................................................................ 0.07 0.58 0.60 0.41

Note:Quarterlyandyear-to-datecomputationsofpershareamountsaremadeindependently.Therefore,thesumofpershareamountsforthequartersmaynotagree

withpershareamountsfortheyear.

(1)The results of operations for the four quarters of fiscal 2004 and fiscal 2003 reflect the reclassification of the Wholesale operating results as discontinued

operations.