Advance Auto Parts 2004 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

new$100,000 trancheDterm loan facilityand$340,000

tranche E term loan facility. The borrowings under the

trancheDtermloanfacilityandtrancheEtermloanfacil-

itywereusedtoreplacethetrancheA,A-1,CandC-1term

loanfacilities.

Duringfiscal2002,theCompanyrepaidaportionofits

trancheAandtrancheBtermloanfacilities.Subsequently,

it also refinanced the remaining portion of its tranche B

term loan facility under its previous senior credit facility

by amending and restating the credit facility to add a

new $250,000 tranche C term loan facility. The borrow-

ings under the tranche C term loan facility were used to

refinance the tranche B term loan facility. In conjunc-

tion with the extinguishment of this debt, the Company

wrote off deferred financing costs in accordance with

EITFNo.96-19.Thewrite-offofthesecostsisclassified

asalossonextinguishmentofdebtof$8,542intheaccom-

panyingconsolidatedstatementsofoperations.

Duringfiscal2002,theCompanyalsorepurchasedand

retiredaportionofitsseniorsubordinatednotesandsenior

discountdebentures.Thepremiumspaidandthewrite-off

of the related deferred financing costs are classified as a

lossonextinguishmentofdebtof$8,280intheaccompa-

nyingstatementsofoperations.

AsofJanuary1,2005,theCompanywasincompliance

withthecovenantsoftheseniorcreditfacility.Substantially

all of the net assets of the Company’s subsidiaries are

restrictedatJanuary1,2005.

AtJanuary1,2005,theaggregatefutureannualmaturi-

tiesoflong-termdebtareasfollows:

2005........................................................................................ $ 31,700

2006........................................................................................ 24,525

2007........................................................................................ 40,200

2008........................................................................................ 63,375

2009........................................................................................ 52,700

Thereafter............................................................................... 257,500

$470,000

13.StockRepurchaseProgram

Duringthethirdquarteroffiscal2004,theCompany’s

BoardofDirectorsauthorizedastockrepurchaseprogram

of up to $200,000 of the Company’s common stock plus

related expenses. The program will allow the Company

to repurchase its common stock on the open market or

in privately negotiated transactions from time to time in

accordance with the requirements of the Securities

and Exchange Commission. As of January 1, 2005, the

Companyhasrepurchasedatotalof3,700sharesofcom-

monstockatanaggregatecostof$146,222,or$39.52per

share. At January 1, 2005, the Company had $53,778,

excludingrelatedexpenses,availableforstockrepurchases

underthestockrepurchaseprogram.

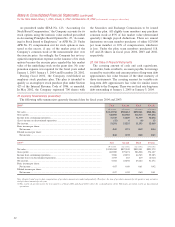

14.IncomeTaxes

The provision(benefit)for incometaxesfrom continu-

ingoperationsforfiscal2004,fiscal2003andfiscal2002

consistsofthefollowing:

Current Deferred Total

2004

Federal........................... $102,171 $ 1,318 $103,489

State................................ 9,042 5,190 14,232

$111,213 $ 6,508 $117,721

2003

Federal............................ $ 23,759 $44,820 $ 68,579

State................................ 923 8,922 9,845

$ 24,682 $53,742 $ 78,424

2002

Federal............................ $(11,958) $44,740 $ 32,782

State................................ 62 6,686 6,748

$(11,896) $51,426 $ 39,530

The provision(benefit)for incometaxesfrom continu-

ing operations differed from the amount computed by

applyingthefederalstatutoryincometaxratedueto:

2004 2003 2002

Incomefromcontinuing

operationsatstatutoryU.S.

federalincometaxrate........... $107,012 $71,298 $35,587

Stateincometaxes,netof

federalincometaxbenefit..... 9,251 6,399 4,386

Non-deductibleinterestand

otherexpenses........................ 745 1,263 914

Valuationallowance................... 236 (1,002) 241

Other,net.................................... 477 466 (1,598)

$117,721 $78,424 $39,530

During the years ended January 1, 2005, January 3,

2004 andDecember28, 2002,the Companyhad a(loss)

income from operations of the discontinued Wholesale

DealerNetworkof$(63),$(572)and$4,691,respectively.

TheCompanyrecordedanincometax(benefit)expenseof

$(24), $(220) and $1,820 related to these discontinued

operationsfortheyearsendedJanuary1,2005,January3,

2004andDecember28,2002,respectively.

Deferredincometaxesarerecognizedforthetaxconse-

quences in future years of differences between the tax

basesofassetsandliabilitiesandtheirfinancialreporting

amountsateachperiod-end,basedonenactedtaxlawsand

statutory income tax rates applicable to the periods in

whichthedifferences areexpectedtoaffect taxable

income.Deferredincometaxesreflectthenetincometax

effectoftemporarydifferencesbetweenthebasesofassets

and liabilities for financial reporting purposes and for

NotestoConsolidatedFinancialStatements(continued)

FortheYearsEndedJanuary1,2005,January3,2004,andDecember28,2002(inthousands,exceptpersharedata)