Advance Auto Parts 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AdvanceAutoParts,Inc.andSubsidiaries

17

• Consistent growth and execution of our commercial

deliveryprogram;

• Enhancedadvertisingandfocusonservingthecustomer;

• Traininganddevelopmentofourteammembers;and

• Investingintechnologyandinnovativestoresystems.

In addition, we are focused on optimizing our overall

expenses at all levels of the organization as well as con-

tinuing to execute our supply chain initiatives to better

optimizeourdistributioncostsandmakeourlogisticsnet-

workoperatemoreefficientlyandmoreproductively.

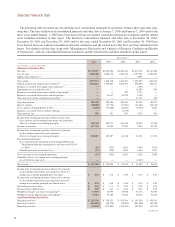

Thefollowingtablehighlightscertainoperatingresults

andkeymetricsfor2004,2003and2002:

FiscalYear

2004 2003(1) 2002

Totalnetsales

(inthousands)............... $3,770,297 $3,493,696 $3,204,140

Comparablestoresales

growth....................... 6.1% 3.1% 5.5%

DIYcomparablestore

salesgrowth.............. 2.8% 2.4% 5.6%

DIFMcomparablestore

salesgrowth.............. 22.9% 7.2% 5.0%

Averagenetsalesper

store(inthousands)...... $ 1,453 $ 1,379 $ 1,303

Inventoryperstore

(inthousands)............... $ 453,035 $ 438,669 $ 429,399

Inventoryturnover........ 1.74 1.72 1.75

Grossmargins............... 46.5% 45.9% 44.8%

Operatingmargins........ 8.7% 8.3% 6.1%

Note:Thesemetricsshouldbereviewedalongwiththefootnotestothetable

settingforthourselectedstoredatainItem6.“SelectedFinancialData”located

elsewhereinthisreport.Thefootnotescontaindescriptionsregardingthecalcu-

lationofthesemetrics.

(1)Allfinancial metricsfor2003 include the53rdweek, except theaveragenet

salesperstoreandinventoryturnovermetrics.

Key2004Events

The following key events occurred during 2004 and

reflectopportunitiesthat willsupportourstrategicinitia-

tivesdiscussedabove:

• Ourboardofdirectorsauthorizeda$200millionstock

repurchase program during the third quarter of 2004.

Thisprogramallowsustorepurchaseoutstandingshares

ofourcommonstockatpricesthatwebelieveareattrac-

tive with confidence of our ability to produce strong

operatingresultsinthefuture.AsofJanuary1,2005,we

hadrepurchasedatotalof3.7millionsharesatanaggre-

gatecostof$146.2million.

• Weenteredintoavendorfinancingprogramduringthe

firstquarterof2004allowingustoextendourpayment

terms on certainmerchandise purchases.Thisprogram

will allow us to leverage our working capital and utilize

existingcashflowtofundourstrategicinitiativesandcap-

italrequirements.

• During2004,wepurchasedanewNortheastdistribution

centerinPennsylvania.Thisfacilityisplannedtobegin

servicingourexpandingstorebaseintheNortheastregion

oftheUnitedStatesduringthefirstquarterof2005.

• Wecompletedtherefinancingofourseniorcreditfacility

duringthefourthquarterof2004.Ouramendedsenior

credit facility provided for an additional $100 million

forstockbuybacksunderourstockrepurchaseprogram.

DiscontinuedOperations

Prior to 2004, we operated a second segment for our

wholesalebusiness.OnDecember19,2003,wediscontin-

uedthesupplyingofmerchandisetoourwholesaledistri-

bution network, or Wholesale. Wholesale consisted of

independently owned and operated dealer locations, for

whichwesuppliedmerchandiseinventoryandcertainser-

vices.Duetothewidevarietyofproductssuppliedtothe

dealersandthereducedconcentrationofstoresspreadover

a wide geographic area, it had become difficult to serve

these dealerseffectively. Thiscomponent ofourbusiness

operated in the wholesale segment and excluding certain

allocatedandteammemberbenefitexpensesof$2.4mil-

lionand$3.3millionforfiscalyears2003and2002,rep-

resentedtheentireresultsofoperationspreviouslyreported

inthatsegment.Wehaveclassifiedtheseoperatingresults

as discontinued operations in the accompanying consoli-

dated statements of operations for the fiscal years ended

January 3, 2004 and December 28, 2002 to reflect this

decision. For the fiscal year ended January 1, 2005, the

operating results related to the discontinued wholesale

businesswereminimalas aresultofrecognizinganesti-

mateofexitcostsinfiscal2003.

CriticalAccountingPolicies

Our financial statements have been prepared in accor-

dance with accounting policies generally accepted in the

UnitedStatesofAmerica.Ourdiscussionandanalysisof

thefinancialconditionandresultsofoperationsarebased

on these financial statements. The preparation of these

financialstatementsrequirestheapplicationofaccounting

policiesinadditiontocertainestimatesandjudgmentsby

ourmanagement.Ourestimates andjudgmentsarebased

on currently available information, historical results and

otherassumptionswebelievearereasonable.Actualresults

coulddifferfromtheseestimates.

Thepreparationofourfinancialstatementsincludedthe

followingsignificantestimates.