Advance Auto Parts 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AdvanceAutoParts,Inc.andSubsidiaries

21

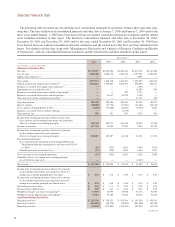

Interestexpensefor2004was$20.1million,or0.5%of

net sales, as compared to $37.6 million, or 1.1% of net

sales,in2003.Thedecreaseininterestexpenseisaresult

ofloweroverallinterestratesresultingprimarilyfromour

redemption of our outstanding senior subordinated notes

andseniordiscountdebenturesinthefirstquarteroffiscal

2003.Additionally,thedecreaseisa resultofloweraver-

age outstanding debt levels on our senior credit facility

throughoutfiscal2004ascomparedtofiscal2003.

Income tax expense for 2004 was $117.7 million, as

compared to $78.4 million for 2003. This increase in

incometaxexpenseprimarilyreflectsourhigherearnings.

Our effective income tax rate was 38.5% for both 2004

and2003.

Werecordednetincomeof$188.0million,or$2.49per

dilutedsharefor2004,ascomparedto$124.9million,or

$1.67perdilutedsharefor2003.Asapercentageofsales,

netincome for2004was 5.0%, as comparedto3.6%for

2003. Our net income for 2003 included the effect of

expensesassociatedwith mergerandintegrationandloss

on extinguishment of debt of $35.5 million, or $0.47 per

dilutedshare.

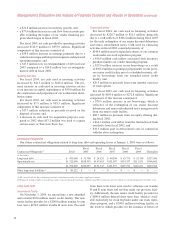

Fiscal2003ComparedtoFiscal2002

Netsalesfor2003were$3,493.7million,anincreaseof

$289.6million,or9.0%,overnetsalesfor2002.Excluding

theeffectofthe53rdweekournetsalesincreased$226.6

million, or 7.1%, over net sales for 2002. The net sales

increase was due to an increase in the comparable store

salesof3.1%,drivenbyincreasesinbothcustomertraffic

and average ticket sales, and contributions from the 125

newstores openedwithin thelastyear.Increases inboth

ourDIYandDIFMbusinessescontributedtothecompa-

rablestoresalesincrease.

Grossprofitfor2003was$1,604.5million,or45.9%of

netsales,ascomparedto$1,434.4million,or44.8%ofnet

sales,in2002.Theincreaseingrossprofitasapercentage

ofsalesreflectscontinuedbenefitsrealizedfromourcate-

gory managementinitiativesand improvedefficienciesin

ourlogisticsnetwork.

Selling, generalandadministrative expenses,including

merger and integration costs of $10.4 million in 2003,

increased to $1,316.3 million, or 37.6% of net sales, for

2003, from $1,238.1 million, or 38.7% of net sales, for

2002. In 2002, merger and integration costs were $35.5

million. The decrease in selling, general and administra-

tive expenses as a percentage of net sales is primarily a

result of a decrease in merger and integration expenses

related to the integration of Discount. These integration

expenses are related to, among other things, overlapping

administrative functions and store conversion expenses.

Thedeclineinmergerandintegrationcostswasanticipated

asweapproachedthecompletionoftheDiscountintegra-

tion. Excluding the impact of the merger and integration

costs, the decline in selling, general and administrative

expensesasapercentageofnetsalesisaresultofleverag-

ing our fixed costs as a result of the impact of the 53rd

weekofoperationsinthefourthquarterof2003.

Interestexpensefor2003was$37.6million,or1.1%of

net sales, as compared to $77.1 million, or 2.4% of net

sales,in2002.Thedecreaseininterestexpenseisaresult

ofloweroverallinterestratesresultingprimarilyfromour

redemption of our outstanding senior subordinated notes

and senior discount debentures in first quarter 2003.

Additionally,thedecreaseisaresultofoveralllowerdebt

levelsin2003ascomparedto2002.

Incometaxexpensefor2003was$78.4million,ascom-

paredto$39.5millionfor2002.Oureffectiveincometax

rate decreasedto 38.5%for2003,ascompared to38.8%

for 2002. The decrease in our effective tax rate was pri-

marilyduetoincreasesinpre-taxincome,whichreduced

theimpactofcertainpermanentdifferencesonthe effec-

tiverate.

During 2003, we recorded $47.3 million in a loss on

extinguishmentofdebt.Thislossreflectsthewrite-offof

deferred loan costs and premiums paid to redeem our

senior subordinated notes and senior discount debentures

during the first quarter of fiscal 2003, and also includes

the related financing costs associated with amending our

seniorcreditfacilitytofinancethisredemption.Addition-

ally,thislossincludestheratableportionofdeferredloan

costs associated with the partial repayment of our term

loansduringfiscal2003.

Werecordednetincomeof$124.9million,or$1.67per

diluted share for 2003, as compared to $65.0 million, or

$0.90perdilutedsharefor2002.Asapercentageofsales,

netincomefor2003 was3.6%, as comparedto2.0% for

2002. The effect of the expenses associated with merger

andintegrationandlossonextinguishmentofdebtonnet

income was $35.5 million, or $0.47 per diluted share for

2003 and $32.0 million, or $0.44 per diluted share for

2002. These per share amounts reflect the two-for-one

stocksplitdeclaredin2003.