Advance Auto Parts 2004 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

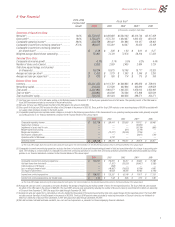

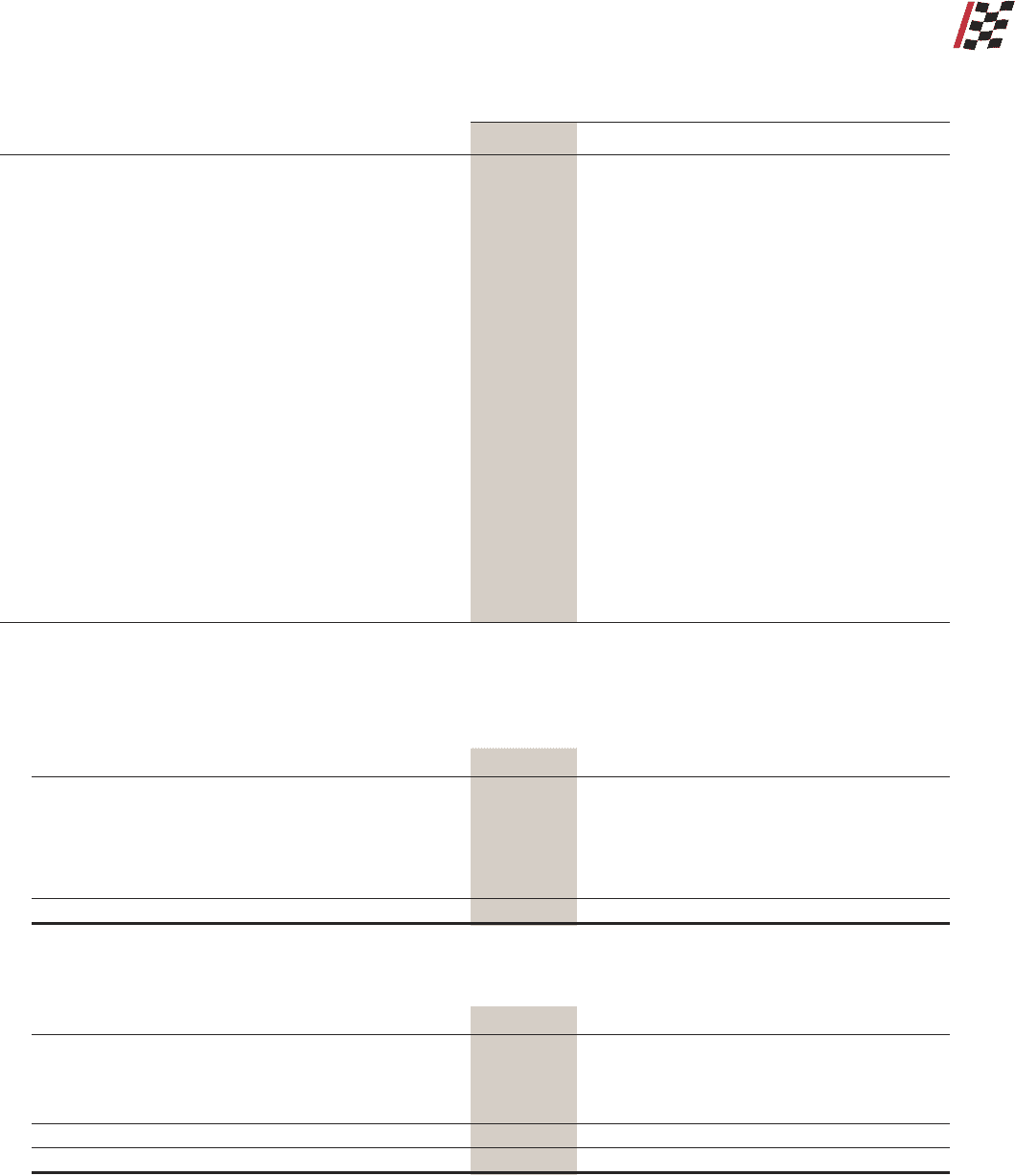

5-YearFinancial

2000–2004

Compounded

Growth

FiscalYear(1)

2004 2003 2002 2001(a) 2000

(inthousands,exceptpersharedata)

StatementofOperationsData:

Netsales(2)............................................................................ 14.8% $3,770,297 $3,430,680 $3,204,140 $2,419,746 $2,167,308

Grossprofit(3)........................................................................ 18.8% 1,753,371 1,575,756 1,434,407 1,062,152 881,013

Comparableoperatingincome(4).......................................... 38.8% 328,758 289,441 231,883 119,127 88,462

Comparableincomefromcontinuingoperations(5).............. 87.6% 188,027 155,091 94,267 35,652 15,188

Comparableincomefromcontinuingoperations

perdilutedshare(5)........................................................... $ 2.49 $ 2.08 $ 1.30 $ 0.61 $ 0.27

Weightedaveragedilutedsharesoutstanding..................... 75,481 74,743 72,376 58,316 57,222

SelectedStoreData:

Comparablestoresalesgrowth............................................ 6.1% 3.1% 5.5% 6.2% 4.4%

Numberofstores,endofperiod.......................................... 2,652 2,539 2,435 2,484 1,729

Totalstoresquarefootage,endofperiod

(inthousands).................................................................. 19,734 18,875 18,108 18,717 13,325

Averagenetsalesperstore(6)............................................... $ 1,453 $ 1,379 $ 1,303 $ 1,346 $ 1,295

Averagenetsalespersquarefoot(7)..................................... $ 195 $ 186 $ 174 $ 175 $ 168

BalanceSheetData:

Inventory............................................................................... $1,201,450 $1,113,781 $1,048,803 $ 982,000 $ 788,914

Networkingcapital............................................................... 416,302 372,509 462,896 442,099 318,583

Totalassets........................................................................... 2,201,962 1,983,071 1,965,225 1,950,615 1,356,360

Totalnetdebt(8)..................................................................... 433,863 464,598 722,506 972,368 582,539

Totalstockholders’equity..................................................... 722,315 631,244 468,356 288,571 156,271

(1)Ourfiscalyearconsistsof52or53weeksendingontheSaturdaynearesttoDecember31.Allfiscalyearspresentedconsistof52weeks.Theoperatingresultsofthe53rdweekin

fiscal2003havebeenexcludedasreconciledinthebelowfootnotes.

(2)Netsalesforfiscalyear2003excludetheeffectofthe53rdweekintheamountof$63,016.

(3)Grossprofitforfiscalyear2003excludestheeffectofthe53rdweekintheamountof$28,762.Grossprofitforfiscal2001excludesanon-recurringchargeof$9,099associatedwith

oursupplychaininitiativesrecordedinthefourthquarter.

(4)Comparableoperatingincomeexcludescertainchargesasincludedinthefollowingreconciliationofthismeasurementtoouroperatingincomepresentedundergenerallyaccepted

accountingpoliciesinourfinancialstatementscontainedintheFinancialReviewofthisannualreport.

2004 2003 2002 2001(a) 2000

Comparableoperatingincome.................................................................................... $ 328,758 $ 289,441 $ 231,883 $ 119,127 $ 88,462

Supplychaininitiatives............................................................................................... —— — (10,492) —

Impairmentofassetsheldforsale.............................................................................. —— — (10,700) (856)

Merger-relatedrestructuring........................................................................................ —— (597) (3,719) —

Mergerandintegration................................................................................................ —(10,417)(34,935) (1,135) —

Stockoptioncompensation......................................................................................... —— — (8,611) (729)

Operationseffectof53rdweek.................................................................................... — 9,210 — — —

Operatingincome........................................................................................................ $ 328,758 $ 288,234 $ 196,351 $ 84,470 $ 86,877

(a)Thefiscal2001chargesrepresentonlythosetakenduringthefourthquarter.FormoreinformationseetheSelectedFinancialDatasectionintheFinancialReviewofthisannualreport.

(5)Comparableincomefromcontinuingoperationsexcludestheitemsinfootnote(4)aboveandtheearlyextinguishmentofdebtandcumulativeeffectofachangeinaccountingprin-

ciple.Thefollowingisareconciliationofcomparableincomefromcontinuingoperationstoincomefromcontinuingoperationspresentedundergenerallyacceptedaccounting

policiesinourfinancialstatementscontainedintheFinancialReviewofthisannualreport.

2004 2003 2002 2001(a) 2000

Comparableincomefromcontinuingoperations........................................................ $ 188,027 $ 155,091 $ 94,267 $ 35,652 $ 15,188

Addbackitemsfromfootnote(4)................................................................................. —(1,207)(35,532) (34,657) (1,585)

Interestexpensein53rdweek..................................................................................... —(368)———

Lossonextinguishmentofdebt.................................................................................. —(46,887)(16,822) (6,106) 4,692

Taximpactofaboveitems........................................................................................... — 18,658 20,235 16,182 (1,144)

Incomefromcontinuingoperations............................................................................ $ 188,027 $ 125,287 $ 62,148 $ 11,071 $ 17,151

Incomefromcontinuingoperationsperdilutedshare................................................ $ 2.49 $ 1.68 $ 0.86 $ 0.19 $ 0.30

(a)Thefiscal2001chargesrepresentonlythosetakenduringthefourthquarter.FormoreinformationseetheSelectedFinancialDatasectionintheFinancialReviewofthisannualreport.

(6)Averagenetsalesperstoreiscalculatedasnetsalesdividedbytheaverageofbeginningandendingnumberofstoresfortherespectiveperiod.Thefiscal2003netsalesexclude

theeffectofthe53rdweekintheamountof$63,016.Thefiscal2001amountswerecalculatedbyreducingthenumberofDiscountstoresbyone-thirteenthtoreflectourownership

ofDiscountfromDecember2,2001(theacquisitiondate)throughDecember29,2001.

(7)Averagenetsalespersquarefootiscalculatedasnetsalesdividedbytheaverageofthebeginningandendingtotalstoresquarefootagefortherespectiveperiod.Thefiscal2003

netsalesexcludetheeffectofthe53rdweekintheamountof$63,016.Thefiscal2001amountswerecalculatedbyreducingthenumberofDiscountstoresbyone-thirteenthto

reflectourownershipofDiscountfromDecember2,2001(theacquisitiondate)throughDecember29,2001.

(8)Netdebtincludestotaldebtandbankoverdrafts,lesscashandcashequivalentsaspresentedontheaccompanyingfinancialstatements.

1

AdvanceAutoParts,Inc.andSubsidiaries