Advance Auto Parts 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

• a$22.8millionincreaseininventorygrowth;and

• a$77.9milliondecreaseincashflowfromaccountspay-

able,excludingtheimpactofourvendorfinancingpro-

gramwhichbeganinfiscal2004.

Forfiscal2003,netcashprovidedbyoperatingactivities

increased $112.9 million to $355.9 million. Significant

componentsofthisincreaseconsistedof:

• a$59.9 millionincrease in earningsprimarilydueto a

reductioninmergerandintegrationexpensesandincreased

operatingmargins;and

• a$47.3millionlossonextinguishmentofdebtinfiscal

2003 compared to a $16.8 million loss on extinguish-

mentofdebtinfiscal2002.

InvestingActivities

For fiscal 2004, net cash used in investing activities

increased by $81.3 million to $166.8 million. The pri-

mary increase in cash used in investing activities relates

toanincreaseincapitalexpendituresof$50.0millionfor

theconstructionandpreparationofournortheasterndistri-

butioncenter.

For fiscal 2003, net cash used in investing activities

increased by $7.5 million to $85.5 million. Significant

componentsofthisincreaseconsistedof:

• a $17.7 million reduction in proceeds received on the

disposalofassets;and

• a decrease in cash used for acquisition purposes com-

pared to 2002 when$13.2millionwasusedto acquire

certainassetsofTrakAutoParts,Inc.

FinancingActivities

For fiscal 2004, net cash used in financing activities

decreased by $220.7 million to $52.1 million, primarily

duetoacashoutflowof$406.4millionduringfiscal2003

fortheearlyredemptionofourseniordiscountdebentures

and senior subordinated notes. Cash used for financing

activitiesinfiscal2004consistedprimarilyof:

• $146.4millionusedtorepurchasesharesofourcommon

stockunderourstockrepurchaseprogram;

• a $56.9 million cash inflow associated with inventory

purchasedunderourvendorfinancingprogram;

• a$25.0millionincreaseinnetborrowingsasaresult

of$105.0millioninprincipalprepaymentsonourprevi-

ousseniorcreditfacilitypriortoscheduledmaturity,off-

set by borrowings from our amended senior credit

facility;and

• $20.5millioninproceedsfromteammemberexercises

ofstockoptions.

For fiscal 2003, net cash used in financing activities

increasedby$103.6millionto$272.8million.Significant

componentsofthisincreaseconsistedof:

• a $70.9 million increase in net borrowings, which is

reflective of the redemption of our senior discount

debenturesandseniorsubordinatednotesusingproceeds

fromourseniorcreditfacility;

• $88.7million inproceedsfroman equity offering dur-

ingfiscal2002;

• a$64.1millioncashinflowfromthefluctuationofbank

overdraftsfromfiscal2002;and

• $38.3 million paid in debt-related costs in connection

withtheaboveredemption.

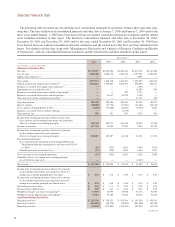

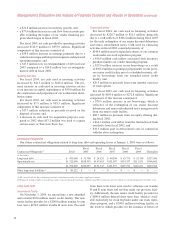

Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations(continued)

ContractualObligations

Ourfuturecontractualobligationsrelatedtolong-termdebtandoperatingleasesatJanuary1,2005wereasfollows:

ContractualObligations(1) Total

Fiscal

2005

Fiscal

2006

Fiscal

2007

Fiscal

2008

Fiscal

2009 Thereafter

(inthousands)

Long-termdebt............................................ $ 470,000 $ 31,700 $ 24,525 $ 40,200 $ 63,375 $ 52,700 $257,500

Operatingleases.......................................... $1,322,000 $188,355 $167,618 $152,057 $134,357 $113,551 $566,062

$1,792,000 $220,055 $192,143 $192,257 $197,732 $166,251 $823,562

Otherlong-termliabilities(2)........................ $ 80,222 $ — $ — $ — $ — $ — $ —

(1)Wecurrentlydonothaveminimumpurchasecommitmentsunderourvendorsupplyagreements.

(2)Primarilyincludesemployeebenefitsaccruals,restructuringandclosedstoreliabilitiesanddeferredincometaxesforwhichnocontractualpaymentscheduleexists.

Long-TermDebt

SeniorCreditFacility

OnNovember3,2004,weenteredintoanewamended

and restated $670 million senior credit facility. The new

seniorfacilityprovidesfora$200.0milliontrancheAterm

loan and a $170.0 million tranche B term loan. Proceeds

fromthesetermloanswereusedtorefinanceourtranche

DandEtermloansandrevolverunderourpreviousfacil-

ity.Additionally,thenewseniorcreditfacilityprovidesfor

a $100.0 million delayed draw term loan, which is avail-

ableexclusivelyforstockbuybacksunderourstockrepur-

chaseprogram,anda$200.0millionrevolvingfacility,or

the revolver(whichprovidesforthe issuanceoflettersof