Advance Auto Parts 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Changesinestimatesassociated withrestructuring lia-

bilities resulted in adjustments to the carrying value of

propertyandequipment,netontheaccompanyingconsoli-

dated balance sheets and did not affect the Company’s

consolidatedstatementsofoperations.Theclosedstoreand

restructuring liabilities are recorded in accrued expenses

(currentportion)andotherlong-termliabilities(long-term

portion)intheaccompanyingconsolidatedbalancesheets.

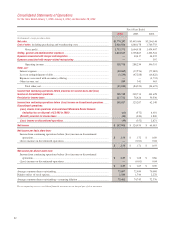

5.Receivables

Receivablesconsistofthefollowing:

January1,

2005

January3,

2004

Trade:

Wholesale(Note3)............................... $— $ 435

Retail...................................................... 34,654 24,594

Vendor........................................................ 60,097 56,727

Installment................................................. 7,506 10,418

Other.......................................................... 7,815 1,755

Totalreceivables........................................ 110,072 93,929

Less:Allowancefordoubtfulaccounts.... (8,103) (9,130)

Receivables,net......................................... $101,969 $84,799

6.Inventories,net

Inventoriesarestatedatthelowerofcostormarket,cost

being determined using the last-in, first-out, or LIFO,

method for approximately 93% of inventories at both

January 1, 2005 and January 3, 2004. Under the LIFO

method, theCompany’scost ofsalesreflectsthecosts of

themostcurrentlypurchasedinventorieswhiletheinven-

torycarryingbalancerepresentsthecostsrelatingtoprices

paidinprioryears.TheCompany’scoststoacquireinven-

toryhavebeendecreasinginrecentyearsasaresultofits

significant growth. Accordingly, the cost to currently

replace inventory is less than the LIFO balances carried

for similar product. As a result of the LIFO method and

the ability to obtain lower product costs, the Company

recordedreductionstocostofsalesof$11,212,$2,156and

$13,128 for fiscal years ended 2004, 2003 and 2002,

respectively.

The remaining inventories are comprised of product

cores,whichconsistofthenon-consumableportionofcer-

tain parts and batteries and are valued under the first-in,

first-out, or FIFO, method. Core values are included as

partofourmerchandisecostsandareeitherpassedonto

thecustomerorreturnedtothevendor.Additionally,these

productsarenotsubjecttothe frequentcostchangeslike

ourothermerchandiseinventory,thereforeresultinginno

materialdifferencefromapplyingeithertheLIFOorFIFO

valuationmethods.

TheCompanycapitalizescertainpurchasingandware-

housingcostsintoinventory.Purchasingandwarehousing

costs included in inventory, at FIFO, at January 1, 2005

and January 3, 2004, were $81,458 and $75,349, respec-

tively.Inventoriesconsistofthefollowing:

January1,

2005

January3,

2004

InventoriesatFIFO,net........................... $1,128,135 $1,051,678

Adjustmentstostateinventories

atLIFO................................................. 73,315 62,103

InventoriesatLIFO,net........................... $1,201,450 $1,113,781

ReplacementcostapproximatedFIFOcostatJanuary1,

2005andJanuary3,2004.

Inventory quantities are tracked through a perpetual

inventorysystem.TheCompanyusesacyclecountingpro-

gram in all distribution centers, Parts Delivered Quickly,

or PDQs, Local Area Warehouses, or LAWs, and retail

stores to ensure the accuracy of the perpetual inventory

quantities of both merchandise and core inventory. The

Company establishes reserves for estimated shrink based

onhistoricalaccuracyandeffectivenessofthecyclecount-

ing program. The Company also establishes reserves for

potentially excess and obsolete inventories based on cur-

rent inventory levels of discontinued product and the

historicalanalysisoftheliquidationofdiscontinuedinven-

torybelowcost.ThenatureoftheCompany’sinventoryis

such that the risk of obsolescence is minimal and excess

inventoryhashistoricallybeenreturnedtotheCompany’s

vendors forcredit.The Companyprovidesreserveswhen

lessthanfullcreditisexpectedfromavendororwhenliq-

uidatingproductwillresultinretailpricesbelowrecorded

costs.TheCompany’sreservesagainstinventoryforthese

matterswere$21,929and$16,011atJanuary1,2005and

January3,2004,respectively.

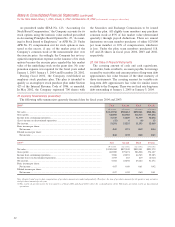

7.PropertyandEquipment

Property and equipment are stated at cost, less accu-

mulated depreciation and amortization. Expenditures for

maintenance and repairs are charged directly to expense

when incurred; major improvements are capitalized.

Whenitemsaresoldorretired,therelatedcostandaccu-

mulateddepreciationareremovedfromtheaccounts,with

any gain or loss reflected in the consolidated statements

ofoperations.

NotestoConsolidatedFinancialStatements(continued)

FortheYearsEndedJanuary1,2005,January3,2004,andDecember28,2002(inthousands,exceptpersharedata)